|

Dot.com 'incubators' slip

|

|

November 9, 2000: 1:56 p.m. ET

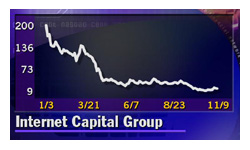

Internet Capital, CMGI tumble on warnings, growth concerns

|

NEW YORK (CNNfn) - The stocks of two so-called Internet "incubators" took a turn for the worse Thursday amid worries that it may be some time before the companies they are nurturing begin to hatch.

Shares of Internet Capital Group Inc. (ICGE: Research, Estimates), which owns interests in 49 business-to-business e-commerce companies, tumbled $5.50, standing 33.4 percent lower at $10.75 in early afternoon Nasdaq trade. That's down more than 95 percent from a 12-month high of $212.

Thursday's losses came after the Wayne, Pa.-based company reported a third-quarter loss after Wednesday's closing bell that was substantially wider than the same period a year earlier, and announced plans to lay off 35 percent of its work force, for which it will take a $25 million-to-$30 million charge against its fourth-quarter earnings.

The company also said it plans to make spin off its businesses in Europe and Japan and seek external financing for them.

Kenneth Fox, ICG's co-founder and managing director of its West Coast operations, said Thursday that between five and eight of ICG's companies are cash-flow positive, and he expects the top 15 to be cash-flow positive within the next 18 months. Kenneth Fox, ICG's co-founder and managing director of its West Coast operations, said Thursday that between five and eight of ICG's companies are cash-flow positive, and he expects the top 15 to be cash-flow positive within the next 18 months.

"We're on the path to be cash-flow neutral well into 2002 without requirements to raise capital," Fox said. He added that the company will consider selling off some of its holdings.

But several analysts weighed in with downgrades of ICG stock Thursday. First Union Securities changed its rating on the company's shares to "buy" from "strong buy." Merrill Lynch downgraded the stock to "accumulate" from "buy." USB Piper Jaffray changed its rating on ICG to "neutral" from "buy."

Online ad market stings CMGI

Meanwhile, CMGI, which holds substantial interests in 70 dot.com companies spanning a broad range of market segments including e-commerce and internet advertising, headed sharply lower as well.

CMGI (CMGI: Research, Estimates) shares were off $4.25 at $17.56, a 19.5 percent decline on the day and 89.3 percent below their 12-month high of $163.50.

It's the Andover, Mass.-based company's exposure to the online advertising market that's pressuring CMGI. After Wednesday's close, CMGI scheduled a teleconference for next Monday during which executives will review the company's expected operating results for fiscal 2001.

While the company did not say it will revise its revenue and earnings estimates downward, industry observers are widely expecting it to do so, considering the recent softness in the market for online advertising. While the company did not say it will revise its revenue and earnings estimates downward, industry observers are widely expecting it to do so, considering the recent softness in the market for online advertising.

On Wednesday, Internet advertising firm Engage (ENGA: Research, Estimates), in which CMGI holds a majority interest, warned that it will fall short of its fiscal first-quarter financial targets, blaming market-related and internal factors.

Paul Schaut, Engage's chief executive, also said he will step down. He will be replaced by Anthony Nuzzo, formerly chief executive of Marsh & McLennan's start-up Internet bank.

U.S. Bancorp Piper Jaffray lowered its revenue estimates for CMGI's fiscal first-quarter, citing Engage's pre-announcement and saying that the broader softness in the online advertising market is likely to have an impact on other companies within CMGI's portfolio.

-- Reuters contributed to this report

|

|

|

|

|

|

|