|

Tough road for Kerkorian

|

|

November 28, 2000: 2:41 p.m. ET

Daimler says $8B suit has no merit while legal experts call it long shot

|

NEW YORK (CNNfn) - German carmaker DaimlerChrysler AG Tuesday said an $8 billion lawsuit brought by Kirk Kerkorian has no merit, as experts questioned its chance at success.

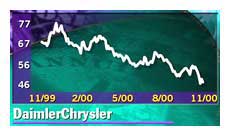

Analysts and legal experts said it was unlikely that the high-rolling investor, DaimlerChrysler's third-largest shareholder and its largest U.S. investor, would win his legal challenge, but said the wrangle could do further damage to a company that has seen its stock slump virtually without respite this year.

The suit, filed late Monday by Kerkorian's Tracinda Corp., charged that he and other investors were fraudulently lured into backing the $38 billion purchase of U.S.-based Chrysler in 1998. It said that despite promises at the time of merger discussions, Juergen Schrempp, the chairman of DaimlerChrysler, never intended for the two companies to operate as a merger of equals with Chrysler veterans continuing to run that unit.

DaimlerChrysler said that, based on what it knows of the lawsuit, it  regards Kerkorian's complaint as having no substance. The German company rejected the notion that it might divest Chrysler -- one of the remedies proposed in the Tracinda lawsuit. regards Kerkorian's complaint as having no substance. The German company rejected the notion that it might divest Chrysler -- one of the remedies proposed in the Tracinda lawsuit.

The chances of undoing the $38 billion, two-year old merger are "slim and none," according to Mark Sargent, dean of the Villanova University Law School and an expert in securities law.

"You can't unscramble an omelet," said Sargent. "If there was wrongdoing, the remedy would be damages. It would be extraordinary to undo a merger, particularly one of this magnitude."

Terry Christensen, Kerkorian's attorney, said Monday that an the unwinding of the merger was not the key demand of the suit and that Kerkorian would be satisfied with financial compensation. But he said if the court finds that the best way to compensate shareholders is to undo the merger, the suit wants to make sure that all of Chrysler's original assets are returned to the company.

An analyst at a European investment bank told CNNfn.com Kerkorian's likely aim was to force Daimler into buying back stock to try to boost the share price. He successfully pressured Chrysler into similar moves twice before the Daimler takeover.

Shares of DaimlerChrysler lost  0.70 to 0.70 to  46.50 Tuesday, while shares of the American depositary receipts (ADRs) of DaimlerChrysler (DCX: Research, Estimates) lost $1.73 to close at $39.52 in U.S. trading. The ADRs are nearly 50 percent off a yearly high of $78.68 and just above a yearly low of $37.90. 46.50 Tuesday, while shares of the American depositary receipts (ADRs) of DaimlerChrysler (DCX: Research, Estimates) lost $1.73 to close at $39.52 in U.S. trading. The ADRs are nearly 50 percent off a yearly high of $78.68 and just above a yearly low of $37.90.

"(DaimlerChrysler) have a legitimate excuse for not doing this," said the analyst, who spoke on condition of anonymity. "They are bleeding cash at Chrysler; it's time to consolidate cash, not give it away." He said that the financial situation at Chrysler "would get worse before it gets better."

Asked about the desire for a buyback, the Tracinda spokeswoman would only repeat that the suit seeks compensation for lost value.

The suit itself seems to suggest the time to unwind the merger has passed. It charges that German managers from Daimler waited nearly two years to replace most of the U.S. executives in charge of Chrysler because it did not want to be hit with litigation before now.

"Defendants knew that they could not act immediately to subordinate Chrysler and its executives to direct control by Daimler-Benz and its executives because they would risk embarrassing litigation which could potentially cause the unraveling of the Chrysler-Daimler-Benz merger," charges the suit.

Suit seen as hurting troubled automaker

While the DaimlerChrysler stock gained late Monday on news of the suit, it was off Tuesday as analysts worried about the impact on the company's efforts to regain profitability.

Howard Wheeldon, an analyst with Prudential in London who has a "hold" rating on DaimlerChrysler shares, said his concern is that the lawsuit could drag on for months. That could eat up resources of a management that could better spend its time on issues such as restoring newly bought Japanese carmaker Mitsubishi to profitability, rebuilding Chrysler's dwindling market share and cutting costs.

"The suit is having a negative impact" on DaimlerChrysler shares, said Philippe Barrier, an analyst with SG Securities, who has a "hold" rating on the stock, though he added: "I'm not sure (Tracinda) can be successful." "The suit is having a negative impact" on DaimlerChrysler shares, said Philippe Barrier, an analyst with SG Securities, who has a "hold" rating on the stock, though he added: "I'm not sure (Tracinda) can be successful."

David Healy, an analyst with Burnham Securities, said recent losses at Chrysler and a decline in stock price have little to do with the management structure of the combined company.

