|

Pepsi seeks strategic deals

|

|

November 15, 2000: 2:04 p.m. ET

CFO says company wants only strategic deals, but was mum on Quaker Oats

|

NEW YORK (CNNfn) - A top PepsiCo Inc. executive said Wednesday the soft drink and snack food company remained very interested in adding to its expansive holdings through acquisitions, but would not pursue any deal that ultimately hurt its bottom line.

Speaking at UBS Warburg's Food, Beverage and Household Products conference in New York, PepsiCo Chief Financial Officer Indra Nooyi said her company follows a tight checklist of requirements when considering any acquisition, including assuring the deal either immediately added to the company's earnings or was neutral in the first year "with a solid ramp-up in year two."

But while admitting the company routinely conducts "window shopping" exercises, she also hinted it was in no rush to complete a merger anytime soon.

"We are an investment banker's worst nightmare," she said. "With little debt and a strong cash flow, we have the ability to do almost anything. But we don't need to."

Nooyi's comments come less than two weeks after cereal and sport drink conglomerate Quaker Oats rejected a nearly $14 billion buyout offer from PepsiCo (PEP: Research, Estimates), causing the world's No. 2 soft drink producer to walk away from the negotiating table.

Quaker Oats' lure to Pepsi was driven primarily by its Gatorade operation, which dominates roughly 80 percent of the U.S. sports drink market.

Pepsi has rapidly diversified its portfolio in recent years, adding such products as Tropicana juices and the fast-growing South Beach Beverage Co., to help overtake its primary rival, Coca-Cola Co. (KO: Research, Estimates). Adding Gatorade would only bolster Pepsi's future growth prospects in the eyes of analysts, particularly as the growth of soft drinks continues to slow. Pepsi has rapidly diversified its portfolio in recent years, adding such products as Tropicana juices and the fast-growing South Beach Beverage Co., to help overtake its primary rival, Coca-Cola Co. (KO: Research, Estimates). Adding Gatorade would only bolster Pepsi's future growth prospects in the eyes of analysts, particularly as the growth of soft drinks continues to slow.

Though Gatorade represents only 40 percent of Quaker Oats (OAT: Research, Estimates) overall sales, analysts said an acquisition of the entire company would be prudent at a reasonable price, assuming some of its other operations could be sold off.

Nooyi repeatedly declined to comment on the Quaker Oats talks, but did hint that while Pepsi traditionally encouraged targeted acquisitions, it would acquire a large company that didn't fit the company's profile as a whole in order to obtain the more attractive units at its core.

"The challenge is to get the diamond and manage the rest," she said. "To get the parts you want, sometimes you have to grab the whole thing."

When asked to comment directly on the growth prospects of the sports drink category, Nooyi would only agree with an analysts' assessment that the industry's outlook was "terrific."

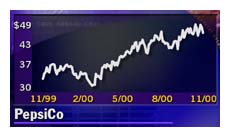

PepsiCo shares fell $1.12 to $46.69 in early afternoon trading Wednesday.

|

|

|

|

|

|

PepsiCo

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|