|

Asia ends mostly lower

|

|

November 20, 2000: 6:01 a.m. ET

Tech shares slump in Tokyo, Seoul, Taipei; HK banks, properties rise

|

LONDON (CNNfn) - Asia's main markets ended mostly lower Monday as political uncertainties in the United States and Japan put pressure on shares of chipmakers and other high-technology companies.

In Tokyo, the Nikkei 225 dipped 0.1 percent to close at 14,531.65, as investors awaited the outcome of a no-confidence motion directed at  Prime Minister Yoshiro Mori expected later in the day. Prime Minister Yoshiro Mori expected later in the day.

"People are unwilling to make any big bets," said Dick Beason, chief strategist at UBS Warburg, adding that most observers expected Mori to survive the no-confidence vote, "but by a very, very small margin".

Singapore's Straits Times index fell 1 percent to 1,934.19, while the Taiwan Weighted Index plunged 6.2 percent in Taipei to end at 4,845.21, its lowest close in more than four-and-a-half years, as speculation the economy might face a crisis put pressure on an already jittery market.

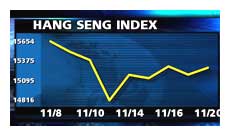

In Hong Kong, the Hang Seng Index bucked the regional trend, rising 1.1 percent to close at 15,346.66.

In the currency market, the yen weakened to ¥109.19 against the U.S. dollar from ¥108.62 in late trading in New York before the weekend.

In the U.S. Friday, the blue-chip Dow Jones industrial average closed down 0.3 percent, or 26.16 points, at 10,629.87, while the technology-heavy Nasdaq composite index fell 4.69 points, or 0.2 percent, to 3,027.19.

Sony plans tracking stock

On the Tokyo exchange, electronics titan Sony fell 1.3 percent after the company announced it would issue a tracking stock to give investors more direct exposure to its Internet service division. Chip and computer maker Fujitsu sank 1.5 percent.

Mobile telecoms giant NTT DoCoMo, Japan's biggest company by market capitalization, fell 1.7 percent. But its parent, telecom giant Nippon Telegraph and Telephone, rose 2.1 percent, as investors judged its 3.5 percent drop over the past week was overdone.

Semiconductor maker NEC fell 1.2 percent and Advantest, a maker of chip testing equipment, shed 1.5 percent.

Mazda Motor accelerated 4.9 percent, extending Friday's 6.1 percent advance, as investors cheered its restructuring plans, including a partial shift  of production to Europe and job cuts. of production to Europe and job cuts.

In Hong Kong, the benchmark index was led by a sharp rise in the holding company that owns the stock exchange, followed by gains in defensive shares from utilities to banks.

Hong Kong Exchanges and Clearing rose 3.4 percent as institutional investors snapped up shares in the wake of plans by Singapore Exchange to begin trading its shares on Thursday.

"HKEX is viewed as a good company as the exchange's turnover is expected to rise. Its shares have room to move higher as they are trading at slightly below some of their counterparts," said Peter Lai, a director at OCBC Securities.

Pacific Century CyberWorks was up 0.9 percent. Media reports over the weekend said that Britain's Cable and Wireless wants to sell its 15.3 percent stake in Richard Li's PCCW for $3.6 billion.

Mainland China's largest mobile-phone operator China Mobile (Hong Kong) rose 1 percent.

Heavyweight international bank HSBC Holdings ended up 0.9 percent while affiliate Hang Seng Bank rose 1.6 percent.

Property titan Cheung Kong (Holdings) rose 1.1 percent while Sun Hung Kai Properties added 0.4 percent.

Dealers said stocks in the utilities sector were in demand as defensive investments following recent volatility in telecom shares.

Electricity supplier HK Electric climbed 1.6 percent while fellow power producer CLP Holdings edged up 0.6 percent. Shares of natural gas distributor Hong Kong and China Gas closed up 1.1 percent.

Panic in Taiwan

In Singapore, technology shares led the index lower. Heavyweight Chartered Semiconductor Manufacturing fell 4.2 percent while Venture Manufacturing slid 2.5 percent.

United Overseas Bank fell 2.4 percent and Overseas Union Bank dipped 1.2 percent.

The Taiwan Weighted Index plunged, leading some analysts to forecast the onset of an economic crisis because many companies use stock as collateral for bank loans.

"The situation is really quite severe," said Alan Lu, assistant research  manager at Concord Securities. "We could really have an economic crisis," he said. manager at Concord Securities. "We could really have an economic crisis," he said.

The Finance Ministry dismissed talk of a crisis, however, saying problems were restricted to a few weak institutions.

Shares of Taiwan's three biggest commercial banks, Chang Hwa Bank, First Commercial Bank, and Hua Nan Bank, all fell by the 7 percent limit imposed on daily share-price movements.

The market was already falling amid political worries and concern about of declining demand for semiconductor shares.

Taiwan Semiconductor Manufacturing dropped 6.4 percent and rival United Microelectronics dropped by the 7 percent daily limit. Merrill Lynch last week cut its rating on microchip foundries to "accumulate" from "buy".

In Seoul, the Kospi lost 2.5 percent to end at 537.40. Hyundai Engineering rose 5.2 percent after the company announced its latest reform plan. Hyundai Electronics Industries, the country's second-largest semiconductor maker, ended down 2.2 percent after saying it had restructured its businesses into three groups, semiconductors, liquid crystal displays, and telecommunications and support.

Rival Samsung Electronics fell 3.7 percent, and South Korea's largest telecom operator SK Telecom fell 1.7 percent.

Profit reports in Australia

Sydney's S&P/ASX 200 index dipped 0.1 percent to end at 3,325.1 as investors remained cautious ahead of the outcome of the U.S. election.

Media company and market heavyweight News Corp. dropped 1.7 percent.

Australia's biggest bank, National Australia Bank, which went ex-dividend 64 cents, fell 1.7 percent. Commonwealth Bank of Australia rose 2.4 percent.

Sugar, aluminum and building materials group CSR rose 3.1 percent after it unveiled a better-than-expected 21 percent rise in interim profit and a cautiously optimistic outlook for the full year.

Australia's biggest grocer Woolworths fell 1.5 percent even after it said it expected solid increases in sales and earnings over the next year. The stock has experienced an almost non-stop rally since March this year, leaving it little room to rise on Monday's report, said traders.

Elsewhere in the region, Jakarta's JSX index rose 1.2 percent and Kuala Lumpur's KLSE Composite index slipped 0.5 percent. Manila's PHS Composite index ended up 0.4 percent, while Bangkok's SET index fell 2.1 percent .

--from staff and wire reports

|

|

|

|

|

|

|