"For the last year or so, the Chrysler group was pretty much in hands of Americans," Healy said. "I think it's market forces more than mismanagement that caused its problems. And I think what's Kerkorian is really upset about is not the German managers, it's the fact he's lost a billion in the value of his stock."

Kerkorian owns about 33 million shares of the stock, or about 4 percent of the overall company. He had held 13.75 percent of Chrysler Corp. at the time of the merger, making him the largest shareholder at that time.

At the latest price, DaimlerChrysler is worth about  47 billion, or $40.2 billion, little more than the $38 billion that Daimler-Benz paid for Chrysler two years ago. 47 billion, or $40.2 billion, little more than the $38 billion that Daimler-Benz paid for Chrysler two years ago.

Nonetheless, with its share price equal to nearly 10 times this year's expected earnings per share, according to earnings tracker First Call, DaimlerChrysler stock is more expensive than shares in its U.S. rivals. Ford Motor Co. (F: Research, Estimates) shares trade at a price/earnings ratio of 7.1, and General Motors Corp. (GM: Research, Estimates) stock at about 5.4.

Tough times for Chrysler unit

The Chrysler unit, Detroit's third-biggest automaker, recently reported a $512 million loss in the third quarter, and projected more losses in the current quarter and continued problems into next year.

It made that warning the same day it fired Chrysler veteran James Holden as chief executive of the company, replacing him with Dieter Zetsche, a veteran Daimler executive, to try to stem the flow of red ink. It also named another Daimler executive as the new chief operating officer of the Chrysler unit.

While U.S. auto sales remain at a historically high level, the introduction of new light truck models, particularly from Japanese automakers, have hit profits in Chrysler's core North American light truck market.

Chrysler along with the GM and Ford have shut plants and raised incentives in order to deal with increasing truck inventories. Tuesday's report from the U.S. Commerce Department that showed a the first drop in three months in orders for durable goods, another sign of the slowing of the U.S. economy.

Does executive turnover equal broken promises?

More than a dozen senior Chrysler executives have resigned, retired, or been forced out since the merger was finalized in November 1998. Still, Villanova's Sargent said that for Kerkorian to win his case, he'll have to prove the company violated corporate governance provisions of the merger agreement.

"In the absence of violations of those specific agreements on apportioning of power, it would be difficult to enforce any broader promise about the relations between the two entities," Sargent said.

Kerkorian's suit cites a number of terms of company's business combination agreement which are no longer in force, including co-chairmen from both Daimler and Chrysler, and a management board with about half the members from each company. Many of those provisions were changed months ago.

"Tracinda never suspected and could never have uncovered defendants' true intentions because Mr. Schrempp and DaimlerChrysler always came up with a seemingly legitimate business reason for terminating or transferring a Chrysler executive," charges the suit.

Tracinda's suit cites comments Schrempp made recently in interviews that he never saw the creation of DaimlerChrysler as a merger of equals, but always planned to make Chrysler a division of the German parent.

A DaimlerChrysler spokesman said the domination of German executives in the company is due to evolution, not a master plan.

"We have always said it was a merger of equals, but things have changed over the months," said DaimlerChrysler's Thomas Froehlich. "The structure now is what emerged from the merger of equals, but things have developed into what we are today."

Froehlich reiterated the company's commitment to holding the German and American businesses together. He told CNNfn.com there are "no such plans" to spin off or sell the Chrysler division.

Froehlich said his comments reflected those made eight days ago by Shrempp when he spoke to Chrysler staff in Auburn Hills, Mich.

Analysts say CEO ouster, share buyback is suit's aim

The suit doesn't actually specify financial damages sought, but a statement from the company said it is seeking $2 billion in actual damages, about half of that from the lack of a takeover premium paid at the time of the merger due to the "merger of equals" promise, and about half from the loss in value of the stock since then. The suit also seeks $6 billion in punitive damages.

European analysts said Kerkorian wants to oust Schrempp, the architect of the 1998 deal, but seems unlikely to succeed for now. Schrempp has support from important German investors and analysts said he has no natural successor among the ranks at DaimlerChrysler.

But despite Kerkorian's efforts to takeover Chrysler in 1995, a spokeswoman for Tracinda denied that is the goal of the suit.

"This is not about a takeover, nor is Tracinda looking to influence or control management," said the spokeswoman. "This is about financial compensation for loss value. That's what's fair."

|

|

|

Kerkorian sues DaimlerChrysler - Nov. 28, 2000

DaimlerChrysler may cut jobs - Nov. 23, 2000

Daimler lowers Chrysler forecast - Nov. 17, 2000

DaimlerChrysler set to oust U.S. unit's CEO - Nov. 14, 2000

DaimlerChrysler operating profit skids 80% as Chrysler Group sales slump - Oct. 26, 2000

Chrysler losing money, key design executive - Sept. 27, 2000

Chrysler's president leaving Daimler - Sept. 24, 1999

Chrysler, Daimler Benz in auto merger deal - May 7, 1998

|

|

|

|

DaimlerChrysler

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|