|

Litton electronics hit market

|

|

November 7, 2000: 11:57 a.m. ET

Defense contractor selling advanced electronics group; numerous buyers seen

|

NEW YORK (CNNfn) - Litton Industries officially unveiled plans Monday to sell its $1.6 billion Advanced Electronics Group as part of its continuing effort to refocus the defense contractor on higher-growth telecommunications, wireless and shipbuilding industries.

The Woodland Hills, Calif.-based company, the No. 1 U.S. builder of non-nuclear ships for the U.S. Navy, said it hired Merrill Lynch to oversee the sale, which was first discussed by company officials last month.

The advanced electronics business, which includes the company's navigation and electronic warfare operations, employs roughly 9,500 people and generated $1.6 billion in sales during fiscal year 2000, more than half of which were made to the U.S. government

Although the operation represented roughly 29 percent of Litton's $5.6 billion in overall sales during its last fiscal year, company officials said an internal evaluation revealed it would generate greater shareholder value in the hands of a company more focused on its core business lines of designing shipboard electronics and controls, military avionics systems, communications systems and electro-optical equipment.

"We believe this decision is in the best interest of our shareholders, customers and employees since it will allow us to create a stronger company and one better able to take advantage of the opportunities in all our business segments," Chairman and CEO Michael Brown said.

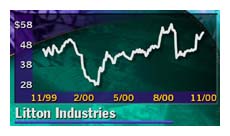

Litton (LIT: Research, Estimates) shareholders seemed to agree. The company's stock rose $1.06 Monday to close at $54.06 and is now roughly 20 percent above its closing price before the possible sale was announced last month. Litton (LIT: Research, Estimates) shareholders seemed to agree. The company's stock rose $1.06 Monday to close at $54.06 and is now roughly 20 percent above its closing price before the possible sale was announced last month.

Industry analysts said the unit would likely attract no shortage of bidders and could ultimately generate a after-tax price tag in excess of $1 billion for the company.

Among the possible bidders include fellow defense contractors Northrop Grumman Corp. (NOC: Research, Estimates) and General Dynamics Corp. (GD: Research, Estimates), satellite technology provider TRW Inc. (TRW: Research, Estimates), communications products maker L3 Communications Holdings (LLL: Research, Estimates), and government communications provider Harris Corp.

Analysts said British electronics systems provider BAE Systems Inc. (BAE: Research, Estimates), French German defense and space contractor EADS N.V. and a host of private leverage buyout funds may also consider bidding for all or part of Litton's electronics business.

"Everybody's going to be looking at these little bits and pieces and deciding what they like and don't like," said Joseph Campbell, an analyst with Lehman Brothers. "There's enough attractive pieces in that business that quite a few people will express an interest."

Litton spokesman Randy Belote said the company is operating under no specific timetable to complete the sale. Litton will hold an investor and analyst conference call on Wednesday to give further detail on the sale.

Following the divestiture, the company anticipates making greater investments in its commercial electronics and materials business, allowing it to increase its global production capabilities and broaden its product offerings for the telecommunications and networking markets during the next two to three years.

The divestiture will continue a movement launched by the company last year to focus more broadly on stronger-growth areas like telecommunications and ship building. Accordingly, the company divested of three non-core information systems units last year, while beefing up investments in its ship systems and telecommunications operations.

|

|

|

|

|

|

Litton Industries

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|