|

CN buys U.S. railroad

|

|

January 30, 2001: 2:29 p.m. ET

Pays $1.2 billion in cash and debt for beleaguered Wisconsin Central

|

NEW YORK (CNNfn) - Canadian National Railway Co. announced plans to buy Wisconsin Central Transportation Corp., a deal that will help its desire to move further into the U.S. rail market.

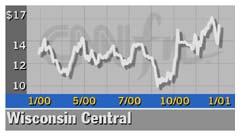

The deal, valued at $1.2 billion, including $400 million in assumed debt. Under the agreement announced Tuesday Canadian National will pay $17.25 a share in cash for Wisconsin Central shares, a premium of 15.5 percent over Monday's closing price.

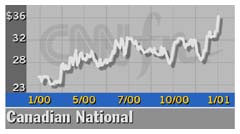

In trading Tuesday, Wisconsin Central (WCLX: Research, Estimates) shares rose $1.06 to $16, while the U.S. shares of Canadian National (CNI: Research, Estimates) gained $2.45 to $36.20. In Toronto trading shares of Canadian National gained 2.95 Canadian dollars to C$53.70.

The deal would be a more modest entry into the U.S. market for Canadian National than the railroad's December 1999 bid to join with Burlington Northern Santa Fe (BNI: Research, Estimates), a move that would have created a transcontinental railroad that was the continent's largest.

That deal, which would have been the largest in rail history, was blocked by U.S. regulators who were concerned that the combination would prompt a new round of rail deals that would have left the continent with only two major transcontinental railroads. The regulators issues a moratorium on major railroad mergers that lasts until June. That deal, which would have been the largest in rail history, was blocked by U.S. regulators who were concerned that the combination would prompt a new round of rail deals that would have left the continent with only two major transcontinental railroads. The regulators issues a moratorium on major railroad mergers that lasts until June.

Wisconsin Central operates what are known as regional or "short-line" railroads, which generally carry freight from a shipper to another railroad instead of a final destination.

Wisconsin Central is the largest short-line railroad operator, with 2,850 miles of track serving primarily Wisconsin and Michigan but also reaching into Illinois and Minnesota and Ontario. It also has ownership interest in a number of overseas rail operations that may be sold as part of this deal. Officials with the two railroads insist this deal has none of the problems or controversies involved in the proposed CN-BNSF deal.

Click here for a look at transportation stocks

"The CN/WCTC transaction is a simple, straightforward, pro-competitive, end-to-end combination," said a statement from Paul Tellier, CEO of CN. He said no point of either system would go from two down to one railroad choice for shippers, and there would be no adverse impact on competition.

Kathy Luhn, a spokeswoman for the National Industrial Transportation League, a trade group for major rail customers, said the deal does look good on the face of it, but that the group would have to see details before endorsing it.

Luhn said she believes the deal was completed now because the U.S. Surface Transportation Board, which regulates rail mergers, was considering rules that might have reclassified Wisconsin Central as a Class 1 railroad rather than a Class 2 railroad, subjecting it to stricter merger rules as well as a moratorium on deals that won't expire until June. Luhn said she believes the deal was completed now because the U.S. Surface Transportation Board, which regulates rail mergers, was considering rules that might have reclassified Wisconsin Central as a Class 1 railroad rather than a Class 2 railroad, subjecting it to stricter merger rules as well as a moratorium on deals that won't expire until June.

Dennis Watson, spokesman for the STB, couldn't comment on possible STB rules, but said that Wisconsin Central was still a Class 2 railroad. Dennis Watson, spokesman for the STB, couldn't comment on possible STB rules, but said that Wisconsin Central was still a Class 2 railroad.

Wisconsin Central has been under pressure from its founder and former CEO, Edward Burkhardt. Burkhardt, who was ousted from the top spot in the company in August 1999, led a proxy fight starting last fall to replace the company's board and sell off the overseas assets.

The company held off that challenge earlier this month, but it did respond by assuring institutional shareholders it was moving towards a sale. In November it hired Goldman Sachs to explore a sale.

Shares rose 41 percent between when Burkhardt announce his takeover effort Oct. 22 and Monday's close. Burkhardt said he had mixed feelings about the sale of the railroad to CN.

"Overall I'm happy about this, but the price is low compared with the worth of the company," he said. "I think it's reflective of the decline in value that has occurred under the current management. But it is realistic and I think we have to be realistic. Canadian National is clearly getting a bargain."

This is the second major U.S. rail purchase by Canadian National, which bought the former Illinois Central in a $2.4 billion in stock, cash and assumed debt. The deal was announced in February, 1998 and approved by regulators in March, 1999.

|

|

|

|

|

|

|