|

Xerox nabs some cash

|

|

January 10, 2001: 9:52 a.m. ET

Struggling copier maker receives $435M in financing from GE Capital

|

NEW YORK (CNNfn) - Copier maker Xerox Corp. said Wednesday it received $435 million in secured financing from General Electric Co.'s GE Capital unit, an indication that the struggling company is in the throes of turning itself around.

The financing brings Xerox's cash balance up to $1.8 billion and gives it more breathing space to come up with a plan that can put the once-revered company back on the profitability track. On Tuesday, Xerox confirmed it has hired private investment bank Blackstone Group LP as an investment adviser.

Xerox put up its lease receivables in England as collateral for the loan, which is expected to be repaid over 18 months. The two companies also are discussing possible plans for GE Capital to provide equipment financing for Xerox customers in several European countries. Xerox put up its lease receivables in England as collateral for the loan, which is expected to be repaid over 18 months. The two companies also are discussing possible plans for GE Capital to provide equipment financing for Xerox customers in several European countries.

Xerox, best known as "the document company," has fallen out of favor in the past year for continuing to focus on products and services that deal with documents and failing to embrace more paperless technologies such as computer networking systems and scanning devices.

To get itself back on track, the Stamford, Conn.-based company already has announced plans to cut about $600 million in general administrative costs and a "significant" number of jobs. In March, Xerox cut 5,200 jobs, or about 5 percent of its work force.

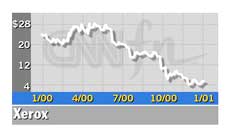

Xerox (XRX: Research, Estimates) shares, which have lost three-quarters of their value in the last 12 months amid a number of earnings shortfalls, closed down 50 cents Tuesday at $5.88 on the New York Stock Exchange.

|

|

|

|

|

|

Xerox

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|