|

Cell firms 'face bust'

|

|

January 5, 2001: 9:30 a.m. ET

Forrester: profit crash looms for mobile operators after UMTS spending binge

|

LONDON (CNNfn) - A profit collapse and "major failures" are poised to strike Europe's mobile-phone industry in the next few years, according to a new study of the sector.

Traditional revenues in Europe's mobile-phone service market will fall by more than one-third by 2005, erasing operating profits altogether by 2007, technology consultant Forrester Research projected in a report Friday.

The firms will rack up operating losses from 2007 to 2013, the study found.

The crux of Forrester's argument is that increased revenues from soaring usage of mobile Internet and data services won't be enough to offset the anticipated drop in voice-related revenue, which along with messaging services has been the staple source of revenue for cell phone companies such as Vodafone and T-Mobil.

Forrester's pessimistic forecast comes after mobile-phone companies across Europe made high-stakes gambles to purchase next-generation Universal Mobile Telecommunications Standard licenses across the continent.

The auction of UMTS licenses, which will allow service providers to offer Internet and data services via cell phones, have cost as much as  128 billion ($122 billion) by some estimates. 128 billion ($122 billion) by some estimates.

"UMTS will be remembered as the trigger that imploded Europe's mobile industry," wrote Lars Godell, telecom analyst at Forrester, insisting that the smaller operators will be squeezed out amid a price pinch. "We expect that consolidation will leave only five groups serving all mobile users by 2008."

Godell said the increasingly competitive market will leave little room for smaller players: "Scale will become a key success factor as grim profitability prospects and huge capital requirements take their toll. Vodafone, T-Mobil, France Telecom/Orange and BT Cellnet will make up four certain winners."

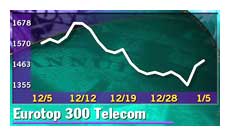

Buying UMTS licenses isn't the only cost mobile operators have faced: there's also the cost of building out networks, which drives the total tab upwards of  300 billion, according to securities firm Bear Stearns. Those looming costs pummeled European telecom shares in 2000, causing the FTSE Eurotop telecom services sub-index to fall 35 percent last year. 300 billion, according to securities firm Bear Stearns. Those looming costs pummeled European telecom shares in 2000, causing the FTSE Eurotop telecom services sub-index to fall 35 percent last year.

Behind the warning is the expectation that stiff competition will drive down prices for cellular services such as text messaging, voice and data traffic. New market entrants, such as grocers who resell cell-phone services, will siphon off market share from traditional service providers, the report said.

Mark James, a telecom sector analyst with Nomura International, told CNN that while competition is likely to reduce revenues for mobile-phone service providers, the unknown is whether data services will be able to compensate for the lost voice revenues soon enough.

"You can't make these mobile phone valuations stack up on voice and voice alone," he said. "You have to believe in data – and we do over the longer term... the danger of course is that the decline in voice may precede the take-up of data."

Forrester also estimated that the European market will reach saturation near the 76 percent penetration rate expected by 2005, and only the strong will survive. Today, about 50 percent of European adults own a cell phone.

In trading Friday, shares of UK-based Vodafone Group (VOD) rose 2.3 percent, British Telecommunications (BT-A) climbed 3 percent, France Telecom (PFTE) gained 2.8 percent, T-Mobil (ATOI), a subsidiary of Deutsche Telekom (FDTE), rallied 7.1 percent. DT rose 4.1 percent.

Among those jockeying for the last spot, Spain's Telefónica rose 2 percent, Netherlands-based KPN rose 0.5 percent and TIM, the mobile-phone unit of Telecom Italia, rose 3.1 percent.

|

|

|

|

|

|

Forrester Research

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|