|

Enron tops forecasts

|

|

January 22, 2001: 12:40 p.m. ET

Energy firm reports 34% profit growth excluding charges for Azurix deal

|

NEW YORK (CNNfn) - Enron Corp., North America's biggest marketer of electricity and natural gas, reported a 34 percent jump in fourth-quarter earnings Monday, exceeding forecasts. The company's stock climbed 3.5 percent on the news.

The Houston-based supplier of electricity and natural gas posted profit of $347 million, or 41 cents per diluted share, up from $259 million, or 31 cents per share, in the year-earlier quarter. The results exclude charges associated with a December deal to take its struggling water services affiliate Azurix Corp. private.

Wall Street had been expecting profit of 35 cents a share, according to First Call, which tracks analysts' estimates. Wall Street had been expecting profit of 35 cents a share, according to First Call, which tracks analysts' estimates.

Enron (ENE: Research, Estimates) credited its gains in the quarter to growth in online transactions for wholesale energy.

Including an after-tax charge of $287 million related to Enron's share of an asset writedown for Azurix (AZX: Research, Estimates), net earnings fell to $60 million, or 5 cents per diluted share, for the quarter.

Click here to check the performance of utility stocks

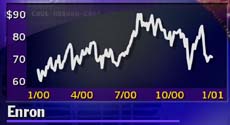

Enron, which has expanded beyond energy into fields such as broadband telecommunications, saw its stock soar last year, but shares have struggled so far in 2001. Monday's earnings report, however, sent the stock up $2.50 to $73.38 in afternoon trading. That's down from a 52-week high of $90.75.

Meanwhile, the company said Monday that it does not anticipate the California power crisis to have a significant impact on its earnings. The state imposed rolling electricity blackouts last week as California's top two utilities hover near bankruptcy amid soaring wholesale electricity costs.

Enron's president and chief operating officer, Jeff Skilling, told analysts during a conference call that the company does not own electricity generation assets in California, but participated in buying and selling wholesale electricity in the state.

-- from staff and wire reports

|

|

|

|

|

|

|