|

Excess trucks to hit profits

|

|

November 8, 2000: 4:50 p.m. ET

As inventories of profitable models grow...production cuts, incentives loom

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - U.S. automakers are seeing their inventories of light trucks growing, and analysts expect that will squeeze profits going forward as production is cut and incentives are increased.

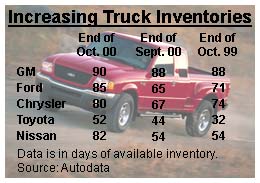

Preliminary data from Autodata Inc. shows that the overall inventory of Ford Motor Co. light trucks grew to 85 days at the end of October from 65 days a month earlier, while DaimlerChrysler saw the light trucks inventories rise to 80 days from 67 days. General Motors Corp. saw inventories edge up to 90 days from 88 days a month earlier.

Toyota's light truck inventories were the only ones near the 60-day range considered ideal, but even it saw an increase, as did its Japanese competitor Nissan. All the October inventory figures also are well above year-earlier figures.

"Usually when things slow down, you get both [production cuts and increased incentives]," said David Garrity, analyst with Dresdner, Kleinwort Benson. "It's hard to get one or the other by themselves." "Usually when things slow down, you get both [production cuts and increased incentives]," said David Garrity, analyst with Dresdner, Kleinwort Benson. "It's hard to get one or the other by themselves."

October sales figures from Autodata show industry-wide sport/utility vehicle sales gaining 7.7 percent in the month, but that gain was almost all due to the availability of Chrysler's hot PT Cruiser model, which made its debut earlier this year and thus was not included in year-earlier results. Minivan sales also ticked up slightly. It was a 7.1 percent fall-off in pick-up truck sales that hurt the light-truck segment overall.

"The point is inventories are building over the ideal 60-day marks," said Bill Seltenheim, Autodata's vice president. "They've maybe reached a point where the market is getting saturated."

Auto earnings forecasts coming down

Garrity cited concerns about inventory levels in reports Tuesday, although he has yet to change his earnings estimates. He said the large drop in full-size pick-up sales in October is a sign of declining business activity more than a drop in consumer spending or confidence, because many of the larger trucks are bought by businesses.

Stephen Girsky of Morgan Stanley Dean Witter and Gary Lapidus of Goldman Sachs both lowered their earnings estimates for Ford and GM earlier this week, and their estimates lowered consensus forecasts for both companies for both the fourth quarter and 2001.

"Truck profits are rolling over," wrote Lapidus Tuesday. "Big Three earnings are highly leveraged to light trucks, accounting for 120 percent of global profits. Demand is slowing and is about to collide with rising supply, eroding capacity utilization and margin. Light truck profits will be under considerable pressure over the next few years." "Truck profits are rolling over," wrote Lapidus Tuesday. "Big Three earnings are highly leveraged to light trucks, accounting for 120 percent of global profits. Demand is slowing and is about to collide with rising supply, eroding capacity utilization and margin. Light truck profits will be under considerable pressure over the next few years."

Lapidus' and Girsky's lowered earnings estimates depressed the consensus forecast from earnings tracker First Call for GM's 2001 earnings to $9.02 a share from $9.11 a share.

Lapidus dropped his GM estimate for next year to $7.70 while Girsky's dropped to $7.50 a share. Other analysts are likely to reconsider their forecasts in light of the new sharply lower floor for GM's estimates, said Chuck Hill, First Call's director of research.

Lapidus dropped the 2001 estimate for Ford to $3.45 a share, while Girsky lowered his to $3.50 a share, which also lowered the floor of estimates and dropped the First Call consensus number to $3.71 a share from $3.74 a share. Girsky also dropped his fourth-quarter estimate for Ford to 85 cents a share, which nudged the consensus estimate 1 cent lower to 86 cents.

Ford says it will not be hurt by inventories

Officials with the automakers admit that inventories are rising, that light truck production is likely to be shaved in the future and that the overall capacity-demand equation for the segment is turning against the balance that helped produce high profits in recent years.

But an official with Ford, which was hit as badly as any of the Big Three partly as a result of the recall of Firestone tires used on many of its light-truck models, said that the numbers are not a shock for the company or future results.

"Anytime you go from higher sales rates to lower sales rates, you're going to have to make some inventory adjustments," said George Pipas, the sales analysis spokesman for Ford. "And it's clear there's more capacity being aimed at most profitable market in the world -- the North American light truck market. But you could see this coming a mile away. I think we are well positioned." "Anytime you go from higher sales rates to lower sales rates, you're going to have to make some inventory adjustments," said George Pipas, the sales analysis spokesman for Ford. "And it's clear there's more capacity being aimed at most profitable market in the world -- the North American light truck market. But you could see this coming a mile away. I think we are well positioned."

Pipas said part of the rise of inventory numbers is due to weak sales of some models that carried the recalled Firestone brands -- such as the Explorer, best-selling S/UV, or the Ranger light pick-up truck. The days' supply is computed by dividing vehicles available by the sales over the previous 30 days, so even with a relatively steady number of vehicles on the lots, the inventory statistic can rise.

For example, the number of Explorers only increased to 91,000 from 87,000 at the end of September. But a 21 percent drop in Explorer sales from September's sales figures translated into an increase in the days' supply inventory to 80 days from 58 days.

Ford's light pick-up Ranger saw its inventory soar to 87 days from 50 days a month earlier. Part of that was due to the fact that Ranger plants were shut down for almost six weeks in August and September due to the Firestone recall, depressing the earlier inventories, Pipas said.

New Explorer model could burn off inventory

Ford will soon stop production of the 2001 Explorer to begin production of the 2002 Explorer, which is a new design of the vehicle, so inventory numbers should start to drop soon, insisted Pipas.

"Today's level of Explorer stock is not a concern," he insisted.

Still other observers say that the industry could see profits much tougher to come by than in recent years due to the increasing supply of light trucks.

"The business by and large is much more competitive right now, and I don't think it's going to become any less competitive anytime soon," said David Cole, director of office for the study of automotive transportation at the University of Michigan. "It's going to force the next level of shakeout. It's clear we're in an era where it's dog eat dog."

Shares of GM (GM: Research, Estimates) closed up 75 cents to $57.75 after taking a hit Tuesday following Lapidus' lowered estimate. Ford (F: Research, Estimates) shares slipped 19 cents to $24.81, while the American depositary receipts of DaimlerChrysler (DCX: Research, Estimates) edged up 6 cents to $46.46, and the ADR's of Toyota (TM: Research, Estimates) gained 77 cents to $83.16.

Click here to send mail to Chris Isidore

|

|

|

|

|

|

|