|

Could it be recession?

|

|

November 22, 2000: 8:51 a.m. ET

The 'R' word is dreaded on Wall Street, but some signs are pointing that way

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Could it be? After chugging along faithfully for almost 10 years, could the U.S. economy be poised for a recession?

Judging strictly by the economic numbers, far from it. The U.S. economy is poised for a slowdown, a gentle easing of growth prompted by the Federal Reserve's series of interest rate increases over the past year and a half. The job market remains robust, inflation remains contained and consumers, while more wary, still are relatively confident about their future prospects.

At least that's what the economic data say. The financial markets, however, tell a much different story. They have priced in doom and gloom as far as the eye can see. Corporate bond yields are at their highest levels since 1998. Bank lending has dried up. Venture capital firms are keeping a tight fist on their check books. And the S&P 500 spells recession, with the index on track to post its worst annual performance in more than two decades. To date, the S&P has dropped 8.3 percent; it fell 9.7 percent in 1981.

So who is right? Have the markets ridiculously overreacted by pricing in the sad end to the longest economic expansion in U.S. history? Or are the experts who dissect all those different numbers that foretell the progress of the economy and the direction of interest rates simply missing, or arguably ignoring, the writing on the wall?

"That really is the trillion-dollar question," said Steven Slifer, chief economist with Lehman Brothers in New York. "The markets are pricing in extremely negative news and the forecasters are talking about not-so-bad but not-as-positive news. I suppose the truth lies somewhere in between."

The sharp shrill of the television set

Judging from newspaper headlines, magazine headlines and the sharp note of TV announcers' voices as they recount the play-by-play triple-digit downfall of stocks, the U.S. economy is not doing particularly well. And that is certainly true: Concern about declining stock prices, whether it directly affects them or not, has made people think twice about spending their hard-earned cash on things like new cars, computers and vacations.

Add to the mix the uncertainty as dot.com businesses go belly-up almost daily along with more stringent lending among banks and venture capitalists and it does not paint a promising picture for the economy going forward -- at least not to Main Street. Unlike 1999, when gross domestic product growth averaged an annual 5 percent, GDP expansion is expected to ring in at about 4 percent in 2000 and around 3.5 percent in 2001, according to the International Monetary Fund -- good numbers by any measure, but not the heady growth American consumers and businesses are accustomed to. By contrast, the textbook definition of recession is two consecutive quarters of contraction. Add to the mix the uncertainty as dot.com businesses go belly-up almost daily along with more stringent lending among banks and venture capitalists and it does not paint a promising picture for the economy going forward -- at least not to Main Street. Unlike 1999, when gross domestic product growth averaged an annual 5 percent, GDP expansion is expected to ring in at about 4 percent in 2000 and around 3.5 percent in 2001, according to the International Monetary Fund -- good numbers by any measure, but not the heady growth American consumers and businesses are accustomed to. By contrast, the textbook definition of recession is two consecutive quarters of contraction.

And those growth forecasts assume a lot: that employment will remain bountiful, that inflation will remain under wraps, that interest rates will remain stable or even come down, that international demand for American-made goods will continue and, as some analysts wryly say, that a U.S. President will be elected. But no matter how confident, no economist is willing to predict with certainty that all those things will happen in the magical order that will keep the economy on the road of continued prosperity.

"A lot of people are starting to come to the conclusion that we are in for a hard landing, based on the downturn in stocks and higher yields and spreads in the bond market," said Kim Rupert, a markets analyst with Standard & Poor's MMS in San Francisco. As for the prospect of a recession, "Things are never out of the question," she said. "It is not a zero percent possibility, but I think the probability is still extremely low."

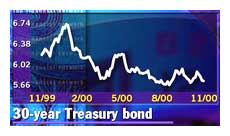

The bond market is bracing for recession

Not according to the corporate bond market.

There, where companies with more-risky prospects borrow money, things are looking pretty grim. The average yield on a 'BBB'-rated corporate bond is currently 13.3 percent, up from an average 10.3 percent demanded by investors back in September 1998, when the collapse of hedge fund firm Long Term Capital Management seized up the corporate bond market and prompted the Fed to begin cutting rates. Because a bond's yield moves inversely to its price, as the price, or value of a bond goes down, the yield rises. In that regard, yields in the double digits typically spell prices much lower than where they started.

For some economists and market watchers, the downturn of the corporate bond market and the lack of lending among financial institutions could spell big troubles for companies going forward -- something that could kick the economy in the gut a lot harder than many currently are predicting. For some economists and market watchers, the downturn of the corporate bond market and the lack of lending among financial institutions could spell big troubles for companies going forward -- something that could kick the economy in the gut a lot harder than many currently are predicting.

That has some serious implications for companies that have borrowed in the corporate debt arena to finance their operations -- firms such as Amazon.com (AMZN: Research, Estimates), whose 10-year 'CCC+'-rated bonds currently yield 13.83 percent, or Global Crossing Ltd. (GX: Research, Estimates), whose 10-year 'BB'-rated bonds yield 10.13 percent. And Xerox's (XRX: Research, Estimates) 'BBB' 2-year bonds that yield 9.12 percent.

