|

Focus: IPO rebirth?

|

|

November 9, 2000: 1:19 p.m. ET

New issues hope to ride Transmeta success; Luminent to shine

By Staff Writer Luisa Beltran

|

NEW YORK (CNNfn) - This week's impressive first-day performance of chipmaker Transmeta Corp. fueled expectations that the new issue market's traditional fourth-quarter surge was finally underway. But while analysts predict investors will unwrap a few more IPO gems this year, many also are looking to the first quarter of next year for the real rebound.

Dismissing the notion that Transmeta (TMTA: Research, Estimates), which doubled on its first day of trade Tuesday, could single-handedly revive the slumping IPO market, analysts are taking a cautious approach, predicting many winners but few of the moon shots unearthed early in the year.

"One deal never makes a market," said John Fitzgibbon, editor of WorldFinanceNet.com. "It's the [broad] market that makes the IPO market, not one IPO."

Indeed, despite a fervent summer rally that fueled hopes for a strong fourth quarter, the IPO market thus far is failing to live up to expectations, analysts said.

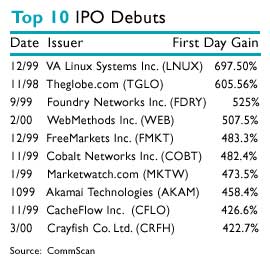

The fourth quarter traditionally is viewed as a strong time for IPOs. Last year, six companies -- including VA Linux Systems Inc. (LNUX: Research, Estimates), Foundry Networks Inc. (FDRY: Research, Estimates) and FreeMarkets Inc. (FMKT: Research, Estimates) -- produced Top 10 record-breaking debuts in the period. VA Linux led the pack, gaining 697.50 percent last December, Foundry Network rose 525 percent in September, earning third place, and FreeMarkets climbed 483 percent, also in December, for fifth, according to data from CommScan, a New York-based investment banking research firm.

But this year's fourth-quarter offerings are a mere shadow of last year's luster. Nasdaq volatility and earnings warnings helped grind the IPO market to a near halt, with about 40 companies pulling or postponing plans for IPOs in October after 19 backed out in September.

The Transmeta IPO cannot single-handedly revive the IPO market. Transmeta, which boosted its price range by 75 percent and then rose 125 percent in its debut, will help the new issues market. But hopes continue to lie with Nasdaq and other offerings for a revival.

Cleaning house

The October downturn helped prevent a recurrence of the summer IPO rally, some analysts said. Summer typically is a slow-time for new issues but companies were lining up to launch their deals, with 157 companies going public in the June to August time period.

David Menlow, president of IPOfinancial.com, sees the recent IPO slump as a way to clean house and flush out the weaker deals that had been coming to market.

A fiber optic surge allowed many "me too" issues to tag along, producing many lackluster results, he said, noting during one week in August as many as 27 companies went public, but 10 of those opened unchanged.

"The rally this summer was really bogus," he said. "It was only a question of time before people realized that there was no substance to that rally."

The broad market currently is experiencing a rebound that many believe will help boost the IPO market. Before Transmeta, signs were apparent last week that investors were once again favoring IPOs and analyst pointed to the offering of Optical Communication Products Inc. (OCPI: Research, Estimates), a maker of fiber optic gadgets that help speed the transmission of data on the Internet, which surged by 63 percent last Friday.

Many are now looking to this week's other offerings, from Luminent Inc. and Computer Access Technology Corp., to add to Transmeta's earlier success. Many are now looking to this week's other offerings, from Luminent Inc. and Computer Access Technology Corp., to add to Transmeta's earlier success.

Chatsworth, Calif.-based Luminent Inc., a maker of fiber optic networking components, plans to sell 12 million shares at $13 to $15 each via Credit Suisse First Boston. Computer Access Technology Corp. expects to sell 3.5 million shares at $12 to $14 each via Robertson Stephens.

Both Luminent, which will trade under the Nasdaq symbol "LMNE," and Computer Access, which will trade under "CATZ," expect to price their deals Thursday and open Friday.

"We have a good market on our hands," Fitzgibbon said.

Another moon shot?

If Nasdaq continues to gain ground, analysts believe that underwriters will be able to push out many of the 184 issues currently in registration to market.

But don't expect another Transmeta blockbuster anytime soon, analysts said. The current group of expected issues lacks any company with the "buzz" surrounding Transmeta.

Some deals on tap may produce strong premiums, analysts said. The issue from TurboLinux Inc., which competes against Caldera and RedHat in the Linux market and recently filed to raise $60 million via lead underwriters Deutsche Banc Alex. Brown, is expected to perform well. Snap Appliances Inc., a maker of network-attached storage services, filed for a $100 million IPO via Merrill Lynch and Salomon Smith Barney, and also may turn in a good debut. TurboLinux will trade under the proposed Nasdaq symbol "NXTI" while Snap will trade under the Nasdaq symbol "SNPA."

The once-strong wireless sector also may get a boost when Verizon Wireless and Nextel International finally begin trading, but it may not be this year. Verizon Wireless, whose $5 billion IPO was expected this month, decided to postpone its deal and now is anticipated in the spring. The new issue from Nextel International also was slated to open this month but is still to be announced, underwriters on the deal said.

If Nasdaq continues to experience volatility, analysts expect many underwriters to push their top deals to the first quarter.

"Clearly we are not going to match last year's fourth quarter," said Corey Ostman, co-chief executive of Alert-IPO.com. "This really pushes a lot of deals into first quarter, which usually gets off to a slow start."

|

|

|

|

|

|

|