LONDON (CNNfn) - The new year began inauspiciously for Europe's markets Tuesday as they ended lower on concern about U.S. growth and a sour start to 2001 for the Nasdaq market.

"We're going to see no enormous change in trend," George Hodgson, an equity strategist at ABN Amro in London, told CNNfn.com, referring to the poor close to 2000 in Europe's markets. "Ahead of the upcoming [earnings] reporting season, the market mood is going to remain apprehensive."

Investor confidence was also rattled by a report Tuesday showing U.S manufacturing last month was at its weakest in a decade, Hodgson said.

In Paris, the blue-chip CAC 40 index closed down 127.52 points, or 2.2 percent, to 5,798.90, with Franco-Italian chipmaker STMicroelectronics (PSTM) falling 8.8 percent. France Telecom (PFTE) slipped 5.1 percent after saying it will buy another 25 percent of Egyptian mobile-phone group Mobinil from Motorola (MOT: Research, Estimates) for $252 million.

London's FTSE 100 index fell 47.8 points, or 0.8 percent, to 6,174.7 as declining technology issues offset gains for food and retail stocks. Search engine software provider Autonomy (AU-) sank 11.8 percent.

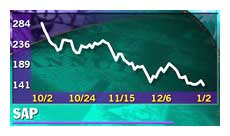

As other European markets closed, Frankfurt's Xetra Dax finished down 2.23 percent to 6,289.82, with software firm SAP (FSAP) down 11 percent, caught in a downdraft as fellow German software firm Intershop (AISH) plunged 70 percent on a profit warning.

In other European markets, Amsterdam's AEX index rose fell 0.5 percent, while the MIB 30 in Milan shed 1.9 percent. The Zurich market was closed for a holiday.

High-growth, technology-rich markets were battered, with Germany's Neuer Markt index plummeting 7.7 percent, the pan-European Easdaq index dropping 3.4 percent, and Britain's TechMark index down 3 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, slipped 1.2 percent, with its computer sector retreating 7.4 percent. But the oil and gas sub-index added 0.5 percent amid signs that OPEC may cut output at its Jan. 17 meeting, driving up crude oil prices.

U.S. stocks were lower after the manufacturing report, with the Nasdaq composite index down 5.1 percent in the first session after chalking up its worst yearly performance on record in 2000. The Dow Jones industrial average off 0.8 percent after three hours of trading.

U.S. stocks were lower after the manufacturing report, with the Nasdaq composite index down 5.1 percent in the first session after chalking up its worst yearly performance on record in 2000. The Dow Jones industrial average off 0.8 percent after three hours of trading.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

In the currency market Tuesday, the euro jumped to a five-and-a-half month peak, hitting 94.86 U.S. cents before falling back slightly to 94.59 cents. That compares with 93.71 cents in late U.S. trading Friday.

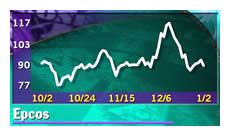

It looked like a depressingly familiar day for technology stocks after the latest profit warning in the downtrodden sector. Infineon Technologies (FIFX), a German chip firm, lost 5.5 percent, and Epcos (FEPC), a producer of electronic components, fell 3.2 percent.

French networking equipment maker Alcatel (PCGE) fell 5 percent while British rival Marconi (MONI) dropped 5 percent in London.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

Online retailer Letsbuyit.com plunged 56 percent on Frankfurt's Neuer Markt. The shares were suspended Friday, when the company sought and was granted a moratorium on debt payments by a Dutch court.

Among telecom companies, Britain's Vodafone Group (VOD), the world's biggest mobile-phone operator, fell 0.7 percent and Finnish mobile phone maker Nokia shed 3.6 percent in Helsinki, erasing an earlier gain of more than 1.7 percent.

France's Bouygues (PEN), a conglomerate whose main holdings are in the construction and telecom businesses, rose 5.2 percent. Traders said a 5.2-percent gain for its Bouygues Offshore (PBOS), behind stronger oil stocks, and lingering speculation that the parent may sell its stake.

Elsewhere in the oil sector, Britain's Shell Transport & Trading (SHEL) rose 1.4 percent as the price of Brent crude oil rose by more than $1 a barrel in London.

Financial sector shares weakened in Frankfurt. Dresdner Bank (FDRB) slipped 3.4 percent, cross-town rival Deutsche Bank (FDBK) shed 3.2 percent and Commerzbank (FCBK) lost 2 percent.

But in Paris, French insurer Axa (PCS) gained 1.7 percent, reversing an earlier 2.8 percent loss. Axa's German rival Allianz (ALV) dropped 2.6 percent.

Media stocks were under pressure across Europe. France's Vivendi Universal (PEX) slipped 3 percent. Its Canal Plus unit said over the weekend it intends to sell its stake in Eurosport, the cable sports channel it owns with commercial TV broadcaster TF1 (PTFI), and plans to create its own pan-Europe sports channel. TF1 fell 4.4 percent.

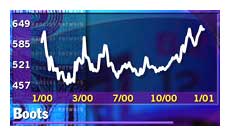

There were bright spots in the retail sector. France's Carrefour (PCA)  rose 0.8 percent. Signs the holiday shopping season was better than first expected provided a boost to retailing stocks across the continent. UK electronics retailer Dixons Group (DXNS) heading an array of retailers on the leader board with a gain of 4.9 percent. rose 0.8 percent. Signs the holiday shopping season was better than first expected provided a boost to retailing stocks across the continent. UK electronics retailer Dixons Group (DXNS) heading an array of retailers on the leader board with a gain of 4.9 percent.

Also in London, drugstore chain Boots [LSE;BOOT] added 4.6 percent, Marks & Spencer (MKS) rose 3.3 percent while foodmaker Associated British Foods (ABF) rose 3.5 percent.

German retailer Karstadt Quelle (FKAR) gained 3.9 percent, but Dax gainers were led by truck maker MAN (FMAN), which rose 4.4 percent.

-- from staff and wire reports

|