|

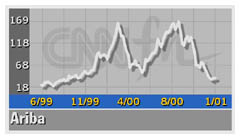

Ariba to purchase Agile

|

|

January 29, 2001: 11:51 a.m. ET

Value of software companies' stock swap transaction placed at about $2.6B

|

NEW YORK (CNNfn) - Ariba Inc. agreed Monday to acquire Agile Software Corp. in a $2.6 billion stock swap, as part of a move to expand its business-to-business offerings.

Mountain View, Calif.-based Ariba (ARBA: Research, Estimates) will exchange 1.35 shares for each Agile share, valuing each Agile share at $54. The purchase price represents a near 26 percent premium to Agile's closing share price of $42.81 on Friday.

The transaction will close in third quarter and will add to Ariba's earnings in fiscal 2002, the company said in statement. The boards of both companies have endorsed the purchase which must still receive governmental and stockholder approval.

Ariba is a leading B-2-B platform and network services provider. Earlier this month, Ariba reported its first-quarter earnings that blew through analysts' estimates, and became the first "pure-play" B2B commerce company to report a profit.

San Jose, Calif.-based Agile (AGIL: Research, Estimates) makes management software that allows companies to collaborate on the Internet by exchanging information about the supply of products and components. San Jose, Calif.-based Agile (AGIL: Research, Estimates) makes management software that allows companies to collaborate on the Internet by exchanging information about the supply of products and components.

The purchase will help Ariba enter the supply chain marketplace, said analyst Robert Johnson of ABN AMRO Inc.

"This is a good deal for Ariba," Johnson said. "It broadens them out in the marketplace and [Ariba's] done it without it being terribly dilutive."

In supply chain management software, Ariba competes against I2 Technologies and Manugistics Group. "Ariba has expanded and they've done a great job in auctions but the next battle is how to line up supply chain management," Johnson said

However, Ariba still has a long way to go to complete in the supply chain space, he said.

The news helped Agile shares surge $5.25, or 12.26 percent, to $48.06 in midday trading, Ariba lost $3.50 to $36.50, I2 (ITWO: Research, Estimates) lost 38 cents to $56.88 and Manugistics (MANU: Research, Estimates) fell $1.12 to $51.38 Monday.

|

|

|

|

|

|

|