|

Bank of America warns

|

|

December 6, 2000: 4:20 p.m. ET

Bank cites higher credit costs, capital markets slowdown for 4Q warning

|

NEW YORK (CNNfn) - Bank of America Corp. warned Wednesday that it will miss fourth-quarter earnings forecasts because of higher credit costs and sluggish capital markets activity, triggering fears of an industrywide profit slowdown.

The warning led to a sharp sell-off in banking stocks. Wall Street is fearful of the increasing number of bad loans at U.S. banks, following a series of interest rate increases by the Federal Reserve that slowed economic growth and helped trigger a slowdown in corporate earnings gains. In a statement revising its earning outlook, Bank of America said credit quality continues to worsen.

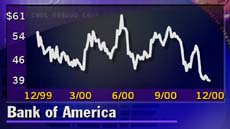

Bank of America (BAC: Research, Estimates) shares fell $3.19, or 7.7 percent, to $38, at 4 p.m. ET on the New York Stock Exchange. Earlier in the session, the stock slipped to $36.31 -- a fresh 52-week low.

Shares of other financial services companies, such as Citibank (C: Research, Estimates) and Chase Manhattan (CMB: Research, Estimates), also lost ground, pressuring the overall market and erasing much of the Dow Jones industrial average's 3.2 percent gain a day earlier. The Dow closed down about 235 points, or 2 percent, to 10,663.

The Charlotte, N.C.-based company, the largest U.S. commercial bank, expects to report fourth-quarter earnings of roughly $1.4 billion, or 85 cents to 90 cents per share, down from the First Call consensus estimate of $1.17 per share and year-earlier profit of $1.23.

The lower-than-expected results are expected to push down full-year results to $4.72 to $4.77 per share in 2000, compared with analysts' previous estimates of $5.03. The earnings pressure also is expected to extend into next year, with full-year 2001 profits now expected in the range of $5.10 to $5.20, down from the First Call forecast of $5.50.

The warning came as a surprise but isn't completely unexpected given the current economic environment, said David Stumpf, an industry analyst at A.G. Edwards & Sons, who downgraded the stock to "accumulate" from "buy."

Stumpf said he anticipates additional earnings warnings from other major banks in the next few weeks. Stumpf said he anticipates additional earnings warnings from other major banks in the next few weeks.

"Certainly it's going to fuel the flames of industry and credit-quality concerns," he said.

Last month, Bank of America disclosed in a regulatory filing that its loan losses were expected to more than double in the fourth quarter, citing problems with a large corporate loan. The bank did not name the borrower, but analysts believed the loan was to troubled consumer products maker Sunbeam Corp. (SOC: Research, Estimates) and worth $450 million to $500 million.

Bank of America said it is budgeting for significantly higher loan losses and credit costs in 2001. The bank said it now expects nonperforming assets, or loans with potential repayment problems, to be about 20 percent higher than third-quarter levels.

Bank of America also noted that its revised earning projections are based on the assumption of a "soft landing" for the U.S. economy and "no change in the company's business mix."

Most economists anticipate the economy will come in for a soft landing, which refers to a situation in which the economy continues to grow, but at a more moderate pace that does not spur faster inflation.

-- from staff and wire reports

|

|

|

|

|

|

Bank of America

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|