|

Ericsson falls on phone exit

|

|

January 26, 2001: 2:58 p.m. ET

Shares plunge as loss widens; outsourcing benefits distant

|

LONDON (CNNfn) - Ericsson, the world's leading maker of wireless communications equipment and the No. 3 wireless handset supplier, said Friday it will quit mobile phone production and cut its sales growth forecast for 2001.

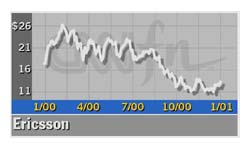

That news, combined with a less-than-stellar quarterly profit report, drove the company's American depositary receipts (ADRs) down $1.94, or 14.9 percent, to $11.06 in afternoon Nasdaq trade.

|

|

VIDEO

|

|

CNNfn's Tom Bogdanowicz reports from London on Sweedish mobile phone giant. CNNfn's Tom Bogdanowicz reports from London on Sweedish mobile phone giant. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Before the U.S. markets opened, the Stockholm, Sweden-based company reported a fourth-quarter profit that had declined 64 percent from the same period a year earlier, dragged down by a 10.3 billion crowns ($1.1 billion) loss in its mobile phone unit.

Moreover, Ericsson (ERICY: Research, Estimates) executives reduced their forecast for sales growth in 2001 to between 15 percent and 20 percent, from an earlier estimate of over 20 percent, and said they expect the company will only break even in the first quarter.

Ericsson's handset unit "has been losing market share to Siemens, the fourth-largest handset maker, and Nokia," the world's largest wireless handset supplier, Jeremy Batstone, an analyst at Natwest Stockbrokers, told CNNfn. "Its performance has been diabolical."

The company said fourth-quarter net profit fell to 2.2 billion crowns, or 0.28 crowns per share, from 6.3 billion, or 0.78 crowns per share, in the same period a year earlier.

Ericsson posted an operating loss of 1.5 billion crowns, compared with a gain of 8.7 billion crown in fourth quarter 1999. The loss excluded a one-time 15.4 billion crown gain from the sale of its stake in Juniper Networks (JNPR: Research, Estimates) and an 8 billion crown charge for pulling the plug on its phone making business.

Analysts expectations varied widely from a much smaller loss to a profit of 1 billion crowns.

Outsourcing aimed at improving profitability

In an effort to beef up its bottom line, Ericsson said it will outsource all of its wireless handset production, the vast majority of which will be taken over by Flextronics International (FLEX: Research, Estimates), a leading supplier of electronics manufacturing services, or EMS, on a contract basis.

During the past several years, there has been a broad trend among electronics manufacturers, including wireless communications equipment and handset providers, toward outsourcing their manufacturing operations.

By farming out their manufacturing to EMS companies, which are highly-specialized supply-chain managers and offer the benefit of economies of scale, electronics manufacturers are able to save money, reduce the amount of time it takes them to get new products to market and focus on their core competencies such as design and development.

In May, Flextronics, which is based in Singapore and has manufacturing operations across the globe, landed what had been the largest wireless outsourcing contract when it inked a $30 billion deal with Motorola (MOT: Research, Estimates), the No. 2 handset maker.

Its contract with Ericsson, which begins in April, is expected to add roughly $500 million to Flextronics' top line annually. The company is expected to assume about 80 percent of Ericsson's wireless handset manufacturing at plants in Brazil, Malaysia, Sweden, the United Kingdom, and the United States.

Ericsson Chief Executive Kurt Hellstrom told CNN the outsourcing was a good move and remained upbeat about the company's prospects, despite an uncertain economic outlook and more cautious market. "A boom doesn't last forever and it doesn't go the other way for very long either," Hellstrom said.

"Next  year we're likely to see continued deceleration in mobile systems revenue growth and a further decline in operating profitability due to increased spending associated with 3G. That's going to be a difficult environment for the stock," Jeffrey Schlesinger, analyst at UBS Warburg, told CNNfn.com. 3G, or third generation, is a high speed network. year we're likely to see continued deceleration in mobile systems revenue growth and a further decline in operating profitability due to increased spending associated with 3G. That's going to be a difficult environment for the stock," Jeffrey Schlesinger, analyst at UBS Warburg, told CNNfn.com. 3G, or third generation, is a high speed network.

Ericsson's move out of handset production had generally been expected as it has long suffered weakness in that business. Some analysts said the move ultimately will help strengthen the company's position as a leading force in the industry's move toward advanced wireless technologies that will enable mobile devices to connect with the Internet.

Still, others voiced concerns about the company's near-term prospects as it faces huge costs and debts after pouring funds into developing high-speed networks.

Merrill Lynch downgraded its near-term rating on the company's shares to "accumulate" from "buy."

"Our initial reaction is that the shares are likely to tread water during what is likely to be a difficult transition in its attempt to outsource 100 percent of its handset production and as its networks operator's division goes through temporary growing pains, which are likely to weigh on margins," analyst Adnaan Ahmad said in a note to clients.

Salomon Smith Barney also downgraded Ericsson, changing its recommendation to "neutral" from "outperform." UBS Warburg chimed in as well, reducing its rating on Ericsson shares to "hold" from "buy."

Mobile phone unit losses balloon

Ericsson's mobile phone division has been losing money since the second quarter of 2000, blaming component shortages after a fire at one of its main suppliers, Philips Electronics, and an uncompetitive product mix.

Ericsson has lost market share to Finland's Nokia, the world's biggest phone maker, which has come out with trendier and more popular models, analysts said.

The company will reduce its work force to 7,000 people from 16,800 at the end of 2000, with 4,200 to join Flextronics and most others being transferred to other units of Ericsson. Around 700 employees will be cut, Hellstrom said.

The company said its 2001 operating margin was expected to be in the range of 6 percent-to-8 percent. Operating margin, a measure of a company's underlying profitability, is operating profit as a percentage of sales. In the first quarter, Ericsson income before tax is expected "to be around zero, affected by operating losses in phones and increased 3G investments."

In addition to its deal with Flextronics, Ericsson said it had signed an agreement with Taiwanese manufacturer GVC for mobile phone development and production as well.

- Reuters contributed to this report

|

|

|

|

|

|

|