NEW YORK (CNNfn) - This week's most highly touted initial public offering, mobile computing chip company Transmeta Corp., raised $273 million Monday, pricing $3 above its already increased range.

Transmeta priced 13 million shares at $21 each. Last Friday the company quelled doubts about its offering that stemmed from IBM's snub of Transmeta's Crusoe chip for an upcoming laptop, by boosting the expected range by $5.

"We saw the increase in price range and it looks like they followed through all the way to pricing," said Corey Ostman, co-CEO of Alert-IPO.com. "This is not surprising."

Ostman said even though the shares are priced about 75 percent higher than originally anticipated, the stock should still see a "very decent first-day pop."

"Generally when you have something like you do here where they raise the price range to $16 to $18 and then price at $21, there is so much momentum involved that it continues," he said. "I don't think they overpriced, and there will be a lot of interest from retail investors."

The Santa Clara, Calif.-based company, which will trade on the Nasdaq as "TMTA" has endured a roller-coaster ride in the past week on the way to pricing its IPO.

Expected to be a breakthrough offering by analysts, Transmeta was set to price last week, but had to delay. Analysts speculated the delay was caused by the IBM news, but stressed the IPO still looked good.

As if to silence any skeptics, Transmeta, under the guidance of lead underwriter Morgan Stanley Dean Witter, boosted its price range on Friday to between $16 and $18, from $11 to $13.

The skinny on Transmeta

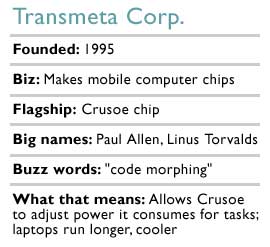

Transmeta company was founded in 1995 and spent its first five years secretly developing its product, a new kind of microprocessor it dubbed "Crusoe."

Since it took took the wraps off Crusoe last January, the new chips have drawn a lot of interest. Since it took took the wraps off Crusoe last January, the new chips have drawn a lot of interest.

Transmeta's chips differ from competing products in the way they achieve their low-power characteristics.

Crusoe chips are designed with a patented technique the company calls "code morphing," meaning they use software to translate the instructions typically handled directly by the transistors on other chips.

The code morphing technology allows the Crusoe processors to adjust the amount of power they consume for specific tasks, which Transmeta says enables them to use less power and run cooler than similar processors.

In the first half of 2000, Transmeta had sales of $358,000 and a net loss of $43.4 million, but has only been shipping its chip for a year.

Sony Corp. (SNE: Research, Estimates), Hitachi Ltd. (HIT: Research, Estimates), and NEC already have laptops which use the Crusoe; Fujitsu Ltd. has committed to using it, and Toshiba Corp. is considering using it.

America Online (AOL: Research, Estimates) and Gateway Inc. (GTW: Research, Estimates) will use the Crusoe in their combined effort on an Internet-access device.

|