|

Sun makes the mark

|

|

January 18, 2001: 6:20 p.m. ET

Server maker logs gains in 2Q sales, profit; lowers growth forecast

|

NEW YORK (CNNfn) - Sun Microsystems on Thursday reported a fiscal second-quarter profit that was in line with Wall Street's expectations, but executives said the current economic climate will result in slightly lower revenue growth than they previously had expected for the full fiscal year.

Sun (SUNW: Research, Estimates), the world's leading supplier of the large computer systems, called Unix servers, which are used to power the Internet, reported net income, excluding certain charges and a gain on the sale of investments, of $552 million, or 16 cents per share during the quarter. That's up from $354 million, or 10 cents per share, during the same period a year earlier and is in line with the expectations of analysts surveyed by earnings tracker First Call.

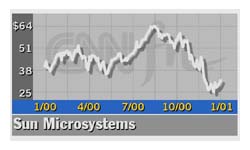

The company's second-quarter revenue totaled $5.1 billion, up 44 percent from the year-ago quarter and just below the $5.3 billion analysts had generally expected, according to the First Call survey. Sun shares rose $2.50 to $34.88 on Nasdaq ahead of the earnings news, which was released after the closing bell.  They fell 62 cents to $34.25 in after-hours trade. They fell 62 cents to $34.25 in after-hours trade.

In a teleconference with analysts after the earnings release, Sun Chief Financial Officer Michael Lehman said Sun's revenue in all of 2001 will rise between 30 percent and 35 percent. In November, he had pegged a growth rate in the "mid-30-percent range."

"Given our experience in Q2 and some of the macroeconomic issues we are all hearing about, we now expect that the annual revenue growth rate for the current fiscal year will be between 30 and 35 percent, just slightly lower than our expectations a few months ago," Lehman said.

During the second half of the fiscal year, Lehman said Sun's earnings per share will grow at a rate slightly below its revenue growth.

For the third quarter, Lehman said he expects Sun's revenue to be flat with the second quarter, which is consistent with his previous guidance.

Lehman declined to provide guidance beyond the current fiscal year. "Given the uncertainty we all see in the market, we do not believe it is appropriate to give you a revenue estimate for next fiscal year," he said.

Click here to check on computer hardware stocks

The company's gross margin, which is the portion of revenue left after expenses, was 47.8 percent in the most recent quarter. That's down from 51.6 percent during the same period a year earlier and 48 percent in this year's fiscal first-quarter. Lehman attributed the decline in gross margins to continued shortages of key components.

Moving ahead, Lehman said Sun's third-quarter gross margin should be roughly the same as the second quarter and begin improving in the fourth quarter as the component shortages ease.

Sun's orders in the fiscal second-quarter, which are an indication of future sales, were $4.95 billion, a year-over-year increase of 32 percent but down slightly from $5.05 billion in the fiscal first-quarter.

Sun was one of only a handful of technology companies that did not warn of a quarterly shortfall due to the recent softness in the U.S. economy, a fact that Lehman pointed out to the analysts participating in the teleconference.

"We were among the very few major companies that did not disappoint you with a pre-announcement of our results," he said. "The market is a strange thing. Companies pre-announce, set lower expectations, sometimes beat the lower expectations and get rewarded. We did not reset expectations, we just went out and delivered an outstanding quarter. As you assess the winners going forward, keep that in mind."

Scott McNealy, Sun's chief executive, attributed the company's performance in what was a difficult quarter for many in large part to its global reach and continued robust demand for its products.

The slowdown in the technology sector has hit personal computer vendors especially hard. But demand for Web servers has continued, especially those for Internet-based businesses, he said.

"Large enterprises cannot stop investing in this Internet technology," McNealy said. "They do so at great peril."

Executives at IBM, which also has its sights trained on the market for Web servers and has been relentless in its efforts to unseat Sun as the server king, made similarly bullish comments about the health of that market when they detailed the company's latest quarterly results on Wednesday.

|

|

|

|

|

|

|