|

Banner day for the Dow

|

|

December 4, 2000: 5:20 p.m. ET

A rush to value stocks lifts industrials as Bush appears closer to White House

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Dow Jones industrial average rallied Monday after the latest twists in the presidential impasse favored George W. Bush, lending clarity to a market battered in part by a month of White House uncertainty.

Oil, tobacco and drug stocks, considered better off under a Bush administration, rose. But technology continued slumping as investors worried about a slowing economy bailed out of the market's highest-priced shares.

Instead, money moved into the industrial, food and utility shares that this time last year couldn't catch a break.

"This is pretty much a continuation of what we've seen for four months now," Ken Tower, director of technical research at UST Securities, told CNN's Street Sweep. "The value stocks are doing better and people are moving out of technology."

In the White House impasse, the U.S. Supreme Court set aside a state court decision which, by extending the deadline for certifying Florida's results, had brought Vice President Al Gore closer to overtaking Bush. The state supreme court now must clarify that decision. In the White House impasse, the U.S. Supreme Court set aside a state court decision which, by extending the deadline for certifying Florida's results, had brought Vice President Al Gore closer to overtaking Bush. The state supreme court now must clarify that decision.

"Clearly, it's a blow to the Gore camp," Leslie Alperstein, political economist at Washington Analysis, told CNNfn's market coverage.

With Bush leading in the latest certified tally, the developments mean that tally is more likely to stand by Dec. 12, when Florida's key electors decide the presidency.

"Every time in the last couple of weeks that this has looked closer to a resolution, the market has done better," Michael Holland, chairman of Holland & Co., told CNNfn's market coverage.

After the market closed, a Florida circuit court judge ruled not to order a recount of disputed ballots in Miami-Dade and Palm Beach counties, areas supportive of Gore, in the latest blow to the vice president.

Click here for full election coverage

The Dow Jones industrial average rose 186.56 points, or 1.9 percent, to 10,560.10.

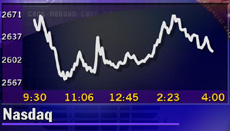

But the Nasdaq composite index fell 29.54, or 1.1 percent, to 2,615.75. The loss puts the index just 18 points above its lowest close of the year, 2,597.98 reached Thursday. But the Nasdaq composite index fell 29.54, or 1.1 percent, to 2,615.75. The loss puts the index just 18 points above its lowest close of the year, 2,597.98 reached Thursday.

The S&P 500 gained 9.74 to 1,324.97.

Market breadth was mixed. Advancing issues on the New York Stock Exchange topped declining ones 1,428 to 1,442 on trading volume of 1 billion shares. Nasdaq losers beat winners 2,526 to 1,427 as more than 1.8 billion shares changed hands.

In other markets, Treasury securities fell. The dollar slid against the yen and euro, which rose to a two-month high versus the U.S. currency.

Dow powers ahead

Amid the month-long presidential impasse, stocks considered helped by a Bush White House have gained as his outlook for victory has improved.

Drug, tobacco and oil companies, seen as less regulated under Bush, rose.

Exxon Mobil (XOM: Research, Estimates) gained $1.88 to $90.69, Merck (MRK: Research, Estimates) shot up $1.31 to $91.94 and Philip-Morris (MO: Research, Estimates) climbed six cents to $37.69.

But tech stocks continued to fall. Among them, Cisco Systems (CSCO: Research, Estimates) lost $2.69 to $45.81, near its low for the year. No official news has come out of the company's two-day meeting with analysts. Still, more than 113 million shares traded, making Cisco the Nasdaq's most active stock. But tech stocks continued to fall. Among them, Cisco Systems (CSCO: Research, Estimates) lost $2.69 to $45.81, near its low for the year. No official news has come out of the company's two-day meeting with analysts. Still, more than 113 million shares traded, making Cisco the Nasdaq's most active stock.

In other tech losers, WorldCom (WCOM: Research, Estimates) dropped $1.19 to $14.81 while Intel (INTC: Research, Estimates) lost $1.09 to $33.03.

The divided action continues a pattern. Many drug, tobacco and oil industrial stocks, in addition to food, industrial and utility shares, have drawn buyers in recent weeks as investors seek out undervalued and stable companies that can hold up as the economy slows.

At the same time, technology stocks, once the markets' best performing shares, have fallen steadily since Labor Day. Companies and the analysts who follow them have been lowering their forecasts for profit growth as a string of data has shown that the economy's expansion is cooling.

In the latest part of that trend, new home sales for October fell 2.6 percent to an annual rate of 928,000, according to the U.S. Commerce Department.

Separately, leading economic indicators designed to forecast the economy's direction fell 0.2 percent for October, according to the Conference Board.

The Federal Reserve meets next week for the last time this year. No analysts expect a rate cut yet, but some think the Fed in its statement may use language that suggests lower rates lie ahead. The Wall Street Journal said Monday the central bank may lower the cost of borrowing sooner rather than later.

"If they don't do it soon, the psychology of the bear market will continue," Frank La Salla, president of BNY Clearing International told CNNfn's Market Call.

The disputed presidential election, meanwhile, hasn't helped the market.

Analysts have debated the impact of this impasse. Some call it a legitimate selling catalyst; others insist it's an excuse. But this much is clear -- the Nasdaq is down 23 percent since Election Day.

In the day's largest deal, PepsiCo (PEP: Research, Estimates) rose $1.44 to $43.81 after saying it would purchase Quaker Oats for $13.3 billion in stock.

The proposal ends a month-long courtship to acquire the parent company of Gatorade. The maker of the dominant brand in the fast-growing U.S. sports drink category who was sought after by Coca-Cola and France's Danone Group.

Quaker Oats (OAT: Research, Estimates) gained $2.38 to $91.

Food stocks like Quaker have been some of the markets' biggest winners during the second half of the year. Sysco Corp. (SYY: Research, Estimates), the nation's biggest food distributor, whose stock has gained 29 percent over the last six months, rose $2.88 to $56.88 Monday. Food stocks like Quaker have been some of the markets' biggest winners during the second half of the year. Sysco Corp. (SYY: Research, Estimates), the nation's biggest food distributor, whose stock has gained 29 percent over the last six months, rose $2.88 to $56.88 Monday.

UST's Ken Tower, who doesn't see an end to the tech sell-off just yet, is heartened that money isn't leaving the market altogether.

"They haven't so much moved their money out of the markets as they have moved it from one place to another," Tower said.

The Dow, the best-performing of the three major indexes, is down 8 percent this year, giving it a chance of posting a gain for 2000. But don't count on the Nasdaq. The index, which soared 85 percent in 1999, would need to climb 35 percent just to break even on the year.

|

|

|

|

|

|

|