|

Lenders target minorities

|

|

November 9, 2000: 12:15 p.m. ET

More blacks, Latinos get higher interest subprime loans than whites, study says

|

NEW YORK (CNNfn) - Predatory lenders are stalking minority homeowners and forcing them to live in a "financial apartheid," according to a recent report.

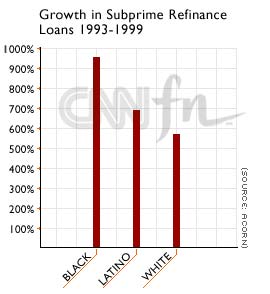

In a study entitled "Separate and Unequal: Predatory Lending in America," the Association of Community Organizations for Reform Now, or ACORN, an activist organization, found minority and lower income borrowers are  much more likely to receive a higher-cost subprime mortgage when refinancing or buying a house. much more likely to receive a higher-cost subprime mortgage when refinancing or buying a house.

The study found African-Americans were 3.7 times more likely to receive a subprime loan than whites, while Latinos were 1.6 times more likely. Subprime borrowers pay higher rates and fees, ACORN said, and they are much more likely to be the victims of predatory lending practices that strip them of the equity in their homes and can lead to foreclosure.

Andrew Cuomo, secretary of the U.S. Department of Housing and Urban Development, said in a statement that the ACORN study "provides extensive and important new research about the surge of subprime lending to minority neighborhoods in cities across the nation."

"Separate and Very Unequal"

In 1999, the report said, 45.1 percent of all conventional refinance loans in the United States, excluding loans for manufactured housing, received by African-Americans were from subprime lenders, as were 19.5 percent of the refinance loans received by Latinos. This compares to 12.1 percent of the refinance loans received by whites.

"It looks like we still have two separate and very unequal financial systems," ACORN National President Maude Hurd said in a news release. "One for rich and one for poor. One for whites, and one for everybody else. We know that many of the people who got subprime loans were pushed into a higher cost loan because the mortgage company saw an opportunity to make more money."

James McLaughlin, director of regulatory affairs for American Banking Association, condemned predatory lending, but said there is more to approving a loan than income. Other factors include a potential customer's credit history, debt and assets, or wealth, that can show if a loan is likely to be repaid.

McLaughlin also said the association is planning to provide consumer education material on its Web site.

Lower income hit hardest

The report also found that the concentration of subprime loans is greatest among lower income minorities.

Not including loans for manufactured housing, two out of every three conventional refinance loans—61.3 percent—received by low-income African-Americans in 1999 were from subprime lenders, and more than half—52.6 percent—of the conventional refinance loans received by  moderate-income African-Americans were from subprime lenders. Almost one in three conventional refinance loans made to low-income Latinos were subprime. moderate-income African-Americans were from subprime lenders. Almost one in three conventional refinance loans made to low-income Latinos were subprime.

Among the report's major findings were:

- Higher income does not change racial disparity: When comparing minority borrowers with white borrowers of the same income, the study said the racial disparity was still present and persisted among higher income borrowers.

- Minorities receive a larger share of subprime purchase loans than of prime conventional loans: In 1999, African-Americans received 13.5 percent of all the subprime purchase loans made in the United States, a four times larger share than the 3.5 percent they received of prime purchase loans. Latinos received 8.5 percent of the subprime loans, almost double their 4.8 percent share of prime loans. Whites, in contrast, received 49.7 percent of the subprime loans, but 75.4 percent of the prime loans.

- Subprime lenders also target lower income white homeowners: Subprime lenders made 24.4 percent of all conventional refinance loans, excluding loans for manufactured housing loans, received by low-income homeowners and 18.5 percent of all refinance loans received by moderate-income white homeowners. In contrast, subprime lenders made just 8.2 percent of the refinance loans to upper-income white homeowners.

Banking Kingpins?

ACORN charges the "kingpins" behind predatory lending can be found among some of the world's largest financial institutions.

ACORN said some institutions have direct ownership of subprime lending subsidiaries, such as Citigroup (C: Research, Estimates) and its Citifinancial Division, which recorded a 77 percent increase in net income to $390 million in 1999. Citigroup is expanding its subprime lending operation with the acquisition of Associates First Capital, the nation's largest consumer lender. Citigroup did not return repeated calls for comment.

ACORN also said investment firms bankroll predators by securitizing their mortgages and selling them to investors. These include Lehman Brothers, Merrill Lynch, Prudential Securities and Salomon Smith Barney.

Consumer Advice

ACORN has several suggestions for consumers who want to protect themselves from predatory lenders:

- Before you begin loan shopping, visit your local non-profit housing counseling center and set up an appointment with a counselor to evaluate your financial situation. ACORN Housing Corp., a HUD-certified housing counseling agency, has offices in 26 cities.

- Ignore high pressure solicitations, including home office visits. Before you sign anything, take the time to have an expert, such as a housing counselor or lawyer, look over any purchase agreement, offer or any other documents.

- Don't agree to sign anything that doesn't seem right even if the seller or lender tells you "It's the only way to get the loan through" or "That's the way it's done." Do not sign blank loan documents.

- Before closing your loan, get a copy of your loan papers with the final loan terms and conditions so you have enough time to examine them. If anything is dramatically different at closing, don't sign it.

|

|

|

|

|

|

|