|

Sears beats estimates

|

|

January 18, 2001: 1:21 p.m. ET

Retailer's 4Q earnings fall 4%, but beat expectations by 4 cents a share

|

NEW YORK (CNNfn) - Sears, Roebuck & Co. reported Thursday that weak holiday sales and sluggish consumer spending in general sank fourth-quarter earnings 4 percent lower than a year-ago, yet beat Wall Street estimates.

The No. 2 U.S. retailer behind Wal-Mart Stores Inc. (WMT: Research, Estimates) also warned that continued slow economic conditions likely would hamper growth in the first quarter and first half of 2001.

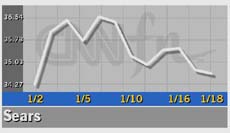

The news sent Sears (S: Research, Estimates) shares down 35 cents, or, about 1 percent, to $34.40 Thursday afternoon.

Excluding non-comparable items, Sears earned $639 million, or $1.91 per share, down from $740 million, or $1.98 per share, a year ago. Analysts polled by research firm First Call expected $1.87 per share.

Charges incurred during the quarter reflect costs associated with the closing of 89 underperforming stores, the company said.

Fourth-quarter revenue edged up a little more than 2 percent to $12.4 billion.

Check out other retail stocks

The company said it expects mid-single-digit growth in operating income for 2001.

"Given the slowing economic environment, 2001 will be a challenging year, particularly in the first half," CEO Alan Lacy said. "We are very focused on delivering solid profit growth for the year...Income growth combined with our share repurchase program should allow us to achieve high single- to low double-digit earnings per share growth."

Sears' results reflect the overall slowdown in consumer spending in 2000, and particularly during the December holiday season as people cut back on shopping in the wake of high fuel costs, a slowing economy and severe weather in the period. Sears' results reflect the overall slowdown in consumer spending in 2000, and particularly during the December holiday season as people cut back on shopping in the wake of high fuel costs, a slowing economy and severe weather in the period.

Those conditions hurt most retailers, including Sears, as they resorted to heavy discounts in order to lure shoppers into the stores in the quarter. While deep discounts drive sales, they cut into profit margins, bringing in a smaller return on each sale.

Sears, which is also undergoing a company-wide restructuring under new CEO Lacy, said Jan. 4 it was closing 89 underperforming stores and eliminating 2,400 jobs.

The closings primarily affect its specialty stores, such as tire and hardware.

The company also is set to open several new store formats focusing on home décor and design called "The Great Indoors."

For the full year, Sears reported net income, excluding special items, of $1.54 billion, or $4.45 a share, up from $1.48 billion, or $3.89 a share, a year earlier.

Revenue increased 3.7 percent to $40.9 billion from $39.5 billion in 1999.

|

|

|

|

|

|

|