|

AT&T to spin off Liberty

|

|

November 15, 2000: 6:44 p.m. ET

No. 1 U.S. telecom intends to spin off media and technology co. next year

|

NEW YORK (CNNfn) - AT&T Corp. unveiled plans Wednesday to spin off Liberty Media Group, its fast-growing media and technology operation, to help alleviate competitive and conflict-of-interest concerns that typically would be brought against both companies by U.S. regulators.

The No. 1 U.S. long-distance and cable company said, subject to a favorable tax ruling from the Internal Revenue Service, it would convert the Liberty Media tracking stock into an asset-based security and introduce the company as a publicly-traded equity during the second quarter of next year.

AT&T said the spin-off would allow Liberty Media greater ability to raise capital and acquire companies that compete with AT&T, while reducing conflict-of-interest concerns for AT&T arising from the Federal Communications Commission's interpretation of its recent cable ownership and attribution rules.

The New York-based AT&T is also reserving the right to use the spin-off to meet regulatory conditions placed on its $54 billion acquisition of cable company MediaOne Group Inc. earlier this year.

In exchange for granting regulatory approval of that deal, the FCC required AT&T to choose one of three divestiture options, including abandoning its stake in Liberty Media, divesting its 25.5 percent stake in Time Warner Entertainment or shedding at least 11.8 million existing cable customers.

However, AT&T spokeswoman Eileen Connolly said her company has not definitively made its decision related to that requirement. However, AT&T spokeswoman Eileen Connolly said her company has not definitively made its decision related to that requirement.

"This arrangement in no way limits or restricts which options we'll pursue," she said, noting the company has until Dec. 15 to choose one of the three options.

Liberty Media, based in Englewood, Colo., is currently a 100 percent-owned subsidiary of AT&T, resulting from the telecom's purchase of former cable company Tele-Communications Inc. in 1999. However, the operation has been accounted for as an equity investment by AT&T, giving the company and it's chairman, media mogul John Malone, tremendous latitude to cut deals and grow the business, primarily through acquisition.

Accordingly, Liberty Media Group, which generated revenue in excess of $1.1 billion last year, now holds stakes in everything from wireless companies like Sprint PCS (PCS: Research, Estimates), magazine publisher Primedia (PRM: Research, Estimates) to satellite-listing provider Gemstar-TV Guide (GMST: Research, Estimates). Malone also recently struck a deal with Rupert Murdoch's News Corp., exchanging his company's stake in Gemstar for a 13 percent non-voting stake in the Australian media conglomerate.

Malone has been pushing AT&T to spin his company out for some time now, but his efforts were hindered by the tax bill AT&T would face if it attempted such a move before next Spring. However, Malone was quoted in published reports last week saying his company was gearing up for such a move.

Because AT&T acquired Liberty Media as part of the tax-free TCI purchase, it would have to pay some taxes on a spin-off if it sells Liberty Media too quickly. The tax penalty could be avoided if AT&T could convince the Internal Revenue Service that it had a material business reason for the sale.

AT&T unveiled its long-awaited restructuring last month, essentially giving its current shareholders the ability to invest in each of the four new units -- AT&T

Wireless, AT&T Broadband, AT&T Consumer and AT&T Business -- within the next two years.

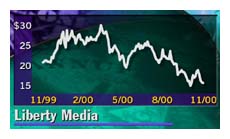

The overhaul ended a three-year effort by AT&T Corp. Chairman Michael Armstrong to build a telecom conglomerate with holdings ranging from cable television to the Internet, and was designed to revive the company's stock price, which has fallen by more than 60 percent this year. Liberty Media is likewise trading at about half of its 52-week high.

Liberty Media (LMG.A: Research, Estimates) shares rose 6 cents to $15.82 in trading Wednesday, while AT&T (T: Research, Estimates) shed 12 cents to $20.56.

-- Reuters contributed to this story

|

|

|

|

|

|

|