|

CBS: Super Bowl ads on target

|

|

January 9, 2001: 3:08 p.m. ET

Says football game's advertising on target, sees record ad revenues

|

NEW YORK (CNNfn) - CBS on Tuesday said it expects to score at the cash register on Super Bowl Sunday, refuting a published report that the network is having a hard time selling ads for the NFL's Jan. 28 championship game.

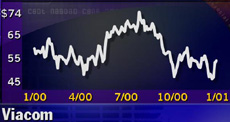

Calling the leftover ad time "a bad sign," The Wall Street Journal on Tuesday reported that Viacom (VIA.B: Research, Estimates)-owned CBS has sold only about 90 percent of its inventory.

Some 10 percent, or about six, of the 30-second spots remain, the paper said, quoting Joseph Abruzzese, CBS's (CBS: Research, Estimates) president of sales. Some 10 percent, or about six, of the 30-second spots remain, the paper said, quoting Joseph Abruzzese, CBS's (CBS: Research, Estimates) president of sales.

In contrast, commercial time on the game was sold out by the same time last year, when the Super Bowl aired on Walt Disney Co.'s (DIS: Research, Estimates) ABC network, the paper said, adding that other networks have typically had only 5 percent of their Super Bowl ad slots unsold just prior to the game.

But a CBS representative told CNNfn.com that the network has sold up to the 90 percent mark "by design," and that the level is approximately where it wanted to be at this point.

The spokesman added that the 90 percent threshold was "right on target" and that the remaining inventory has been held back purposely. In addition, he added, the network is poised to generate more revenue during this Super Bowl than any other.

Click here to see how media stocks are doing

Indeed, the paper, citing data supplied by CBS's Abruzzese, noted that efforts to sell the Super Bowl as a daylong event have put CBS on track to reap some $150 million from advertisers for the entire day -- about 12 percent more than what ABC took in last Super Bowl Sunday.

SG Cowen analyst Edward Hatch said that CBS would have a handful of options with the leftover time, considering the game is still almost three weeks away.

"We don't know what kinds of deals CBS might have in mind for those remaining units," he said. "They could choose to retain a few minutes for itself, to promote (popular program) "Survivor," or their prime time schedule, or even their MTV Network programming."

Challenges for CBS's Super Sunday

CBS's quest to fill its inventory of advertising for the game was certainly different than ABC's efforts last year, when dot.com companies scrambled to pay up to be a part of the event that was watched by a global audience topping 100 million.

Last year, the explosion of young online companies, thirsty for customers and armed with loads of investors' cash, spawned especially strong sales, with some dropping their entire annual marketing budget on one ad – at a cost of up to $3 million for 30 seconds.

But this year, a slowing economy has forced companies to think twice about marketing campaigns. Further, many of the dot.com companies that took a chance during the five-hour event are out of chances – some, such as Pets.com, have gone completely out of business. But this year, a slowing economy has forced companies to think twice about marketing campaigns. Further, many of the dot.com companies that took a chance during the five-hour event are out of chances – some, such as Pets.com, have gone completely out of business.

Finally, experts argue that most of the spots run by the dot.coms failed to produce the results – and audience – they had hoped for. A handful of the 17 dot.com advertisers from a year ago fired their Super Bowl agency or quit consumer advertising altogether.

In the 2000 game, new advertisers such as kforce.com, OurBeginning.com and Computer.com joined the fray, all chasing the runaway success of 1999's big winners, Hotjobs.com (HOTJ: Research, Estimates) and Monster.com.

Hotjobs.com and Monster.com will be back for this year's game, but the list of advertisers reads less like a slice of Silicon Alley, and more like a stroll down Main Street, thanks to companies such as PepsiCo (PEP: Research, Estimates)., Anheuser-Busch (BUD: Research, Estimates), Charles Schwab (SCH: Research, Estimates), and Philip Morris (MO: Research, Estimates), most of whom are staples on every Super Bowl telecast in recent years.

|

|

|

|

|

|

Viacom

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|