|

Fed holds rates steady

|

|

November 15, 2000: 6:14 p.m. ET

U.S. central bank maintains rates, remains vigilant on inflation

By Staff Writer Franklin Paul

|

NEW YORK (CNNfn) - The Federal Reserve opted Wednesday to leave interest rates unchanged and warned once again that it continues to see risks of accelerating inflation – a signal to both Wall Street and Main Street that it may not be done with its series of growth-slowing rate hikes.

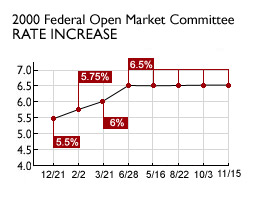

As expected, the Fed's policy-making arm, the Federal Open Market Committee, maintained its federal funds rate -- the target rate at which banks lend money to each other overnight -- at 6.5 percent. The discount rate – the rate at which the Fed's 12 district banks lend directly to member institutions -- remained at 6 percent. As expected, the Fed's policy-making arm, the Federal Open Market Committee, maintained its federal funds rate -- the target rate at which banks lend money to each other overnight -- at 6.5 percent. The discount rate – the rate at which the Fed's 12 district banks lend directly to member institutions -- remained at 6 percent.

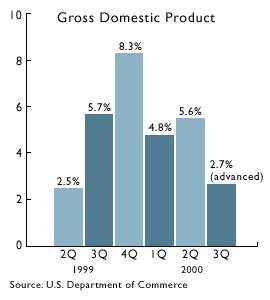

In their statement, the members acknowledged recent evidence that the U.S. economy is slowing from its torrid pace. Indeed, in recent weeks, the government has reported a drop in core wholesale prices, a slowing in creation of new jobs, and the nation's gross domestic product growth rate was its slowest in more than a year.

Still, the committee, which currently consists of 10 voting members and is led by Fed Chairman Alan Greenspan, chose to remain cautious about declaring victory in their fight to rein in the economy and keep inflation from picking up steam, derailing the record economic expansion.

"This is a sign that the committee is beginning to think aloud about shifting to a more neutral position - but the forecast of significantly slower growth will have to come first," said Ian Shepherdson, chief U.S. economist at High Frequency Economics, in Valhalla, New York. "For now, the elevated headline inflation rate and the tight pool of available labor remain bigger concerns, so the Fed's guard is still up."

Reprieve for consumers

The decision means an additional reprieve for consumers from rising interest rates on credit cards and "big-ticket" items such as cars and home appliances. But the Fed will continue to keep a watchful eye on the economy's progress, and will convene in December to reassess.

Investors didn't particularly like that scenario. Wary of the possibility that another rate hike may be on tap, investors frowned on the announcement, sending stocks lower following the 2:15 p.m. ET statement. By the 4 p.m. close, however, both indexes had recouped their losses, ending the day with slight gains. Investors didn't particularly like that scenario. Wary of the possibility that another rate hike may be on tap, investors frowned on the announcement, sending stocks lower following the 2:15 p.m. ET statement. By the 4 p.m. close, however, both indexes had recouped their losses, ending the day with slight gains.

The Nasdaq composite index closed up 27.18 points to 3,165.45, while the Dow Jones industrial average rose 26.54 points to 10,707.60.

Fed watchers had largely predicted the decision by the FOMC to leave rates unchanged. They argued that along with signs that the economy is slowing, they were influenced by jitters on Wall Street about the unresolved U.S. presidential election.

"It is a disappointment right now," Barry Berman, head of equity trading at Robert W. Baird & Co. in Milwaukee told Reuters. "Nobody expected them to change the rate but they were hoping that they would maybe go to a neutral stance. Keeping rates where they did and still warning about inflation, really not backing down, has unnerved the markets a little bit."

Holding the line

It was the fourth consecutive meeting that Fed officials left rates unchanged and the seventh in which it warned about the risks of faster inflation. The Fed boosted rates six times between June 1999 and May of this year, but chose to leave rates unchanged at its June, August and October meetings.

In a statement, the agency said it acknowledged a softening in business and household demand and tightening conditions in financial markets over recent months, but that the economy's condition did not merit a softening in its stance on the threat of Inflation. In a statement, the agency said it acknowledged a softening in business and household demand and tightening conditions in financial markets over recent months, but that the economy's condition did not merit a softening in its stance on the threat of Inflation.

"To date the easing of demand pressures has not been sufficient to warrant a change in the Committee's judgment that against the background of its long-run goals of price stability and sustainable economic growth and of the information currently available, the risks continue to be weighted mainly toward conditions that may generate heightened inflation pressures in the foreseeable future," the FOMC said.

Still, the committee spelled out its concerns, citing tight labor markets and high energy prices as red flags that it has yet to finally tame inflation.

"The utilization of the pool of available workers remains at an unusually high level, and the increase in energy prices, though having limited effect on core measures of prices to date, still harbors the possibility of raising inflation expectations," the FOMC said.

What's next for the Fed?

Market experts suggest that with consumers reining in their aggressive spending and businesses thinking twice about expansion plans, Fed members will soon – perhaps in December -- relax their stance on the economy's inflation risk, something they would do by altering the wording in their official statement.

Interest rates, however, are likely to remain unmoved through the end of this year. Interest rates, however, are likely to remain unmoved through the end of this year.

"Clearly, the FOMC appears reluctant to abandon the formal policy tilt at this time, but could adopt a neutral directive if the economy continues to soften or financial markets continue to tighten," said Wayne Angell, Chief economist at Bear Stearns.

"We continue to believe that the Fed is too tight and we remain on

track for an easing in 2001, preceded by a move to a neutral directive at the December 19 meeting," he added.

The Fed's decision to stand pat on rates may have also been influenced by the undecided presidential election, which has added a queasiness to stock markets. Experts suggested that the FOMC may chose to show their hand only after the election saga, now in its eighth day and threatening to last for weeks, is settled.

"With the ongoing uncertainty about the presidential election, I think it was wise not to change their stance," said John Forelli, Senior Vice President of Independence Investment Associates.

"Greenspan clearly thinks the economy is coming in for a soft landing," he added. "If it gets rough, he still has plenty of room to maneuver."

|

|

|

|

|

|

|