|

Tech earnings preview

|

|

January 6, 2001: 7:30 a.m. ET

IT spending slowdown to create disappointing fourth-quarter results

By Staff Writers David Kleinbard and Richard Richtmyer

|

NEW YORK (CNNfn) - On the eve of earnings season, technology investors are bracing themselves for a series of disappointing financial reports from hardware, software and Internet-infrastructure firms.

Many tech stocks plunged during the fourth quarter, as it became increasingly evident that corporate spending on information technology and consumer spending on PCs were slowing dramatically.

This brought a slew of earnings or revenue warnings from makers of PCs, semiconductors and telecommunications equipment, including Motorola, Teradyne, Apple, Ericsson, Lucent, Compaq, Altera, Applied Materials, Xilinx, LSI Logic, Intel and even Microsoft.

Earnings warnings up 145 percent

As of Jan. 4, 108 technology companies had made earnings or revenue warnings for the quarter ending Dec. 31, up 145 percent from the same period last year. As of the same date, only 24 tech companies had announced that their revenue or earnings would be better than expected, according to Chuck Hill, director of research at First Call/Thomson Financial in Boston, Mass.

The earnings of technology stocks within the S&P 500 rose more than 40 percent in the second quarter of last year and 42 percent in the third quarter. As of Oct. 1, analysts estimated that they would grow 29 percent in the fourth quarter and 28 percent in the first quarter of 2001. However, after increasing evidence of a slowdown in IT spending and PC sales, those estimates have since been slashed to 3 percent and 4 percent, respectively, Hill said. The earnings of technology stocks within the S&P 500 rose more than 40 percent in the second quarter of last year and 42 percent in the third quarter. As of Oct. 1, analysts estimated that they would grow 29 percent in the fourth quarter and 28 percent in the first quarter of 2001. However, after increasing evidence of a slowdown in IT spending and PC sales, those estimates have since been slashed to 3 percent and 4 percent, respectively, Hill said.

"In addition to a slowing of consumer and capital spending, it may be that current PC products are running out of gas," Hill said. "I haven't even thought about upgrading my PC for several years. You used to have to upgrade all the time because you ran out of memory or needed faster processing."

Downturns in technology product cycles coincided with downturns in economic cycles in 1969, 1974 and 1980, Hill said. That pattern may repeat itself in 2001.

Lehman Brothers analyst Daniel Niles forecasts that global IT spending, which was previously expected to grow 10 percent in 2001, is likely to grow closer to 5-7 percent. Niles also forecasts that PC unit growth will be in the low double digits and revenue growth in the low- to mid-single digits this year.

| |

|

|

| |

|

|

| |

All of tech has been massacred, but our data suggests that storage may weather the storm better since its earnings stream will be more reliable than almost any other area of technology

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Thomas Kraemer, Merrill Lynch |

|

Despite those caveats, there still are a few areas within technology where revenue and earnings are expected to grow strongly, including data storage hardware and software and customer relationship management (CRM) software. As an example, storage giant EMC (EMC: Research, Estimates) is expected to report a 35 percent increase in earnings per share on a 14 percent increase in revenue for the quarter ended Dec. 31.

"All of tech has been massacred, but our data suggests that storage may weather the storm better since its earnings stream will be more reliable than almost any other area of technology," said Merrill Lynch analyst Thomas Kraemer.

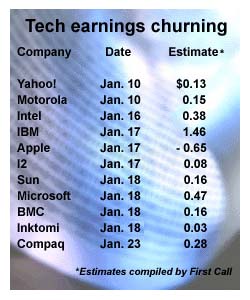

Earnings previews for January 10-18

Yahoo! – Yahoo!'s (YHOO: Research, Estimates) fourth-quarter earnings report on Jan. 10 is going to be the key indicator of the state of the Internet advertising market. Many advertising-supported Web sites have suffered a dramatic reduction in revenue, and analysts suspect Yahoo! will not be immune from this trend much longer. Merrill Lynch analyst Henry Blodget expects Yahoo! to report fourth-quarter earnings of 13 cents per share on revenue of $316 million, versus 9 cents per share on revenue of $203 million in the same period last year. Blodget added that Yahoo! "should just barely make its numbers."

Motorola – Motorola (MOT: Research, Estimates), the world's No. 2 maker of mobile telephones and a leading supplier of semiconductors, is in the midst of a broad restructuring, implementing cost-cutting measures it expects to continue throughout the first quarter of 2001. As for its fourth-quarter results, the Schaumburg, Ill.-based company in early December lowered its guidance, telling the Street that weakening conditions in the global chip market would create a revenue-and-earnings shortfall.

At that time, executives said they expect to log fourth-quarter sales of $10 billion and earnings per share of 15 cents. That compares with earlier guidance of $10.5 billion in sales and profit of 27 cents per share. Analysts are expecting revenue to come in a bit short of what the company told them to expect, at about $10.2 billion, according to First Call.

Motorola is expected to report its fourth-quarter results on Jan. 10.

