|

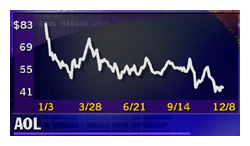

AOL-TWX close FTC talks

|

|

December 8, 2000: 4:46 p.m. ET

Companies end negotiations with FTC; stock options planned for employees

|

NEW YORK (CNNfn) - America Online Inc. and Time Warner Inc. have dealt the last card in their protracted negotiations with U.S. antitrust regulators over the companies' proposed merger, according to a published report Friday.

The Washington Post reported that AOL and Time Warner had effectively concluded talks with the Federal Trade Commission (FTC) and are unlikely to indulge in further concessions to appease regulatory concerns.

Stock options could also soon be in the works for all 85,000 employees of both companies after the merger is completed, according to a report on The Wall Street Journal's Web site Friday. The plan is part of an effort that underscores a shift to a more equity-based compensation at the combined company. Time Warner (TWX: Research, Estimates) is the parent company of CNNfn.com.

While the precise size of the one-time grant hasn't been worked out, it is unlikely to be more than a couple of hundred options for most employees, the Journal reported. Senior executives would get much more, possibly in the millions for top executives such as Chairman Stephen Case and Chief Executive Gerald Levin, the story said.

Meanwhile, a final ruling by the FTC's five-member commission on whether to approve the $183 billion merger is likely next week.

The FTC has been negotiating for months with AOL to make certain that AOL preserves competition by enabling open access on Time Warner's cable system lines.

The Commission has also looked at the extent to which the combined company would make available Time Warner's vast library of magazine, music, television and movie content to rival Internet service providers.

| |

|

|

| |

|

|

| |

We believe in and are developing a broad-based equity plan so that all our people can participate in a stock-option program that will enable them to share in the growth potential of the company.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Edward Adler

Spokesman

Time Warner |

|

Granting options to all employees will mark a big change for Time Warner, where cash compensation is the norm and options historically have been limited to midlevel management and up, the story added. At AOL (AOL: Research, Estimates), like most Internet companies, all employees receive stock options.

"We believe in and are developing a broad-based equity plan so that all our people can participate in a stock-option program that will enable them to share in the growth potential of the company," Time Warner spokesman Edward Adler said in the Journal story, speaking on behalf of both companies.

While the size of the total grant isn't clear, it is unlikely to involve more than 30 million to 40 million options, the story said. The combined AOL Time Warner will have 4.1 billion shares outstanding, according to Securities and Exchange Commission filings.

However, Wall Street analysts estimate the number will be closer to five billion when conversion of existing options is included, the story said.

|

|

|

|

|

|

|