|

Wholesale prices tame

|

|

November 9, 2000: 11:39 a.m. ET

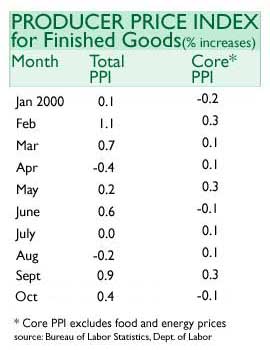

U.S. producer prices rise 0.4% in October, but core rate declines 0.1%

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - U.S. wholesale prices rose at a stronger-than-expected pace in October, but the so-called core rate posted its first decline in nine months, a government report showed Thursday -- a sign for investors that inflation remains subdued.

Overall prices rose 0.4 percent last month, the Labor Department said, above the 0.1 percent gain expected by economists polled by Briefing.com, after September's 0.9 percent jump. But the core rate, which excludes volatile food and energy costs, fell 0.1 percent versus forecasts for a 0.1 percent rise and the 0.3 percent increase posted in September. Overall prices rose 0.4 percent last month, the Labor Department said, above the 0.1 percent gain expected by economists polled by Briefing.com, after September's 0.9 percent jump. But the core rate, which excludes volatile food and energy costs, fell 0.1 percent versus forecasts for a 0.1 percent rise and the 0.3 percent increase posted in September.

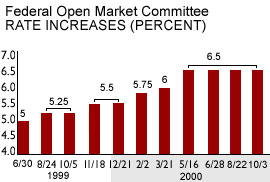

The report offered the best evidence to date that the Federal Reserve's series of interest rate increases may be starting to have the desired effect of stamping out inflation pressures, analysts said. It also offered evidence that companies are becoming more efficient as they absorb rising energy and labor costs and avoid passing those costs on to customers. Cheap imports and competition are also helping restrain prices.

"The decline in the core rate is very good news; it confirms that inflation continues to remain subdued," economist Maria Ramirez of analysis firm Maria Fiorini Ramirez Inc., told CNNfn's Before Hours. "It shows that prices outside of energy are actually falling, which is great news for the Federal Reserve."

Fed handiwork working?

The Fed raised its trend-setting overnight bank lending rate target six times between June 1999 and this past May in an effort to slow the pace of economic growth and contain inflation. The economy expanded at a 2.7 percent annual rate in the third quarter compared with a 5.6 percent pace from April to June.

The question now is whether their handiwork has been enough. On the one hand, parts of the economy, such as the manufacturing sector, are showing definitive signs of slowing down. Activity at U.S. factories contracted for a third straight month in October while prices producers pay for their raw materials fell, a survey of purchasing managers released last week showed. The question now is whether their handiwork has been enough. On the one hand, parts of the economy, such as the manufacturing sector, are showing definitive signs of slowing down. Activity at U.S. factories contracted for a third straight month in October while prices producers pay for their raw materials fell, a survey of purchasing managers released last week showed.

On the other hand, consumer spending remains strong, despite rates for personal and business loans being more than 1-1/4 percentage points higher than they were a year ago. Americans' incomes posted their biggest jump in nearly a year in September while spending also rose and the savings rate remained mired near an all-time low.

Throw higher energy costs into the mix, "and the picture does get a little murky," said Bill Cheney, chief economist with John Hancock Financial Services in Boston. All the same, "energy prices will soon stabilize or retreat. Then we will properly be looking for inflation where we are more likely to find it: in the influence of labor costs."

Energy prices mixed

Indeed, October's overall increase was partly fueled by gains in energy prices, which rose another 1.4 percent last month, the Labor Department said. Even so, the rise in energy costs was due almost entirely to higher natural gas and electricity prices, while gasoline and oil prices actually fell on the month, Ramirez noted. (550KB WAV) (550KB AIFF)

The price of crude oil peaked at a 10-year high of $37.20 per barrel on Sept. 20, but since has tapered off to about $33 per barrel. The price of crude oil peaked at a 10-year high of $37.20 per barrel on Sept. 20, but since has tapered off to about $33 per barrel.

Financial markets registered a mixed reaction to the report. Bonds jumped immediately following the numbers on expectations that inflation remains benign. But stocks fell as equity investors concluded that tame core inflation is not enough on its own to calm worries about higher rates.

"This report does not give the Fed clear guidance that core inflation's rise in the PPI is topping out," said Sherry Cooper, chief economist with brokerage BMO Nesbitt Burns. "It does, however, hint in that direction."

A big part of the decline in the overall core rate last month was a 1.8 percent drop in car prices, the biggest decline in 10 years, the Labor Department said. The decline came as auto dealers attempted to clear their lots to make room for the 2001 models, which typically begin arriving in the fall.

General Motors Corp. (GM: Research, Estimates), the world's biggest automaker, raised average incentives to about $2,200 in October and offered zero-percent loans at Oldsmobile, helping boost sales 7 percent compared with a year earlier, the company reported earlier at the end of last month.

Computer prices dip

In other categories, Food prices rose 0.8 percent in October, the second increase in a row and the largest since a 1.1 percent rise in April. Prices for prescription drugs rose 1.6 percent after dropping 0.1 percent in September.

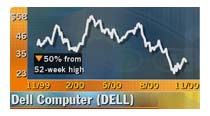

late Wednesday that he now expects "single-digit" sales growth in the months ahead, below previous forecasts. late Wednesday that he now expects "single-digit" sales growth in the months ahead, below previous forecasts.

Prices for finished goods rose 0.5 percent after rising 1.1 percent in September, the department said. Prices for intermediate goods, which include everything from construction materials to paperboard to plastics, rose 0.2 percent in October after rising 0.7 percent in September.

Separately, the Labor Department said the number of Americans filing new unemployment benefit claims rose near a 22-month high of 344,000 for the week ended Nov. 4, from a revised 309,000 the prior week. Economists polled by Briefing.com had forecast jobless claims of 310,000.

|

|

|

|

|

|

|