LONDON (CNNfn) - Europe's main markets were modestly higher Friday, with telecom stocks ending the year on an upbeat note while oil shares fell as crude prices dipped.

London's benchmark FTSE 100 index ended a shortened session at 6,222.5, little changed from the previous close, after reversing gains seen earlier in the day. Newly merged drug heavyweight GlaxoSmithKline (GSK) and BP Amoco (BP-) headed south, leaving the index down more than 10 percent on the year.

The CAC 40 index of blue-chip stocks in Paris was up nearly 1 percent 5907.1, as European Aeronautic Defence & Space Co (PEAD) retreated, offset by a gain for data network operator Equant (PEQU) The market looked set to close a few points below its end-1999 value of 5,958.32.

In Frankfurt, which also closed early ahead of the New Year weekend, the electronically traded Xetra Dax ended up 61.97 points, or almost 1 percent, at 6,433.61, with troubled automaker DaimlerChrysler (FDCX) and software developer SAP (FSAP) leading the way up. The benchmark index finished the year down 8 percent.

In other regional markets, Amsterdam's AEX index rose almost 0.8 percent and Zurich's SMI slipped to close down 0.2 percent, while Milan's MIB30 slipped 0.1 percent.

In other regional markets, Amsterdam's AEX index rose almost 0.8 percent and Zurich's SMI slipped to close down 0.2 percent, while Milan's MIB30 slipped 0.1 percent.

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, was 0.1 percent higher, with the auto sub-index up 1.1 percent and the telecom sector rising almost 2 percent.

Trading volumes on European markets were "so thin it's difficult to get a read on anything," Jeremy Hawkins, chief European economist at Bank of America, told CNNfn.com.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

Wall Street edged up at the start of trading Friday. The tech-heavy Nasdaq composite gained 0.7 percent to 2,576.41, while the blue-chip Dow Jones industrial average added 0.2 percent to end at 10,893.79.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

In the currency market, the euro was little changed against the dollar, buying 93.03 U.S. cents, up slightly from 92.97 cents in late New York trading a day earlier.

The euro got a boost from comments by Britain's central bank governor Eddie George, who said the downturn in the United States might be sharper than desirable for the global economy, and that the current recovery in the euro was encouraging.

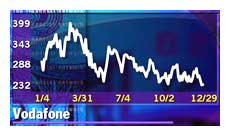

Telecom shares were mostly higher on European exchanges, with Britain's Vodafone Group (VOD), the world's largest mobile-phone operator, rising 5.3 percent. Germany's Deutsche Telekom (FDTE) was 2 percent higher, while France Telecom (PFTE) gained 0.5 percent. Telecom shares were mostly higher on European exchanges, with Britain's Vodafone Group (VOD), the world's largest mobile-phone operator, rising 5.3 percent. Germany's Deutsche Telekom (FDTE) was 2 percent higher, while France Telecom (PFTE) gained 0.5 percent.

Norwegian telecom group Telenor rose 1 percent. The company said it would sell a 10 percent stake in Germany's Viag Interkom to British Telecommunications (BT-A) in a deal worth more than 20 billion crowns ($2.3 billion). BT rose 0.3 percent.

Oil stocks fell as the price of Brent crude dipped 49 cents to $23.22 a barrel on London's International Petroleum Exchange. BP Amoco, the world's third-largest publicly traded oil company, fell 1.1 percent and Shell Transport & Trading (SHEL), which owns 40 percent of Royal Dutch/Shell, declined 0.5 percent. France's TotalFina Elf (PFP) dipped 0.3 percent.

European Aeronautic Defence and Space Company (PEAD) shed 3.2 percent after a report in French newspaper Les Echos said U.S. plane maker Boeing had landed more orders for airliners than EADS' 80 percent-owned Airbus Industrie in 2000. European Aeronautic Defence and Space Company (PEAD) shed 3.2 percent after a report in French newspaper Les Echos said U.S. plane maker Boeing had landed more orders for airliners than EADS' 80 percent-owned Airbus Industrie in 2000.

Drug companies had a mixed day. France's Aventis (PAVE) rose 1.5 percent, while Britain's GlaxoSmithKline (GSK), the world's second-biggest drugmaker by sales, fell 1.6 percent.

In the auto sector, Germany's DaimlerChrysler (FDCX) climbed 3.5 percent. Shares of the world's fifth-biggest carmaker have slid some 15 percent since mid-December amid mounting losses at its troubled U.S. Chrysler unit. Luxury carmaker BMW (FBMW) rose 2.6 percent, while PSA Peugeot Citroen (PUG) gained 1 percent in Paris.

SAP (FSAP), Europe's largest software maker, advanced 3.3 percent in Frankfurt, while British accounting software company Sage Group (SGE) rose 2.9 percent in London.

French computer and software firm Groupe Bull (PBUL) dropped 4.2 percent after a report in the Wall Street Journal said the company had discovered an error in its books that had overstated its cash position by  100 million ($93 million). The company denied there was any accounting error. 100 million ($93 million). The company denied there was any accounting error.

Also in the red Friday, missiles-to-magazines company Lagardère (LMMB) fell 1.6 percent, phone equipment maker Alcatel (PCGE) dipped 1.8 percent and construction-to-mobile phone operator Bouygues (PEN) lost 1.8 percent.

Banking stocks were higher across Europe, with France's Société Générale (PGLE) climbing 1.3 percent and Germany's Commerzbank (FCBK) up 3.1 percent.

Data network operator Equant rose 2.5 percent, topping the leader board in Paris, and food-service company Sodexho Alliance rose 2.1 percent.

--from staff and wire reports

|