|

Deutsche to reorganize

|

|

December 4, 2000: 6:39 a.m. ET

German bank aims to boost profit as it repackages businesses into two units

|

LONDON (CNNfn) - Deutsche Bank AG, the world's second-largest bank, said Monday it plans to reorganize its corporate structure, combining its five operating units into two in a move aimed at boosting profit.

One unit will handle the German bank's investment banking and corporate services divisions, while the other will contain the asset management and retail banking businesses.

No changes will be made to Deutsche Bank's board as a result of the new structure.

Analysts said they would suspend judgment on the revamp, which had been the subject of market speculation, until Deutsche provided some figures on how much money the change would save, and who named chiefs for the new divisions. Analysts said they would suspend judgment on the revamp, which had been the subject of market speculation, until Deutsche provided some figures on how much money the change would save, and who named chiefs for the new divisions.

"It's no big change, we have seen similar things at other banks," said Dieter Hein, a banking analyst at Crédit Lyonnais Securities.

Deutsche has been criticized for the way it has run its retail banking division - typically a less profitable activity than investment banking and asset management.

"This new organizational alignment allows us to further strengthen the services provided to our clients worldwide," Rolf Breuer, spokesman of the Deutsche board, said in a statement.

Breuer said the shake-up would position the bank successfully for the future and help it build shareholder value.

In the first nine months of 2000, net income soared to  4.37 billion ($3.8 billion) from 4.37 billion ($3.8 billion) from  1.83 billion. 1.83 billion.

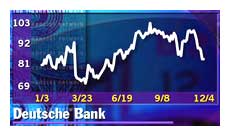

Deutsche Bank (FDBK) shares were down 2.6 percent at  83.30 in midday Frankfurt trade. 83.30 in midday Frankfurt trade.

|

|

|

|

|

|

Deutsche Bank

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|