|

Goodbye to Dad's Olds

|

|

December 12, 2000: 4:56 p.m. ET

A century-old icon eats roadside dust, thanks to globalization and competition

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Cars are America and America is cars. The car is family. The car is refuge. It is comfort. It is status. And it is hardly ever just a way to get to A from B.

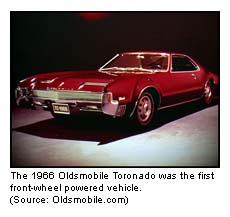

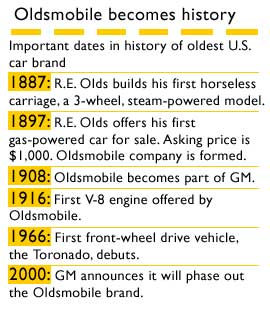

That explains why the death of the name Oldsmobile, unveiled by General Motors Corp. Tuesday, leaves such pangs in many people's hearts. From its Model 37 closed-carriage car of the 1930s to the 1966 front-wheel-drive Toronado to the grand and best-selling Delta 88, Oldsmobile has been an enormous part of America's love affair with the car for a very long time.

But like other American icons and institutions, Oldsmobile, one of six car lines offered within the GM (GM: Research, Estimates) family, is the latest victim of a world gone global. In today's competitive world, it's all about value, selection, availability, reliability and price -- things that other carmakers in North America, Europe and Japan produce in spades at similar or better prices than GM. But like other American icons and institutions, Oldsmobile, one of six car lines offered within the GM (GM: Research, Estimates) family, is the latest victim of a world gone global. In today's competitive world, it's all about value, selection, availability, reliability and price -- things that other carmakers in North America, Europe and Japan produce in spades at similar or better prices than GM.

It is also a victim of a company that, by its own admission, has too much product and increasingly, too few customers. Despite more than $3 billion invested in new models in the past several years, including the Alero, the new and improved Bravada S/UV and the luxury Aurora, GM decided Tuesday that Oldsmobile, as a name, simply can't keep up anymore.

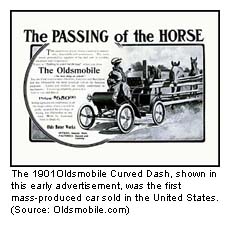

"It's symptomatic of the market as it is today," said Van Wilber, a director of research with the Alliance of Automobile Manufacturers in Southfield, Mich. "It's getting harder and harder to compete just on name recognition or simple brand loyalty. I think Oldsmobile eventually realized that a 103-year-old name doesn't necessarily create brand loyalty."

Oldsmobile: Smooth. Dependable.

For years, Oldsmobile's image was that of stability. Big. Solid. Smooth. Dependable. That was Oldsmobile's niche. And for years it worked. Throughout the 1960s and '70s, the carmaker was among the top sellers in the United States.

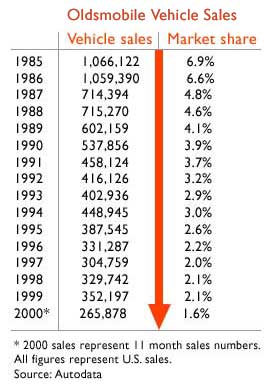

The Olds Cutlass was one of the country's best-selling domestic cars, and the name Oldsmobile was the one of the most lucrative for GM through the 1980s, selling more than 1 million cars a year. The Olds Cutlass was one of the country's best-selling domestic cars, and the name Oldsmobile was the one of the most lucrative for GM through the 1980s, selling more than 1 million cars a year.

But by the late '80s, Oldsmobile was in serious trouble. Competition, both from European and Japanese automakers and from other GM product lines, began eating into Oldsmobile's market share like road salt on a snowy day. The division responded by introducing a string of new cars that simply failed to entice. Ad campaigns, including the famous "It's not your father's Oldsmobile," failed to attract a younger generation of buyers.

