LONDON (CNNfn) - Hong Kong's main share index rocketed more than 3 percent Friday, spearheading healthy advances across Asia as some telecom stocks posted double-digit percentage gains. Japan's Nikkei average rose on an influx of new money to the market, pushing banks stocks higher.

Tokyo's benchmark Nikkei average of 225 stocks ended up 186.82 points, or 1.3 percent, at 14,835.33. Traders said the launch of new investment trusts focusing on domestic equities bolstered many "Old-  Japan" stocks. The recently formed Mizuho Holdings, the world's biggest bank by assets, rose 8.7 percent. Japan" stocks. The recently formed Mizuho Holdings, the world's biggest bank by assets, rose 8.7 percent.

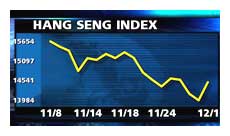

In Hong Kong, the Hang Seng index ended up 457.04 points, or 3.3 percent, at 14,441.43, with China Mobile jumping 7 percent on news Beijing would not change its mobile phone tariffs this year or next. The stock had slumped in the past week on reports China might put an end to operators' right to charge customers for incoming mobile-phone calls.

Singapore's Straits Times index added 0.1 percent to close at 1,955, while Sydney's S&P/ASX 200 index closed up 0.3 percent at 3,284.1.

Among other Asian markets, Korea's KOSPI index closed up 1 percent and Taipei's Taiwan Weighted index rose 1.6 percent as chip company United Microelectronics gained 2.9 percent.

Asian technology stocks made progress despite another round of steep declines for their counterparts on Wall Street the previous day. The Dow Jones industrial average slipped 2 percent and the Nasdaq Composite sank 4 percent after new profit warnings by high-tech firms.

In the currency market, the dollar fell to ¥111.23 from ¥111.34 in late trading in New York Thursday.

The future of Japanese Prime Minister Yoshiro Mori was thrown into fresh doubt Friday with the resignation of his right-hand man, Liberal Democratic Party Secretary-General Hiromu Nonaka, only days after helping Mori overcome a rebellion from within his own ruling party.

Banks lead the way in Tokyo

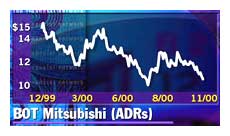

Japan's banks fueled the Nikkei's advance Friday, with sector leader Mizuho followed by Tokai Bank, up 6.8 percent, Sumitomo Bank, which rallied 6.2 percent, and Bank of Tokyo-Mitsubishi with a rise of 6.8 percent.

Other "old-economy" Japanese stocks raced higher. Among automakers, Mazda Motor rose 6.2 percent and Nissan Motor rose 4.9 percent.

There were also bright spots among telecom shares. KDDI jumped 13.8 percent, paring the bulk of its 20 percent slide in the last  two months as it begins to roll out advanced mobile-phone. Japan Telecom rose 4.3 percent. two months as it begins to roll out advanced mobile-phone. Japan Telecom rose 4.3 percent.

It was a mixed bag for Japan's techs. Softbank, the Internet investor that has stakes in several Nasdaq-listed companies, added 5.9 percent, while chipmaker NEC jumped 4.1 percent.

Among electronics makers, Sony fell 1.4 percent while Matsushita Electric Industrial, the maker of Panasonic appliances, shed 2.7 percent. But rival Fujitsu rose 3.9 percent as investors judged it had fallen too far in recent sessions.

Telecoms lead gains in HK

In Hong Kong, it was a tale of telecoms. China Unicom, a main rival to China Mobile, mirrored the larger company's rebound from heavy selling this week, soaring 15.3 percent Friday. SmarTone Telecommunications, a mobile phone firm that has tended to move in the opposite direction to China Mobile and China Unicom this week, fell 1.6 percent.

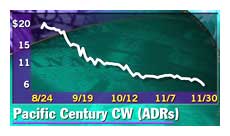

Internet and telecom company Pacific Century CyberWorks bounced 11.3 percent. PCCW said late on Thursday that its US$500 million rights issue was 78.9 percent subscribed. The share offering closed Wednesday.

Hong Kong-listed computer maker Legend Holdings rose 3.7 percent and conglomerate China Resources gained 6.7 percent. In the property sector, Sino Land rose 6.3 percent and New World Development added 6.8 percent.

Hang Seng heavyweight HSBC, an international bank, rose 1.9 percent.

"Financials are proving resilient because of a fall in the size of bad loans worldwide," said Alex Tang, a research director for Core Pacific-Yamaichi International.

Ports-to-telecoms conglomerate Hutchison Whampoa climbed 1.9 percent.

Trading company Li & Fung shed 3.4 percent. The company is heavily dependent on the U.S. for sales and has been hurt by recent data showing the U.S. economy grew at its slowest rate for 4 years in the third quarter.

In Sydney, Sausage Software remained under pressure, dropping 4.8 percent, while in Singapore, chip firm Chartered Semiconductor rose 2.6 percent and electronics maker Omni Industries rallied 6.7 percent, although Singapore Telecommuncations fell 2.7 percent.

In other markets, the KLSE composite in Kuala Lumpur lost 0.6 percent, Bangkok's SET fell 1.5 percent, the PHS composite in Manila slipped 1.3 percent and Jakarta's JSX shed 0.4 percent. The BSE Sensex in Mumbai rose 0.9 percent.

-- from staff and wire reports

|