|

Asia mixed, HK rings gain

|

|

November 7, 2000: 6:09 a.m. ET

Tokyo slips on banks, autos, as News Corp. leads Sydney to record close

|

LONDON (CNNfn) - Asia's main market were mixed Tuesday, with weakness among banking and auto stocks pulling Tokyo's Nikkei modestly into the red while Australia's main index powered to a record close.

In Japan, the Nikkei average of 225 stocks slipped 31.11 points, or 0.2 percent, to end at 15,340.33, with Nissan Motor and the Bank of Tokyo Mitsubishi leading declines.

"My feeling is that the market's in the process of recovery but it's going to take more time for the Nikkei to really lift off," said Hidenori Kawasaki, general manager of equities trading at Kokusai Securities. "The Nikkei will probably be stuck around 15,000 for more than a week." "My feeling is that the market's in the process of recovery but it's going to take more time for the Nikkei to really lift off," said Hidenori Kawasaki, general manager of equities trading at Kokusai Securities. "The Nikkei will probably be stuck around 15,000 for more than a week."

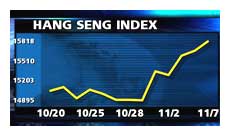

In Hong Kong, the Hang Seng climbed 149.64 points, or almost 1 percent, to finish the session at 15,820.79, led by telecom conglomerate Hutchison Whampoa and Internet and phone company Pacific Century CyberWorks.

Australia's S&P/ASX 200 ended the session at a record high of 3,372.9, chalking up a rise of 38.1 points, or 1.1 percent. Index heavyweight News Corp. led gains, followed by banking stocks such as Australia & New Zealand Banking.

Singapore's Straits Times index edged up 38.1 points, or 1.1 percent, to close at 3,372.9, led by Singapore Airlines, after several analysts reaffirmed "buy" recommendations amid optimism that Southeast Asia's leading airline would weather the financial impact of the jumbo jet crash in Taiwan that killed 82 people last week.

In the U.S. Monday, the Nasdaq composite index fell more than 1 percent to 3,416.21, while the Dow Jones Industrial Average rose 1.5 percent to 10,977.21.

In the currency market, the yen firmed slightly to ¥107.27 against the U.S. dollar from ¥107.44 in late New York trading on Monday.

On the Tokyo exchange, a 2.9 percent drop for Mizuho Holdings led declines across the sector, with Bank of Tokyo Mitsubishi falling 2.2 percent, Sumitomo Bank shedding 1 percent, and Sanwa Bank closing down 0.8 percent.

Nissan Motor skidded 3.3 percent. Investment bank Lehman Brothers cut its recommendation to 'market underperform', citing an overheated U.S. auto market and predicting a sales slowdown. Rival Mitsubishi Motor slipped 1 percent.

Technology stocks were mixed as consumer electronics bellwether Sony fell 2.3 percent, after rising 4.1 percent on Monday.

Others managed to build on the previous day's gains: Advantest, a maker of semiconductor testing devices, added 1.7 percent and Matsushita Communication Industrial rose 2.5 percent. Chipmaker NEC added 2.4 percent.

Toshiba rose 1.1 percent. The consumer electronics company said it had reached an agreement with Germany's Siemens to develop next-generation mobile phones in a move aimed at saving costs and increasing competitiveness.

Fiber-optic cable maker Furukawa Electric slipped 1.9 percent, showing little reaction to news it returned to profit in the past half-year as sales rose almost 7 percent.

Cosmetics firm Fancl fell 11.9 percent, extending its loss to about 25 percent since its announcement last Thursday that it lowered its forecast for net profit for the year to next March.

In Hong Kong, conglomerate Hutchison Whampoa jumped 3.3 percent as investors seized on a local newspaper report saying the company might decide against applying for a third-generation mobile phone license in France. Analysts have speculated that the company cannot find a local partner to enter the 3G market in France and say it would make sense not to go ahead given the high cost involved. In Hong Kong, conglomerate Hutchison Whampoa jumped 3.3 percent as investors seized on a local newspaper report saying the company might decide against applying for a third-generation mobile phone license in France. Analysts have speculated that the company cannot find a local partner to enter the 3G market in France and say it would make sense not to go ahead given the high cost involved.

Cheung Kong Holdings, parent of Hutchison, rose 1.9 percent.

Internet and telecom company Pacific Century CyberWorks rose 1.7 percent as investors continued to trade on news of a syndicated loan the company has secured that will help cut its debt service costs. China's biggest mobile phone operator China Mobile rose 1.4 percent.

Outside Tokyo, banks rally

Banking stocks in Hong Kong, Singapore and Australia rallied. London-based HSBC Holdings, Hong Kong's biggest bank, rose 0.4 percent and Bank of East Asia climbed 2.4 percent.

Singapore's DBS Group Holdings rose 1 percent, United Overseas Bank added 1.6 percent and OCBC Bank jumped 2.5 percent.

In Sydney, Australia & New Zealand Banking rose 1.5 percent and Commonwealth Bank of Australia soared 5.3 percent. News Corp., the most heavily weighted share on the benchmark index, added 1.7 percent.

Mining giant Rio Tinto rose 1.4 percent. The company revised its offer for diamond miner Ashton Mining to A$2.20 ($1.16) a share, outbidding a rival offer from South African diamond miner De Beers.

Elsewhere in the region, Taipei's Weighted index rose 3.9 percent, Manila's PHS Composite added 0.8 percent, Bangkok's SET inched up 0.1 percent and KLSE Composite in Kuala Lumpur was little changed at 763.84.

The KOSPI index in Seoul's lost 0.6 percent.

--from staff and wire reports

|

|

|

|

|

|

|