|

Kandel on the Fed

|

|

November 17, 2000: 6:00 a.m. ET

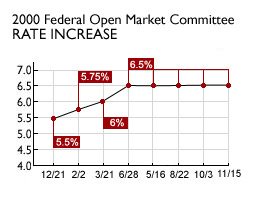

FOMC is still cautious on inflation, but votes to hold interest rates steady

By CNNfn Financial Editor Myron Kandel

|

NEW YORK (CNNfn) - It's a stretch, but the Federal Reserve's announcement on Wednesday that it was not changing interest rates reminded me of something out of the height of the Cold War and the Iron Curtain that enveloped the Soviet Union under the tight-fisted grip of Josef Stalin.

In those days, it was very difficult to get any news out of the Soviet Union and journalists and other observers grasped for any tidbit they thought could offer a clue to the inner workings of its communist government. There wasn't much. But on May Day and other state occasions, Stalin and the other members of the Politburo would gather on the balcony overlooking Red Square to review the traditional display of Soviet military might.

The Kremlin-watchers would eagerly examine the line-up on that balcony, studying who was standing next to whom, how close they were to Stalin, and who was farther away this time than he was on the last occasion. And on that meager evidence, they would make profound analyses of changes in the direction of Soviet policy and leadership.

Without belaboring this comparison, I thought of all this when I heard and read the views of Wall Street observers about the Fed's action -- or rather, inaction -- and the reasons it put forth for that position. Here's the Fed's statement in its entirety:

"The Federal Open Market Committee at its meeting today decided to maintain the existing stance of monetary policy, keeping its target for the federal funds rate at 6.5 percent. "The Federal Open Market Committee at its meeting today decided to maintain the existing stance of monetary policy, keeping its target for the federal funds rate at 6.5 percent.

"The utilization of the pool of available workers remains at an unusually high level, and the increase in energy prices, though having limited effect on core measures of prices to date, still harbors the possibility of raising inflation expectations. The Committee, accordingly, continues to see a risk of heightened inflation pressures. However, softening in business and household demand and tightening conditions in financial markets over recent months suggest that the economy could expand for a time at a pace below the productivity-enhanced rate of growth of its potential to produce.

"Nonetheless, to date the easing of demand pressures has not been sufficient to warrant a change in the Committee's judgment that against the background of its long-run goals of price stability and sustainable economic growth and of the information currently available, the risks continue to be weighted mainly toward conditions that may generate heightened inflation pressures in the foreseeable future."

In analyzing this statement, Goldman Sachs economist Jan Hatzius said it differed in three respects from the Open Market Committee's statement following its previous meeting in early October.

"1. The statement noted concerns about inflationary risk before talking about slower growth.

"2. Growth is now expected to remain below potential, rather than just having slowed 'closer to' potential.

"3. The tentative language in the last paragraph of the statement may suggest that removal of the bias has come closer."

Bottom line, however, Hatzius says, "nothing suggests that the Fed is close to a change in interest rates, in either direction."

Sharply critical of the Fed's position, though, was Lawrence Kudlow, a former member of the Reagan Administration and now chief U.S. investment strategist and chief U.S. economist of ING Barings. He said the Fed made a "blunder-headed move" by failing to shift its policy bias from restraint to neutral, adding that the central bank "should have opened the door to future credit-easing rules, but instead, it remained pig-headed in pursuit of a discredited labor-market theory of inflation."

The Fed, he asserted, should have reduced the federal funds rate by roughly half a percentage point. The Fed, he asserted, should have reduced the federal funds rate by roughly half a percentage point.

And, in discussing the wording of its statement, Kudlow -- never one to pull his punches -- suggested the Fed could use a speechwriter to clarify its language.

Meantime, International Strategy & Investment, a respected firm of economic and political consultants, said it interpreted the Fed's statement as being in line with the fed funds futures market, which is implying a 50-50 chance of a quarter-point ease in interest rates by the end of January.

"That's the way we would read the statement as well," the ISI analysis said. "With no rate decision at stake, the statement of risks and the explanatory language became part of the over-all message the Fed wants to send. We think the Fed wanted to signal a continuity of policy, since it's not all that concerned with the current state of affairs, but they also acknowledged the growing signs of a slowdown. This doesn't represent a hawkish stance, and it doesn't lower the odds of a rate cut in the first quarter of next year."

Maury Harris, chief economist of the UBS Warburg Economics Group, doesn't go that far. But he says: "With likely moderate inflation, by early next year we continue to expect the Federal Reserve System to stop warning that economic risks are skewed toward inflation."

Kudlow, despite his criticism of the Fed, concedes that "it's possible that help is on the way." He says he wouldn't rule out a fed funds rate cut in December. He says the futures markets are predicting a quarter-point easing by next April, and then he adds: "But April is a long time away."

So whether it's studying the line-up on the Kremlin balcony, reading the tea leaves, examining the entrails of ancient sacrifices, or trying to fathom Fed policy statements, analyses and forecasts can be varied and imprecise. My view, for whatever it's worth, is that the Fed's next move is not yet in the cards, but will be determined by how much -- or how little -- the economy slows in the coming six weeks.

|

|

|

|

|

|

Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|