|

Motorola meets Street

|

|

January 10, 2001: 6:51 p.m. ET

No. 2 mobile-phone maker meets 4Q targets, stresses future cost cuts

|

NEW YORK (CNNfn) - Motorola Inc., the world's second-largest supplier of mobile phones and a leading semiconductor maker, posted fourth-quarter sales and earnings Wednesday that met Wall Street's expectations.

After the closing bell, Motorola (MOT: Research, Estimates) said it logged an operating profit of $335 million, or 15 cents per share, during the quarter ended Dec. 31, 2000. That compares with operating earnings of 26 cents per share during the same period a year earlier and is in line with the 15 cents per share analysts surveyed by earnings tracker First Call had expected the company to report.

Motorola's total revenue for the quarter was $10.1 billion, which also is in line with the analysts surveyed by First Call and is 11 percent above the $9.1 billion in revenue the company reported during the fourth quarter of 1999.

While Motorola met the Street's most recent quarterly financial estimates, those estimates have been drastically reduced over the course of the past three months.

Last month, Motorola told investors weakness in the global semiconductor market and delays in cost-cutting in wireless phone production would cause it to fall short of its already reduced fourth quarter financial targets. At that time, the company said sales would come in at about $10 billion while earnings per share would be 15 cents.

In their third-quarter earnings conference call, Motorola executives originally had told analysts to expect fourth-quarter earnings of 27 cents per share on sales of $10.5 billion, which also was a significant downward reduction from their previous guidance. In their third-quarter earnings conference call, Motorola executives originally had told analysts to expect fourth-quarter earnings of 27 cents per share on sales of $10.5 billion, which also was a significant downward reduction from their previous guidance.

In its earnings release, which was issued after the close of trading, the company did not provide any specific forecasts for the current quarter and the remainder of 2001. Executives are expected to provide those details in a teleconference Thursday morning.

However, the company did send clear signals that it intends to aggressively cut costs in order to compensate for a slowing economy.

In a statement, Christopher B. Galvin, chairman and chief executive officer of the Schaumburg, Ill.-based company, said Motorola, anticipating a weaker economy, began implementing cost reductions in the third and fourth quarters of 2000 and will continue cutting costs in the current quarter.

"These actions have been designed to adjust our costs to softening global market conditions and, as the market recovers, to restore the trend of improved profitability that we had achieved over the last two years," Galvin said.

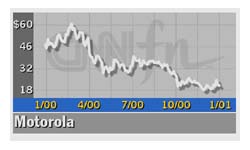

Motorola shares, which have fallen more than 65 percent from a 12-month high of $61.54, ended Wednesday's regular session up 50 cents at $21.19. They edged up slightly to $21.63 in after-hours trade.

Behind the numbers

Sales in Motorola's personal communications segment, which includes its production of wireless phones, rose a scant 1 percent to $3.5 billion while orders in that segment fell 20 percent to $2.9 billion, Motorola said.

Meanwhile, operating profit in the personal communications segment, which is one of the company's most closely-watched businesses, fell to $76 million from $242 million a year ago.

Click here for a look at other wireless stocks

The company blamed increased manufacturing costs for the operating profit declines in that unit, which has been dogged recently by weaker-than-expected demand for wireless handsets as well as supply constraints.

On Tuesday, Nokia, the world's leading supplier of wireless handsets, released a report showing that its mobile-phone sales in 2000 had fallen short of some market observers' expectations.

Motorola said it has taken significant steps to realign its personal communications segment to respond to changes in the market and to improve the existing cost structure. The focus has been on product simplification and restructuring of the supply chain, the company said.

In addition to its strong position in the market for wireless handsets, Motorola stands as the world's sixth largest supplier of semiconductors, a segment of technology where there have been mounting concerns about growth.

During the fourth quarter, Motorola said its semiconductor product segment sales rose 7 percent to $1.9 billion, but orders declined 19 percent to $1.6 billion. The company said semiconductor orders for chips used in wireless communications products were particularly low, while orders for chips used in imaging and entertainment devices rose.

Semiconductor segment operating profits rose to $158 million from $80 million in the year-ago quarter, Motorola said.

Meanwhile stronger sales of broadband communications equipment, such as cable modems, helped to balance out the weakness in other segments. The company said its broadband communications segment sales were up 52 percent at $1.1 billion and orders rose 49 percent to $1.1 billion from a year ago. Operating profits in that business increased to $156 million from $95 million a year ago.

Sales within the company's global telecom solutions segment -- formerly known as the network systems segment – increased 19 percent to $2.1 billion and orders rose 5 percent to $1.8 billion, Motorola said.

At the same time, that unit's operating profits declined to $193 million, compared with $245 million a year ago, which the company attributed to increased research and development and selling expenses.

|

|

|

|

|

|

Motorola

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|