|

European techs rebound

|

|

December 1, 2000: 12:48 p.m. ET

Tech shares soar in London, Frankfurt; drug stocks falter across region

|

LONDON (CNNfn) - Europe's leading markets ended higher Friday, as investors snapped up technology and telecom shares following recent steep losses.

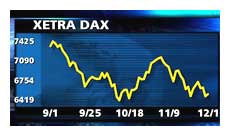

Frankfurt's electronically traded Xetra Dax rose 131.99 points, or 2.1 percent, to 6,504.32, with leading software firm SAP (FSAP) and recent laggard automaker DaimlerChrysler (FDCX) among the top gainers.

London's benchmark FTSE 100 index ended up 28.2 points, or 0.5 percent, with software service firm Misys (MSY), Internet security software supplier Baltimore Technologies (BLM), and chip designer ARM Holdings (ARM) all soaring more than 17 percent. London's benchmark FTSE 100 index ended up 28.2 points, or 0.5 percent, with software service firm Misys (MSY), Internet security software supplier Baltimore Technologies (BLM), and chip designer ARM Holdings (ARM) all soaring more than 17 percent.

The blue-chip CAC 40 in Paris inched up just 0.42 point to 5,928.50 as the earlier tech rally ran out of steam and losses from key drug maker, retail and oil stocks weighed on the market. The index had risen as much as 1.6 percent earlier in the day.

Among other European markets, the AEX index in Amsterdam rose 1.6 percent, Milan's MIB 30 added 0.2 percent and the SMI in Zurich nudged up 0.9 percent.

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, climbed 1.1 percent. The computer services and software sub-index jumped 6.4 percent, while the health-care sector fell 3.1 percent.

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, climbed 1.1 percent. The computer services and software sub-index jumped 6.4 percent, while the health-care sector fell 3.1 percent.

Analysts said it's still too early to expect the tide to turn decisively for tech stocks, which have been hit by waves of selling in recent weeks.

"The tech bounce may be more short-lived than some people think," said Steven Hammond, an equity strategist at Commerzbank in London.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

U.S. markets were higher in midday trade. The technology-heavy Nasdaq composite index rose 3.9 percent, while the blue-chip Dow Jones industrial average was up 0.3 percent.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

In the currency market, the euro inched higher to 87.41 U.S. cents from 87.21 in late New York trading a day earlier.

Investors scoop up techs

Among highlights for tech shares, fiber-optic component maker Bookham Technology (BHM) surged 16.8 percent in London.

Baltimore Technologies (BLM) rebounded 17.6 percent from a 12-month low Thursday. Software consultant Logica (LOG) climbed 11.4 percent after Commerzbank and Deutsche Bank upgraded its recommendations on the stock. ARM Holdings also benefited from an upgrade by Nomura, jumping 17.1 percent. Baltimore Technologies (BLM) rebounded 17.6 percent from a 12-month low Thursday. Software consultant Logica (LOG) climbed 11.4 percent after Commerzbank and Deutsche Bank upgraded its recommendations on the stock. ARM Holdings also benefited from an upgrade by Nomura, jumping 17.1 percent.

British network equipment maker Marconi (MNI) advanced 9.7 percent and French rival Alcatel (PCGE) gained 3.7 percent.

German chipmaker Infineon Technologies (FIFX) joined in the high-tech rally, climbing 2 percent.

German software maker SAP (FSAP) jumped 8.1 percent and engineering and electronics titan Siemens (FSIE) added 4.1 percent.

Telecoms rebound

In the telecom sector, FTSE 100 heavyweight Vodafone Group (VOD) rose 5.3 percent and business network operator COLT Telecom Group (CTM) jumped 10.7 percent. Market heavyweight France Telecom (PFTE) was just 0.5 percent higher and Deutsche Telekom (FDTE) gained 3.6 percent.

Elsewhere, German-U.S. carmaker DaimlerChrysler (FDCX) climbed 4 percent, after falling Thursday to a four-year low. But French automaker Renault (PRNO) fell 1.6 percent and BMW (FBMW) dropped 1.9 percent.

Deutsche Bank (FDBK) added 3.8 percent while French bank BNP Paribas (PBNP) rose 1.9 percent. Insurer AXA (PCS) shed 2.2 percent.

Drug stocks hurt by analyst's cut

Drug stocks fell throughout the region. Anglo-Swedish pharmaceuticals maker AstraZeneca (AZN) fell 3.9 percent after analysts at Credit Suisse First Boston cut their earnings forecasts, citing rising costs. Among its rivals, SmithKline Beecham (SB-) was down 3.6 percent and prospective merger partner Glaxo Wellcome (GLXO) lost 5 percent. France's Sanofi-Synthélabo (PSAN) fell 4.6 percent while Germany's Schering (FSCH) shed 3.6 percent.

South African Breweries (SAB) rose 10.8 percent on talk of a takeover. The company declined to comment.

French luxury goods firm LVMH dropped 3.7 percent and cosmetics firm L'oréal (POR) shed 2.4 percent.

CAC heavyweight oil and gas firm TotalFina Elf (PFP) dropped 2 percent.

U.K. gas retailer Centrica (CAN) rose 2.9 percent after Britain's energy regulator, Ofgem, said Friday it proposed to remove price controls for British Gas Trading, Centrica's main business, in April 2001.

-- from staff and wire reports

|

|

|

|

|

|

|