|

Dream life or in a dream?

|

|

November 15, 2000: 8:20 a.m. ET

A man with two promising career paths starts to take a hard look at retirement

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - James Lim's dream is that his Internet start-up in Korea will deliver up an IPO that will make him rich. But even if the idea fails, he has a nice backup plan -- a promising career in law.

While Lim doesn't have a 401(k), he has been buying big tech stocks in his online account like Cisco Systems and hopes to save enough to settle down someday in southern California and raise a family. In 25 years or so, he'd like to retire and work on his golf game.

But if his start-up succeeds, retirement would happen fast.

"I guess I'm a born planner, but I'm not a born saver," Lim said. "Basically I want to be in a situation where I don't worry too much about money." "I guess I'm a born planner, but I'm not a born saver," Lim said. "Basically I want to be in a situation where I don't worry too much about money."

To many people, the 30-year-old bachelor is already living a dream, with late nights out with friends in Seoul, exotic vacations to Bali and Singapore, and a lawyer's paycheck.

To financial planners, Lim may be living in a dream world.

To dream ...there's the rub

The problem with Lim, like many young professionals, is the plan doesn't always match the dream, financial advisers say. Often, 30-somethings have plenty of talent and great ideas – but they aren't realistic about how much their lifestyles and dreams will actually cost.

"He needs to understand the challenges he's given himself," said Pat Jennerjohn, a certified financial planner and principal at Focused Finances in Oakland, Calif. "This guy is living large ...He has ambitions and that's going to constrain his savings for a while."

Portfolio Rx is a regular CNNfn.com feature that looks at issues like portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a regular CNNfn.com feature that looks at issues like portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information.

Many people also underestimate what they'll need for retirement by not taking into account important factors like portfolio diversification or inflation, financial pros say.

"He's making a huge bet in technology," said Steven Kaye, a certified financial planner and president of American Economic Planning Group in Watchung, N.J. "But that means he's also making a huge bet against every other sector."

Big plans in Seoul

Lim, a graduate of University of California, said he first came to Korea last year while on a business trip working for a small law firm in Los Angeles. He ran into an old friend who introduced him to a guy who was starting an Internet business.

One thing led to another, and Lim became a partner of joyinbox.com, which links buyers and suppliers of floral goods and services. Then, he hooked up with some expatriates working for a Korean law firm, and he soon had a job with the firm in international finance.

He likes having the possibility of IPO riches along with the security of a job as an attorney.

He earns about $125,000 a year, plus a $17,000 bonus. He pays $500 each for housing and his $45,000 student loan, and another $450 on cabs since he doesn't have a car. His biggest expense these days is $700 a month on entertainment since he feels like he should take advantage of living in Asia.

| |

JAMES LIM'S STOCKS JAMES LIM'S STOCKS

|

|

| |

|

Cisco 24%

Oracle 20%

JDS Uniphase 15%

Sun Microsystems 14%

Source: James Lim

|

|

|

While the Korean market is volatile, and he has questions about the economy, the company recently won its first round of venture capital financing, he said. He is a minority shareholder.

Still, he's been dutifully saving about $3,000 to $4,000 a month and investing it in stocks. He also opened a Roth IRA and has diversified into a few mutual funds. He'd like to save about $3 million and have enough to buy a home valued at around $450,000 (in today's dollars).

| |

JAMES LIM'S MUTUAL FUNDS JAMES LIM'S MUTUAL FUNDS

|

|

| |

|

Invesco European 10%

Reserve Small Cap Growth 9%

T. Rowe Price New Asia 8%

Source: James Lim

|

|

|

"I have no retirement plan and that scares me," Lim said. "One thing I noticed about Koreans, they save and save for their retirement. Through osmosis, I started to think about my retirement."

Lim is single, but he'd like to meet a nice woman, get married and have two kids.

Click here to read a previous Portfolio Rx. Or, click here to read last week's Checks & Balances.

He used to be the guy who called savers "penny pinchers," but now he's worried whether he's putting enough away – and whether he's doing as much as other people his age to plan for the future. He also wonders if his portfolio is diversified enough to weather stormy markets.

What the experts say

Jennerjohn and Kaye did not review the plans for the start-up, yet both discounted the possibility of internet riches in their analyses.

"He has a secret ambition he's going to IPO and be a millionaire," Jennerjohn said. "This tech shakeup is going to change a lot of people's thinking. It's an upscale way of buying a lottery ticket. It doesn't come into the plan."

One of Lim's most obvious mistakes is that his income is too high to qualify for a Roth IRA, she said. He will have to "recharacterize" it to a traditional IRA.

"I'd like to see him working at a job that has a good retirement plan like a 401(k)," Jennerjohn said.

Because of the impact of inflation, Lim will need to save $6 million, about $3,300 a month, to have $3 million in purchasing power, she said.

| |

JENNERJOHN'S RX JENNERJOHN'S RX

|

|

| |

|

Increase value exposure with Thornburg Value or Selected American

Increase allocation in international funds

|

|

|

Jennerjohn thinks all of Lim's holdings are "keepers," but she would diversify into value stocks. For example, she recommend Thornburg Value or Selected American, two funds that know how to find value in the new economy, for his IRA. Thornburg Value, for example, is a good all-cap fund with some international holdings.

As far as his online account, Jennierjohn thinks Lim should increase his overseas exposure to 15 to 30 percent by increasing his allocation in the two international funds.

Kaye estimated that Lim will have to save $13,000 a year for retirement and another $10,000 a year per child for college, assuming a rate of return of 9 percent. College costs have been skyrocketing at a rate of 10 percent a year, but he thinks it will level off to about 7 percent. Kaye estimated that Lim will have to save $13,000 a year for retirement and another $10,000 a year per child for college, assuming a rate of return of 9 percent. College costs have been skyrocketing at a rate of 10 percent a year, but he thinks it will level off to about 7 percent.

Kaye said Lim needs to be more realistic about his expenses. Lim should also consider disability insurance, since, at his age, one of his biggest assets is his earning potential.

Lim may want to consult someone familiar with international tax law to see if he qualifies for any write-offs, Kaye said.

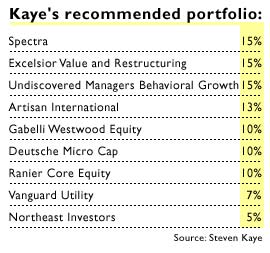

As far as the investments, Kaye would recomment a portfolio of mutual funds that includes more exposure to value stocks and mid- and small-cap holdings.

Kaye's lineup includes names like Spectra, a large-cap value fund managed by veteran David Alger, and Artisan International, an overseas fund. Vanguard Utility Fund, which invests in utility stocks, helps "soften" the aggressive edge.

"That's a very nice, diversified, moderately-aggressive portfolio," Kaye said.

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. Please include a daytime phone number so that we may reach you. If we choose your portfolio, we will use your information, including your name in an upcoming story.

* Disclaimer

|

|

|

|

|

|

|