Oldsmobile as an unproductive division of GM certainly wasn't alone. After lumbering through the 1980s with a cozy lock on the U.S. auto market, the Big Three -- Ford (F: Research, Estimates), Chrysler and GM -- began to see their sales displaced by cheaper and better imports, particularly on the luxury end of the scale. Honda introduced Acura. Toyota unveiled Lexus. Nissan introduced Infiniti. And BMW and Mercedes introduced lower-priced models, flooding the U.S. market with a bevy of automotive choice. Oldsmobile as an unproductive division of GM certainly wasn't alone. After lumbering through the 1980s with a cozy lock on the U.S. auto market, the Big Three -- Ford (F: Research, Estimates), Chrysler and GM -- began to see their sales displaced by cheaper and better imports, particularly on the luxury end of the scale. Honda introduced Acura. Toyota unveiled Lexus. Nissan introduced Infiniti. And BMW and Mercedes introduced lower-priced models, flooding the U.S. market with a bevy of automotive choice.

In response, GM poured billions into research and design to produce better, safer, more innovative cars -- at prices that were equal to if not more compelling than their growing roster of competitors. They introduced air bags, antilock brakes and premium comfort packages that gave consumers more for less than the price of a Honda or a Toyota. And if that weren't enough, they offered massive incentives to make sure of it.

An identity crisis

But Oldsmobile, as a brand, never really fit it. It was above Buick, but below Cadillac. It was above Pontiac but not considered as sporty or youthful as Chevrolet. It sold but one S/UV and, despite ads proclaiming the opposite, never really succeeded in shedding its image as a magnet for older drivers. Try as it might, GM's Oldsmobile couldn't seem to find its niche.

The proof was like a flashing sign on the road. Oldsmobile's sales and market share plunged steadily for well over a decade, dropping to only 265,878 vehicles sold in the first 11 months of this year, representing only 1.6 percent of the U.S. market. By comparison, in 1985 the brand sold 1.1 million U.S. vehicles, or 7 percent of the total market. The proof was like a flashing sign on the road. Oldsmobile's sales and market share plunged steadily for well over a decade, dropping to only 265,878 vehicles sold in the first 11 months of this year, representing only 1.6 percent of the U.S. market. By comparison, in 1985 the brand sold 1.1 million U.S. vehicles, or 7 percent of the total market.

"It was one of the brands that meshed with all the others and never truly had its own identity," said Jeff Schuster, a senior manager of forecasting with automotive consulting firm J.D. Power and Associates in Troy, Mich. "There were too many brands, so something had to go. Being that this was the one that was fluttering, it made the most sense."

While the Oldsmobile line of cars may be the biggest to die, it certainly isn't the first. DaimlerChrysler (DCX: Research, Estimates) last year announced that it was dropping its Plymouth brand at the end of the 2001 model run; the only other company to completely drop a line of cars was American Motors, which dumped its AMC Eagle brand of four-wheel-drive vehicles back in 1987.

Analysts generally applauded GM's move to shed the Oldsmobile line, figuring it will save the company money and allow it to put additional resources into developing products among its other brand names.

Better late than never

"I guess the old cliché applies of better late than never," said Ephraim Levy, an auto analyst with Standard & Poor's. "The division really didn't have a niche in the market, and GM's decision to scrap it will allow it to commit more resources to other lines that do have a niche and help turn a profit."

Jon Burnham, chief executive of Burnham Securities, took it a step further, telling CNNfn that, for GM to really compete, it should scrap all of its separate divisions and implement the same strategy as Honda, Toyota or Mazda, which have one lower-priced fleet of cars, and another division of higher-end models. (420KB WAV) (420KB AIFF)

To be sure, few expect GM to shed other divisions now that it plans to lay the Oldsmobile name to rest. Rather, GM will probably go back to the drawing board to develop the next generation of cars that attracts as many eager buyers as S/UV's did in the 1990s, said Schuster.

But in the short term, there will likely be a little pain. According to Schuster, North American output of cars and trucks, measured in units, is expected to fall to 16.4 million units in 2001 from an expected 17.5 million units in 2000 -- a significant decline. If the economy continues to slow and consumers continue to get more and more gun shy about making new purchases, those numbers could deteriorate even more, he said. But in the short term, there will likely be a little pain. According to Schuster, North American output of cars and trucks, measured in units, is expected to fall to 16.4 million units in 2001 from an expected 17.5 million units in 2000 -- a significant decline. If the economy continues to slow and consumers continue to get more and more gun shy about making new purchases, those numbers could deteriorate even more, he said.

All the same, "We don't see that happening right now," Schuster said. "This is an opportunity for GM to unveil some not-so-pleasant news and get it over with, but in the next few years we see sales being relatively strong."

|

|

|

|

|

|

|