|

Philips buys Agilent unit

|

|

November 17, 2000: 4:21 p.m. ET

In Philips' second deal of week, Dutch firm to pay $1.7B for health care unit

|

NEW YORK (CNNfn) - Philips Electronics agreed Friday to acquire the health care group of Agilent Technologies for $1.7 billion cash, extending the global reach of its medical systems unit.

The purchase significantly bolsters Philips Medical Systems, a unit of Philips, by providing an entrance into high-growth markets such as home care technology and automatic external defibrillators. Amsterdam, Netherlands-based Philips (PHG: Research, Estimates) will add the Agilent's group's 400 products and services, such as patient monitoring and ultrasound imaging.�

The medical unit deal follows Philips' purchase earlier in the week of ADAC Laboratories for about $426 million, or $18.50 a share.

Philips Electronics, Europe's largest consumer electronics maker, makes television sets, CDs and other electrical appliances such as shavers. So far, Philips has invested $4 billion into its medical systems group over the past several years, the company said. Philips Electronics, Europe's largest consumer electronics maker, makes television sets, CDs and other electrical appliances such as shavers. So far, Philips has invested $4 billion into its medical systems group over the past several years, the company said.

"This will put Philips Medical Systems in a good position to be a strong world player in this industry and provide our shareholders with a valuable proposition to generate significant value," Philips Electronics CEO Cor Boonstra said.

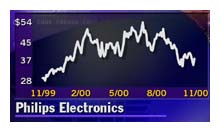

Agilent (A: Research, Estimates) shares jumped on the news nearly 12 percent, or $5, to $47 in afternoon trading. Philips shares rose 19 cents to $35.69.

The sale

Agilent Technologies, a spinoff from Hewlett-Packard (HWP: Research, Estimates), went public in November 1999.

In August, Agilent announced a major restructuring to improve its operational performance. Agilent, a leading maker of analysis equipment, reviewed all its businesses, which included communications, electronics and life sciences, as well as the health care group.

The group's sale was not prompted by its performance over the past several months, Agilent executives said on a conference call open to the media.

The Agilent health care services group employs about 5,000 people and has annual sales of about $1.5 billion. For the nine months ended July 31, the group posted $53 million in operating losses on $1.1 million in revenue, including one-time charges from Agilent's separation from Hewlett-Packard.

"We concluded we had higher priorities to invest in and health care came in at the bottom of the list," Agilent CEO Robert Walker said. "We concluded we had higher priorities to invest in and health care came in at the bottom of the list," Agilent CEO Robert Walker said.

Life sciences is a better long-term business, which is not experiencing the consolidation, nor is as mature, as health care, Agilent executives said. The company expects its overall growth to increase "somewhat" after the deal is completed, Walker said.

Agilent estimates it will have less than $200 million in expenses associated with the health care group.

Agilent received about one times revenue for the health care unit, said analyst Edward White, of Lehman Brothers.

The health care unit did not fit with Agilent's other businesses, White said, and the sale will allow the company to focus more on its high-growth areas. The health care business grows about 5 to 7 percent a year but works best when a company has a broad base of products.

Agilent realized it would have to ramp up the health care business for it to produce a sizeable return, White said.

"Agilent wants to focus on telecommunications, products sold into that, and life sciences," White said. "Health care didn't really fit into all of that."

No specific completion date has been set, but the deal is expected to close within the next several months, an Agilent spokeswoman said. The transaction is subject to customary regulatory hurdles and other closing conditions.

Agilent expects to report fourth-quarter earnings Monday.

|

|

|

|

|

|

Agilent Technologies

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|