Intel – The sluggish demand for PCs will weigh on Intel's (INTC: Research, Estimates) financial results for the quarter. In early December, the world's largest supplier of PC microprocessors told analysts to expect fourth-quarter revenue that is roughly equivalent to the $8.7 billion it logged in the third quarter.

That's well below the 4-8 percent sequential revenue increase the Street had expected prior to the warning. First Call's consensus earnings estimate for Intel in the fourth quarter is 38 cents per share, although some analysts are expecting earnings of as much as 44 cents per share during the quarter.

Intel is expected to report its results on Jan. 16.

Apple Computer – Analysts have very low expectations for Apple's fourth-quarter results, due to be reported on Jan. 17. Last month, Apple warned of a huge shortfall in revenue for the quarter ending Dec. 30, which will cause the company to report its first quarterly loss in three years. The company said it expects to report revenue of about $1 billion and a net loss, excluding investment gains, of between $225 and $250 million. Analysts had previously expected Apple (AAPL: Research, Estimates) to report a profit of about $10 million, or 3 cents per share, in the period, on revenue of $1.6 billion.

The company is suffering from lower-than-expected education-related sales and weak sales of its Power Mac G4 Cube system. Analysts are expecting the company to report a loss of 64 cents per share on revenue of just over $1 billion.

i2 Technologies - i2 is a leading business-to-business software company best known for its TradeMatrix platform of B2B solutions. TradeMatrix allows companies to set up marketplaces that enable customers and suppliers to do business together in real time. The company's Rhythm product suite does supply chain management, customer management and product lifecycle management. Its main competitors are Ariba (ARBA: Research, Estimates), Commerce One (CMRC: Research, Estimates) and Manugistics (MANU: Research, Estimates). The expanding use of the Internet for supply-chain management and inter-company marketplaces is expected to cause i2's revenue for the December quarter to rise 96 percent to $344 million from $175 million in the same period last year, with earnings per share reaching 8 cents. The company is scheduled to report on Jan. 17.

IBM – High-tech bellwether IBM (IBM: Research, Estimates) is one of only a handful of companies in the sector that has not warned that lower-than-expected demand will cause it to miss its most recent quarterly financial projections. However, a growing number of analysts has been raising red flags on the tech titan recently.

Just last week, Prudential Securities analyst Kimberly Alexy reduced her revenue forecast on IBM to $24.5 billion from $25.3 billion, saying she believes the company's notebook computer business was particularly hard hit by the slowdown in demand for computers in the fourth quarter. She was the latest in a line of equity analysts who have grown cautious of IBM, including Merrill's Kraemer, who downgraded his rating on IBM's shares to "neutral" from "accumulate," saying he expects the company to continue to reduce its revenue-growth projections moving into the new year, and A.G. Edwards analyst Shelby Seyrafi, who pointed out that the sheer size of the company makes it difficult for IBM to shield itself from a slowdown in technology spending.

Analysts polled by First Call are generally expecting Big Blue's fourth-quarter bottom line to come in at $1.46 per share, although the estimates range between $1.38 and $1.53 per share. Revenue is expected to come in at roughly $25.5 billion, according to the survey. IBM is expected to report its results on Jan. 17.

Sun Microsystems – When Sun Microsystems (SUNW: Research, Estimates), the world's leading supplier of Web servers, reported its fiscal first-quarter financial results last October, executives told the Street to expect the company's fiscal second-quarter revenue and earnings to be slightly more than they had previously forecast. At that time, they said they expect revenue growth to be in the high-40 percent range, with earnings per share increasing either at that level or below it. Then, after several tech companies chimed in with revenue and earnings warnings, Sun executives reiterated that guidance in mid-November, saying they remain on track to meet their financial goals for the quarter as well as the fiscal year. Analysts polled by First Call are expecting Sun to report a profit of 16 cents per share when it reports its latest quarterly results on Jan. 18.

Microsoft – Last month, the software giant warned investors that a worldwide slowdown in personal computer sales will result in disappointing profits and revenue. It was the first time in 10 years that the company issued a sales warning. Microsoft (MSFT: Research, Estimates) said its revenue for the December quarter is now expected to be between $6.4 billion and $6.5 billion, while earnings per share will come in between 46 cents and 47 cents. That was 5 to 6 percent below the company's prior guidance. The company will report its results on Jan. 18.

"The slowdown in consumer PC sales could not have come at a worse time for Microsoft," said CIBC World Markets analyst Melissa Eisenstat. "The December quarter is seasonally the heaviest period of consumer buying because of Christmas."

Inktomi -- Inktomi (INKT: Research, Estimates), which makes software that speeds the flow of information over the Internet, warned earlier this month that its fiscal first-quarter revenue and earnings will come in below its previous expectations. The company said revenue for the quarter ended Dec. 31 is now expected to be $80 million to $81 million, compared with its previous revenue forecast of $89 million to $91 million. Inktomi said it expects earnings for the quarter to be between breakeven and a penny per share, compared with its previous guidance of earnings between 2 cents and 3 cents per share. Executives at the Foster City, Calif., company blamed the shortfall on a slowdown in spending on Internet infrastructure products. The company is scheduled to report its results on Jan. 18.

|

|

|

|

|

|

|