|

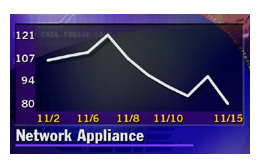

Network Appliance dives

|

|

November 15, 2000: 6:12 p.m. ET

Storage hardware maker plunges 21 percent after Bear Sterns downgrade

|

NEW YORK (CNNfn) - The stock of high-flying storage hardware maker Network Appliance showed Wednesday that a company can hand in winning financial results for a quarter but still lose in the harsh judgment of the stock market.

Network Appliance's (NTAP: Research, Estimates) stock plunged Wednesday after an analyst at Bear Stearns cut his rating on the company in response to concerns that its earnings and sales growth may slow. It finished the day down $20.12 at $76.12, a drop of about 21 percent, and was one of the most actively traded stocks on Nasdaq.

After the close Tuesday, Network Appliance reported second-quarter earnings and sales that topped Wall Street forecasts, as demand for its data-storage products surged.

Most analysts issued positive comments about Network Appliance Wednesday morning. But Bear Stearns analyst Andrew Neff cut the stock from "buy" to "attractive," citing what he sees as slowing business momentum.

"The stock's rich multiple requires continued strong upside surprises and estimate increases -- both of which are unlikely to happen near-term as the law of large numbers catches up with the company," Neff said in a research note.

The Bear Stearns analyst said he remains confident about the company's competitive position and management's ability to execute and manage the company's rapid growth. He kept his fiscal 2001 earnings-per-share estimate at 40 cents on revenue of $1.1 billion and his fiscal 2002 estimate of 55 cents on revenue of $1.6 billion.

Growth of network-attached storage

Network Appliance competes in the market for network-attached storage (NAS) products called Filers. The company's storage devices are connected directly to a local area network rather than to a server. Network-attached storage has the advantage of allowing multiple servers to share one storage device, and is well adapted for situations where users need to access small amounts of data on a frequent basis. However, trying to send large blocks of data over an Internet connection can be slow.

By contrast, most storage today is directly attached to a server. The market in 1999 was 92 percent server-attached storage, amounting to $27.7 billion in revenue. However, server-attached storage is expected to decline to 62 percent of the market by 2003, according to the IT research firm IDC. By contrast, most storage today is directly attached to a server. The market in 1999 was 92 percent server-attached storage, amounting to $27.7 billion in revenue. However, server-attached storage is expected to decline to 62 percent of the market by 2003, according to the IT research firm IDC.

Rapidly growing demand for storage drove Network Appliance's revenue to $579 million in fiscal 2000 from $166 million in fiscal 1998. The company expects its revenue to reach $1.1 billion in fiscal 2001.

Storage giant EMC (EMC: Research, Estimates) has the leading position in the market for server-attached storage, and some analysts and investors are concerned about its expanding presence in Network Appliance's market for network-attached storage.

EMC is expected to introduce a network-attached storage product based on technology it acquired through its Nov. 1 purchase of CrosStor for $300 million. When EMC launches that product, possibly in early December, analysts will pay close attention to its pricing and performance to measure the potential impact on Network Appliance.

"I think that EMC will put a viable network-attached product on the market," said Mark Kelleher, an analyst at FAC Equities in Boston, Mass. "But there is room in the market for two players. We have made no changes to our revenue or earnings expectations for Network Appliance."

Kelleher said that EMC's new network-attached product could have an impact on Auspex Systems (ASPX: Research, Estimates) also. Auspex makes a network-attached storage device that uses the same file-management software as CrosStor uses. Now that EMC owns CrosStor, Auspex will need to re-examine its strategy, Kelleher said.

Merrill Lynch analyst Thomas Kraemer advised investors to buy Network Appliance's stock during this dip, saying that the company's "fundamental strengths remain solid and sustainability of revenue growth looks solid."

Credit Suisse First Boston analyst Amit Chopra said that EMC's entry into the network-attached storage market "bears watching," but kept his "buy" rating on the stock.

|

|

|

|

|

|

|