|

IBM beats Street

|

|

January 17, 2001: 6:28 p.m. ET

Big Blue's 4Q sales, profits squeak by analysts' estimates

|

NEW YORK (CNNfn) - IBM Corp. on Wednesday reported fourth-quarter sales and profits that beat Wall Street's expectations.

And the company's top financial executive said its diverse product mix and global spread will insulate it from any short-term weakness in the U.S. economy and enable it to meet its profit targets for 2001.

After the markets closed, Big Blue reported earnings of $1.48 per share during the quarter. That compares with $1.12 during the same period a year earlier and beat the $1.46 per share analysts surveyed by earnings tracker First Call had expected.

At $25.6 billion, IBM (IBM: Research, Estimates) sales rose 6 percent from the year-ago quarter and came in slightly ahead of the $25.5 billion analysts had expected, according to the First Call survey.

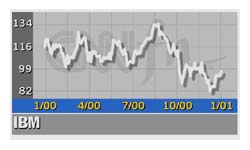

IBM shares rose $3.94, or 4.3 percent, to $96.69 in New York Stock Exchange trade Wednesday. They soared another $6.31 to $103 in after-hours trade.

Click here to see which stocks are moving after hours

IBM is one of only a handful of technology companies that had not warned of a quarterly shortfall because of weak demand in the personal computer market. However, the body of opinion on the Street had been split.

For example, some said strong sales of IBM's latest line of mainframe computers, called the eServer zSeries 900 and selling for as much as $1 million each, had likely offset weakness in other areas such as PCs.

But several analysts also have raised red flags on Big Blue. For example, Prudential Securities recently lowered its revenue forecast, citing weakness in the notebook computer business. Merrill Lynch downgraded its rating on IBM shares to "neutral" from "accumulate," warning that the company will likely reduce its revenue-growth projections moving into the new year. But several analysts also have raised red flags on Big Blue. For example, Prudential Securities recently lowered its revenue forecast, citing weakness in the notebook computer business. Merrill Lynch downgraded its rating on IBM shares to "neutral" from "accumulate," warning that the company will likely reduce its revenue-growth projections moving into the new year.

In a teleconference with analysts Tuesday evening, John Joyce, IBM's chief financial officer, credited the quarter's strong results to solid growth in Big Blue's non-PC businesses and said the company remains on track to meet Wall Street's current earnings expectations of $4.99 per share for 2001.

"As we've been telling you, we expected that our revenue growth would continue to build in the fourth quarter as it did in each quarter throughout the year, and that's exactly what happened," he said.

In an interview on CNNfn's Moneyline News Hour Wednesday, Bear Stearns analyst Andrew Neff said he was surprised at the guidance IBM provided for 2001, considering the state of the U.S. economy. (69K WAV) or (69K AIFF)

Joyce said IBM benefited in the fourth quarter from a shift in the marketplace to services and solutions from a product-oriented focus. About three years ago, Louis Gerstner, IBM chairman and chief executive, pointed IBM in that direction, implementing a strategy under which IBM is focused more on integrating hardware, software and services as opposed to its historical role as a "box builder."

During the fourth quarter, Joyce said IBM's services business grew in double digits across all its segments, and the company ended the year with a services backlog of $85 billion.

He also said IBM continued to see strong demand for IBM's servers, which are high-powered computer systems used to power Internet-based businesses. For more than a year, IBM has been locked in a fierce battle with Sun Microsystems, which currently leads in that market, implementing an ambitious sales and marketing campaign. He also said IBM continued to see strong demand for IBM's servers, which are high-powered computer systems used to power Internet-based businesses. For more than a year, IBM has been locked in a fierce battle with Sun Microsystems, which currently leads in that market, implementing an ambitious sales and marketing campaign.

"We saw improved performance across the board in our server business, especially for our Web servers and our new z900 mainframes, which were designed specifically for e-business," he said.

Moving into 2001, Joyce said IBM expects continued strength in higher-growth businesses such as services, software and technology, while PCs and hard-disk drives will be soft as a result of weaker demand and pricing in that segment.

While he noted that there is still uncertainty surrounding the strength of the U.S. economy, Joyce said IBM's diverse product mix and global spread will help to insulate the company from any short-term weakness

"We don't have a better crystal ball than you do, but based on our fourth-quarter results and everything we know today about the coming year, we remain confident with the consensus earnings-per-share estimate for 2001, which is consistent with our longer-term business model," Joyce said.

IBM's said its fourth-quarter revenue from computer hardware totaled $11.4 billion, up 10 percent from the same period a year earlier, or 15 percent were it not for foreign currency effects.

Revenue from the IBM Global Services division, including maintenance, grew 5 percent, or 12 percent at constant currency, in the fourth quarter to $9.2 billion, the company said. E-business services revenues grew more than 70 percent year over year.

Software revenue totaled $3.6 billion, down 1 percent, or up 6 percent at constant currency, over the prior year's fourth quarter.

IBM Global Financing revenue increased 6 percent, or 10 percent at constant currency, to $1 billion. Revenue from the Enterprise Investments/Other area, which includes custom hardware and software products for specialized customer uses, declined 11 percent, 3 percent at constant currency, from 1999's fourth quarter to $425 million.

The company's total fourth-quarter gross profit margin was 37.7 percent, compared with 36.7 percent in the fourth quarter of 1999.

For all of 2000, IBM's earnings per share rose 19 percent to $4.44, while net income increased 16 percent to $8.1 billion compared with 1999, after excluding an after-tax net benefit from the sale of the IBM Global Network and other special charges.

|

|

|

|

|

|

|