|

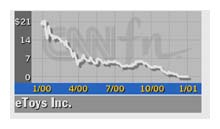

Buyer for eToys?

|

|

January 16, 2001: 5:11 p.m. ET

Shares surge 211% on buyout speculation including Target, Wal-Mart

|

NEW YORK (CNNfn) - Shares for eToys Inc. surged 211 percent Tuesday on speculation that the online retailer was close to finding a buyer.

Los Angeles-based eToys (ETYS: Research, Estimates) rose 41 cents to close at 59 cents.

"We are seeing stock move around and so we think that something is going on," said ABN AMRO analyst Kevin Silverman.

In December, the troubled retailer announced that revenue for the crucial holiday quarter would be significantly less than earlier projections, largely because of "a generally harsh retail climate and the continued disfavor of Internet retailing."

Etoys also stated that it had hired Goldman Sachs & Co. as its financial advisor to explore strategic alternatives for the company, which may include a merger, asset sale, investment in the company or another comparable transaction. Etoys also stated that it had hired Goldman Sachs & Co. as its financial advisor to explore strategic alternatives for the company, which may include a merger, asset sale, investment in the company or another comparable transaction.

In January, the firm announced that it would be cutting 70 percent of its work force of 1,000 and plans to cease warehouse operations in Commerce, Calif., and Greensboro, N.C.

"Obviously since eToys made the announcement in December there has been lots of speculation on who might buy," said analyst Melissa Williams of Gerard Klauer Mattison & Co.

Etoys could not be reached for comment.

Wal-Mart, Target interested?

Potential suitors could include Wal-Mart Stores and Target Corp., Williams said, because both companies are still building an online presence and could leverage the eToys experience and infrastructure. Wal-Mart (WMT: Research, Estimates) is the nation's largest toy retailer while Target (TGT: Research, Estimates) ranks fourth.

Williams discounted chances that Kmart Corp., the third-largest U.S. retailer, would be interested, because of its relationship with BlueLight.com, its shopping portal and free-Internet-access initiative. Toys R Us (TOY: Research, Estimates), the second largest U.S. retailer, would also not be attracted because of its 10-year agreement with Amazon.com (AMZN: Research, Estimates), through which it sells toys.

"The buyer that makes most sense is the buyer that has a strong presence in the traditional retailing of toys," Williams said.

ABN AMRO's Silverman said that Mattel Inc. (MAT: Research, Estimates), Hasbro Inc. (HAS: Research, Estimates) and Walt Disney Co. (DIS: Research, Estimates) could also be potential buyers.

|

|

|

|

|

|

|