|

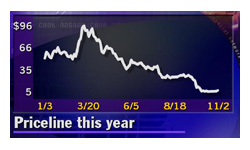

Priceline hits lower forecast

|

|

November 2, 2000: 7:25 p.m. ET

Web discounter reports 3Q loss, CFO resignation, job cuts

Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Priceline.com, whose shares have been more steeply discounted than most of the airline tickets it sells, reported a third-quarter loss Thursday that met Wall Street's lowered expectations and announced a restructuring plan under which it will lay off 16 percent of its workforce.

The company also said Heidi Miller has resigned after serving as Priceline's chief financial officer for less than a year.

Executives at Priceline in Norwalk, Conn., also said they expect revenue to fall in the fourth quarter, blaming the shortfall in part on the negative publicity that has been surrounding the company.

Priceline, which uses an online reverse auction which allows customers to name the price they are willing to pay for a service or product, has been under a lot of pressure in recent weeks following an earnings warning and an announcement that the company would stop offering groceries and gasoline through its service.

After rising 66 cents to $6.84 in Nasdaq trade ahead of Thursday's earnings release, Priceline (PCLN: Research, Estimates) shares dropped $1.66 to $5.19 in after-hours trade. The stock is off more than 95 percent from its 52-week high of $104.25. After rising 66 cents to $6.84 in Nasdaq trade ahead of Thursday's earnings release, Priceline (PCLN: Research, Estimates) shares dropped $1.66 to $5.19 in after-hours trade. The stock is off more than 95 percent from its 52-week high of $104.25.

During the third quarter, Priceline said it lost $2 million, or a penny per share. That compares with a loss of $11.9 million, or 8 cents per share, during the same period last year, and is in line with the penny-per-share analysts surveyed by earnings tracker First Call had expected the company to lose.

At $341 million, Priceline's revenue came in slightly below expectations. Wall Street had generally expected the company's top line to come in at around $341.9 million, although some estimates were as high as $345 million, according to the First Call survey.

In a teleconference after the earnings release Thursday evening, Daniel Schulman, Priceline's president and chief executive, blamed the revenue shortfall in part on the negative publicity surrounding Priceline's service.

He also said fuel surcharges as well as the airlines' own fare-reduction programs contributed to the company's lighter-than-expected top line.

Moving into the fourth quarter, Schulman said Priceline has continued to see weaker demand, and that by the end of October, there had been no signs of firming.

"We expect revenues to decrease sequentially in the fourth quarter," he said.

During the quarter, Priceline said it had positive operating cash flow and its earnings before interest, taxes, depreciation and amortization were slightly positive. The company finished the quarter with $131 million in cash and short-term investments.

"The cash position doesn't look that bad, but it all depends on the burn rate going forward," said Tom Courtney, an analyst at Banc of America Montgomery who has been among Priceline's harshest critics.

The company did not provide a cash flow statement nor did its executives give any guidance on the conference call regarding how quickly Priceline is burning through its cash. "I think you're going to see a really wide range of estimates unless they help us with that, which I'm not sure they'll do," Courtney said.

Restructuring will cost in fourth quarter

In an effort to stem its mounting losses, Priceline said it is taking a number of steps to improve its cost structure, which will result in an unspecified fourth-quarter charge against earnings.

The company also has reshuffled its senior management team following the departure of Miller as CFO.

Miller, formerly chief financial officer of Citigroup, joined Priceline in February, a move analysts thought would help the company establish fiscal discipline and boost its credibility on Wall Street.

BofA Montgomery's Courtney said Miller's departure deals a major blow to Priceline, but it's not really a surprise considering the huge decline in value of the company's stock. "She's not the first very strong executive to leave a dot.com that's had its stock go down."

"We appreciate the contribution that Heidi has made and respect her decision to pursue opportunities and apply her talents in a more established business environment," Priceline's Schulman said.

Bob Mylod, previously the company's vice president of finance, has been selected to replace Miller as CFO, Priceline said.

As for the restructuring, Priceline said it will lay off 87 of its 535 employees, for which it will record an unspecified charge against earnings. "The effect of this is not currently determinable, it but will adversely affect the fourth quarter results," Schulman said.

Priceline also said it will take $9 million non-cash charge in connection with a change in the warrant terms with Delta Air Lines, which is a major shareholder. A warrant is a type of security issued with preferred stock that allows the holder to buy a proportionate amount of common stock at a specified price, usually higher than the market price at the time of issuance.

Under the new terms, Priceline said it reduced the number of shares underlying Delta's warrant to 4.675 million shares from 5.5 million shares, and reduced the strike price from $56.63 per share to the market price.

"While the effect of these charges will adversely impact fourth-quarter results, we believe they are necessary and appropriate to position the Company for long-term improvement of its operating results," Schulman said.

|

|

|

|

|

|

Priceline

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|