|

Asian stocks end higher

|

|

January 12, 2001: 5:42 a.m. ET

Technology shares lift Tokyo, property rebound boosts Hong Kong

|

LONDON (CNNfn) - Asian markets closed higher Friday as investors took encouragement from the previous day's third successive rise in U.S. technology stocks.

In Tokyo, the Nikkei 225 average closed up 1.1 percent at 13,347.74, rebounding from a string of declines to pare its loss for the week to 3.7  percent. percent.

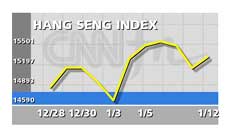

In Hong Kong, the Hang Seng index ended up 1.4 percent at 15,295.42, some 1 percent below its close the previous Friday. Singapore's Straits Times index inched 0.3 percent higher to close at 1,919.82, a 2.8 percent retreat from its level a week earlier.

On the currency market, the U.S. dollar was little changed against the Japanese yen, buying ¥117.78, compared with¥117.69 in late trading in New York the previous day.

In the U.S. Thursday, markets ended higher, with the technology-heavy Nasdaq composite index surging 4.6 percent to 2,640.57 while the blue-chip Dow Jones industrial average added 0.1 percent to end at 10,609.55.

Tokyo stocks strengthen

Tokyo stocks snapped a three-day losing streak, lifting the Nikkei 225 from a 27-month low. Key tech shares were buoyed by the Nasdaq's rally, while the postponement of a big initial public offering in Japan gave a boost to investor sentiment.

"The Nasdaq's three-day rally came as a huge relief to the market," said Hiroshi Sato, head of equities products at Cosmo Securities.

Nomura Research Institute, an affiliate of Japan's biggest brokerage Nomura Securities, said before the start of Friday trade it would postpone its initial public offering, expected to be one of the year's largest. The news helped to ease concerns about a glut of new shares.

Tokyo Electron, a maker of semiconductor manufacturing equipment, leapt 4.8 percent, while chip and electronics maker NEC rose 5.6 percent and consumer electronics bellwether Sony gained 2.1 percent.

Traders said high-tech exporters were benefiting from the yen's renewed weakness, which increases the yen value of their overseas revenues, although a further depreciation may be taken as a sign of a slowdown in Japan's fragile economic recovery and dampen market sentiment.

But investors were encouraged by comments by Trade Minister Takeo Hiranuma that he asked the authorities to look into the possibility of easing regulations regarding corporate share buy-backs.

Under current law, companies are allowed to buy back their own shares either for employee stock option schemes or to cancel them.

Analysts have said allowing firms to buy back and hold their own shares, to be sold to the market later or eventually cancelled, could help to absorb a share glut caused in part by banks and manufacturers stepping up their selling of shares they hold in other firms.

Such selling weighed heavily on banking stocks on Friday, with many major banks falling even as the broader market headed higher. Mizuho Holdings fell 4.3 percent.

DoCoMo snaps losing streak

Japan's dominant mobile-phone operator NTT DoCoMo managed a modest bounce, rising 1 percent after a three-day slide that had taken it to its lowest levels in 15 months.

Shares in DoCoMo lost more than 30 percent of their value over the past month on expectations it would soon issue new shares to raise funds for ambitious overseas expansion plans.

Ryohin Keikaku ended down 14.2 percent. The retailer of clothing and household goods lowered its group net profit forecast for the year to February to ¥5.2 billion ($44 million) from ¥8.06 billion.

Ryohin Keikaku's shares fell about 80 percent in 2000, battered by the success of rival Fast Retailing.

In Hong Kong, property stocks boosted the main index after U.S. investment bank Morgan Stanley Dean Witter on Thursday recommended portfolio investors increase their exposure to the sector.

Property developer New World Development surged 9.8 percent, while Cheung Kong (Holdings) added 2.5 percent and Sun Hung Kai Properties gained 3.2 percent.

China Mobile, China's largest mobile-phone company, was up 2.5 percent, while ports-to-telecom conglomerate Hutchison Whampoa was up 1.8 percent.

Internet and telecom company Pacific Century CyberWorks fell 2.7 percent, reaching its lowest level since taking over Cable & Wireless HKT.

Seoul's KOSPI index closed up 4.6 percent at 587.87 as foreign investors snapped up shares. Hyundai Motor rose 8.2 percent after a South Korean newspaper reported the country's largest automaker is close to a deal with its German-U.S. partner DaimlerChrysler. SK Global rose by its daily limit to 10,150 won on rumors that it was close to selling its stake in SK Telecom, which saw its own shares rise 6.5 percent. Seoul's KOSPI index closed up 4.6 percent at 587.87 as foreign investors snapped up shares. Hyundai Motor rose 8.2 percent after a South Korean newspaper reported the country's largest automaker is close to a deal with its German-U.S. partner DaimlerChrysler. SK Global rose by its daily limit to 10,150 won on rumors that it was close to selling its stake in SK Telecom, which saw its own shares rise 6.5 percent.

In Taipei, the Taiwan Weighted index closed down 0.6 percent at 5,339.40 in cautious trade ahead of a 10-day break for the Chinese New Year holiday, starting Jan. 19.

Banking shares dropped after the government on Thursday announced it was setting up an office to deal with the island's mounting bad loan problems. China Development Bank fell 3.5 percent, Chang Hwa Bank lost 3.7 percent and Chiao Tung Bank was 5.5 percent lower.

In Sydney, the benchmark ASX/S&P 200 index gained 0.5 percent to close at 3,243.2.

Global media titan News Corp. jumped 3.8 percent and its preferred stock was up 5.3 percent. Brokers said the stock was benefiting from recently improved sentiment towards U.S. media and technology stocks.

Telecom firm Telstra climbed 1.5 percent while miner MIM slid 5.3 percent following a profit warning issued Thursday.

In Bangkok, the SET index surged 5.5 percent, the KLSE composite in Kuala Lumpur gained 0.5 percent, Jakarta's JSX index lost 0.7 percent and Manila's PHS composite index ended up 1.7 percent.

--from staff and wire reports.

|

|

|

|

|

|

|