That's because the amount of interest they are required to pay their bond holders is far greater than they ever anticipated, noted Richard Berner, chief economist with Morgan Stanley Dean Witter in New York. Paying more in outstanding interest means less on the bottom line -- a signal for stock investors that even a company like Amazon that has seen its stock price fall almost 80 percent in the past eight months still might not be fairly valued.

Banks are tightening their lending

One institution that most believe certainly can save the day is the Fed. Back in 1998, when lenders refused to nibble on corporate bonds at almost any price, the Fed swooped in and lowered short-term interest rates three times in as many months to ease investors' fears about a credit crunch occurring, and restore calm to jittery financial markets.

| |

|

|

| |

|

|

| |

The stock market is pricing in a hard landing, an acceleration of inflation and a Fed that may or may not come to the rescue. Part of that message is emanating from the bond market and part of it is coming from thick smoke signals that banks are sending.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Richard Berner,

Morgan Stanley Dean Witter |

|

Many believe the Fed would do that again if it sees concrete evidence that buyers are truly afraid to commit capital to sellers -- at any price. The Fed opted to leave rates unchanged at its Nov. 15 meeting, holding its influential fed funds target rate at 6.5 percent. Its next and final meeting for the year is Dec. 19.

But few are willing to bet the farm -- even on the Fed.

"The U.S. stock market is pricing in a hard landing, an acceleration of inflation and a Fed that may or may not come to the rescue," Berner said. "Part of that message is emanating from the bond market and part of it is coming from some thick smoke signals that the banks are sending."

Indeed, U.S. banks have all but closed their vault doors on lending cash to new ventures. According to figures complied by MSDW, commercial and industrial lending in the past three months has slowed to a 4.4 percent annual rate from 14.4 percent during the summer months -- the greatest reluctance among banks to lend cash since the 1991 recession.

Loan application? Denied

Even the Fed under the leadership of the seemingly omnipotent Alan Greenspan has taken note of U.S. banks' recent unwillingness to loosen their purse strings. In its November Senior Loan Officer survey of bank lending practices, the Fed found that 44 percent of domestic banking institutions "reported tighter lending standards on their commercial and industrial loans to large- and medium-sized firms," the highest percentage since 1991.

| |

SENIOR LOAN OFFICER SURVEY SENIOR LOAN OFFICER SURVEY

|

|

| |

|

The Fed's latest survey of lending practices among U.S. banks found that 44 percent of domestic banks reported "tighter lending standards," the highest percentage since 1991.

Senior Loan Officer Survey

|

|

|

With the initial public offering market all but shuttered, with the corporate bond market demanding the highest premiums on debt since the early 1990s, and with banks keeping their cash in their vaults, "That leaves companies with no choice but to pay more for financing and development," Berner said. "And it's not just tech, it's a lot of different sectors.

"Take a look at where some of the defaults are on a sector-by-sector basis – health care, shipping, auto parts -- some have been in industries which have been in legal wrangling such as Owens-Corning (OWC: Research, Estimates) -- which filed for bankruptcy because of asbestos claims. But many of these are more 'old economy' companies feeling the heat here," Berner said.

All that is going to have an impact on the economy going forward, said Sherry Cooper, chief U.S. economist with brokerage BMO Nesbitt Burns Inc. As the stock market wavers, consumers will be less confident. As confidence wanes, spending will falter. As spending falters, companies will have more trouble selling goods and services. And as companies have more trouble selling, their profits will falter, prompting investors to further shun their stock.

Sounds an awful lot like a recession, no?

If it looks and smells like recession...

It may sound like it, says Lehman Brothers' Slifer, but it certainly doesn't look like it.

He points to a 30-year-low unemployment rate, solid gains in disposable income, strong consumer confidence and mortgage rates that actually have declined more than a point and a half in the past six months, triggering renewed interest in the housing market. Even government spending is expected to rise, no matter who ends up in the oval office.

"The American consumer feels good, he has the money, he's not worried about losing his job and yes, the stock market has fallen, but that's way down on his list of concerns," Slifer said. "I think that growth is going to slow a bit but it's not going to fade into the sunset."

Certainly other Wall Street notables agree with Slifer, and almost no one is claiming the economy will come anywhere close to a recession. On the contrary, most are bickering over whether the economy will hit the runway hard on its way down or, as it did back in 1994-1995 under Greenspan's careful stewardship, glide back down for another soft landing.

"It really does come down to whether the economics profession is right or whether the markets are right, and I really think the markets are building in a huge amount of unnecessary fear," Slifer said. "From my own viewpoint, I sit here and I go through the various sectors of the economy and I try to figure out where all this alleged weakness is going to materialize -- and I really can't."

|

|

|

|

|

|

U.S. Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|