|

3DFX to close shop

|

|

December 15, 2000: 6:44 p.m. ET

Graphics chip maker to sell assets to tech firm NVIDIA; cites lower demand

|

NEW YORK (CNNfn) - Computer graphics chip maker 3dfx Interactive Inc. said Friday it would sell most of its assets, cut its work force, and ultimately dissolve the company, after being hit by a significant slowdown in demand for its products and proving unable to secure credit.

Multimedia firm NVIDIA (NVDA: Research, Estimates) has agreed to pay $112 million -- $70 million in cash and 1 million shares in NVIDIA common stock -- for 3dfx's (TDFX: Research, Estimates) assets.

"We have experienced a significant slowdown in demand for our products, especially the Voodoo 3 and Voodoo 5 boards. This slowdown is consistent with the overall softness experienced by the PC market, especially in Western Europe," said Alex Leupp, president and chief executive officer of 3dfx.

Voodoo graphics processors enhance computer and arcade machine graphic generating abilities and helps create smoother, more detailed game images and animation.

Leupp added that the company experienced pricing pressures, and that its inability to secure credit hurt its ability to build inventory to meet existing demand. Leupp added that the company experienced pricing pressures, and that its inability to secure credit hurt its ability to build inventory to meet existing demand.

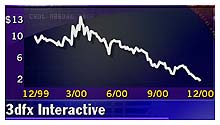

Shares of San Jose, Calif.-based 3dfx closed down 15 cents at $1.78, after hitting a 52-week low of $1.75 during the session. The stock had traded as high as $14.50 over the past year. Shares of Santa Clara, Calif.-based NVIDIA closed at $37.43, down $4.13.

NVIDIA also agreed to loan to 3dfx $15 million for immediate working capital needs.

The assets changing hands include all of 3dfx's intellectual property and chip inventory. The company is transferring the "3dfx" and "Voodoo" brand names and trademarks to NVIDIA.

Once finalized, the agreement also removes pending patent litigation between the two companies.

3dfx shareholders must approve the deal, which requires government antitrust approval. The company said it will "substantially reduce" its work force by early next year in preparation for completion of the deal.

Stung by stalled demand, credit woes

Last month, 3dfx announced plans to close its Juarez, Mexico, card manufacturing plant and stop building the graphics cards that reside in desktop PCs.

In a letter to customers on the company's Web site, Scott Sellers, 3dfx founder and chief technology officer, said the agreement, while a difficult one to make, was necessary.

"Although we've done our best to avoid taking drastic action, we have finally been forced to admit that there is no possible way we can continue in our current state," Sellers said. "As such, we have negotiated an agreement with NVIDIA that will allow us to provide the best possible result to our creditors, investors, employees and customers."

Separately, the company reported a third-quarter net loss of $178.6 million or $4.53 per share. Operating loss, before charges for amortization and impairment of goodwill and intangibles, was $55.9 million in the quarter.

Revenues for the third fiscal quarter were down 63 percent over the same period last fiscal year to $39.2 million compared with $105.9 million for the third quarter of fiscal 2000, ended Oct. 31, 1999.

"Our financial results illustrate the dramatic shift we've seen in the retail market over the past quarter," said Leupp in a statement.

|

|

|

|

|

|

3dfx

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|