|

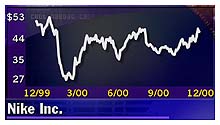

Nike warns on 3Q

|

|

December 19, 2000: 6:06 p.m. ET

Sports-apparel maker's 2Q profits met analysts' estimates but 3Q could fall short

|

NEW YORK (CNNfn) - Sports apparel maker Nike Corp. on Tuesday reported higher second-quarter profits that met forecasts, driven by strong revenue growth in the U.S. and Asia, but warned that its third quarter profits could fall short of expectations.

Nike (NKE: Research, Estimates), the largest seller of athletic footwear and athletic apparel in the world, said it earned 44 cents a share, up 16 percent from 38 cents in the prior year. Analysts surveyed by First Call had predicted a profit of 44 cents a share, with forecasts ranging from 41 cents to 48 cents.

The Beaverton, Ore.-based company said revenue in the quarter ending Nov. 30 was $2.2 billion, up from $2.1 billion a year ago. The Beaverton, Ore.-based company said revenue in the quarter ending Nov. 30 was $2.2 billion, up from $2.1 billion a year ago.

The company said U.S. revenues increased five percent to $1.13 billion, compared to $1.08 billion in the same period last year, although U.S. athletic footwear revenues declined two percent to $705 million. Apparel revenues rose 13 percent to $347 million.

In its Asia Pacific region, quarterly revenues grew 20 percent to $292 million. European revenues grew just two percent to $512 million. Had the dollar remained constant, regional revenues would have increased 23 percent, the company estimated.

"I am pleased with the strides we've made in our global equipment business where revenues grew 41 percent this past quarter and 37 percent year-to-date," Chairman and Chief Executive Phil Knight said in a statement. "The strong dollar continues to negatively impact our European results; constant dollar revenues in Europe were up 23 percent in the second quarter."

Still, the companies chief financial officer, Donald Blair, told a conference call with analysts and investors that the company continues to be very pleased with the performance its international businesses, despite the effect of the strong dollar.

Third quarter profits seen lower than forecasts

Blair added that the challenging currencies issue and continued sluggishness in the U.S. footwear business would weigh on results in the third quarter.

He predicted third quarter profits of 50 cents to 55 cents, near the 52 cents per share it reported in the same period last year, but below the 58 cents expected by analysts surveyed by First Call. Of the 11 analysts surveyed, predictions range from 55 cents to 60 cents.

For the fourth quarter the company said it expects per share earnings of 60 cents to 65 cents.

Worldwide third quarter revenue growth is seen somewhat slower than its year-to-date 6 percent growth figure, he said, although revenue growth in the fourth quarter should be "somewhat faster." For the full year, the company sees final revenues growth in the range of 5 to 7 percent.

Overall, Nike reaffirmed its target of earnings percentage growth in the mid-teens for the full fiscal year.

According to First Call, analysts expect the company to report a profit of $2.36 a share for the year ending May 2001.

Nike's closely watched worldwide "futures" -- orders for goods to be delivered between December 2000 and April 2001 -- totaled $3.6 billion, one percent lower than such orders reported for the same period last year. The company noted that had the U.S. dollar remained constant, futures orders would have increased 3 percent.

The report was released after the closing bell on Tuesday. During the regular session, Nike shares closed at $47.56, up 88 cents.

|

|

|

Nike

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|