|

Fed cuts interest rates

|

|

January 31, 2001: 3:55 p.m. ET

Federal Reserve slashes interest rates by another half-percentage point

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - In an aggressive move to ward off recession, the Federal Reserve slashed short-term interest rates by half of a percentage point Wednesday and signaled further cuts may be needed.

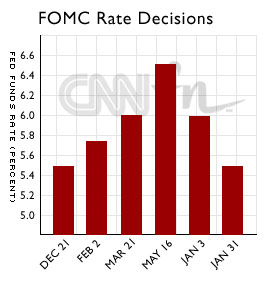

The move brings the federal funds rate, the interest rate banks charge each other on overnight loans, to 5.5 percent, from 6 percent. The rate cut comes the same day the government reported that the U.S. economy grew at a 1.4 percent annual rate in the fourth quarter, the slowest quarterly reading in more than five years.

The move marks the second time this month the Fed has reduced rates. The central bank lowered the federal funds target rate by the same amount in a surprise move Jan. 3. The move marks the second time this month the Fed has reduced rates. The central bank lowered the federal funds target rate by the same amount in a surprise move Jan. 3.

The Fed on Wednesday also lowered the discount rate, the rate of interest the central bank charges commercial banks to borrow money on a short-term basis, to 5 percent, from 5.5 percent.

The cuts were widely expected by financial markets, which have edged up in recent weeks in anticipation of further interest rate reductions to prevent recession. A recession is defined as two consecutive quarters of negative growth.

Stocks bounced wildly following the news, closing mixed. The Dow Jones industrials added 6.16 points to 10,887, while the Nasdaq composite slipped 65.46 points to 2,772. Bonds edged up. Analysts said many equity investors were hoping for an even bigger cut and had already priced a half-point cut into stock prices.

Click here for more on bank stocks

Lower rates are intended to spur spending by businesses and consumers, boost economic growth and increase corporate profits. Immediately after the announcement, a number of major banks cut their prime lending rate to 8.5 percent, from 9 percent.

'A rapid and forceful response'

The rate cut came at the conclusion of a two-day meeting of the Federal Open Market Committee – the Fed's policymaking arm. In a brief statement, the committee said a "rapid and forceful response" was needed to growing signs of weakness in the economy and signaled that it may slash rates again. The FOMC next meets March 20, but a rate shift could come at any time.

"The committee continues to believe that against the background of its long-run goals of price stability and sustainable economic growth and of the information currently available, the risks are weighted mainly toward conditions that may generate economic weakness in the foreseeable future," the statement read.

Click here to read the statement.

Who wins from a rate cut?

Poll: Is the Fed doing enough?

The move marks a further shift from Fed Chairman Alan Greenspan's preferred policy of altering interest rates in quarter-point increments. This marks the first time in Greenspan's 14-year tenure that the central bank has cut rates by a full percentage point in one calendar month.

Diane Swonk, chief economist at Bank One, told CNNfn's Market Coverage that with another half-percentage rate cut, the Fed has effectively opened the door for another possible rate cut in March. (640K WAV) (640K AIFF) Diane Swonk, chief economist at Bank One, told CNNfn's Market Coverage that with another half-percentage rate cut, the Fed has effectively opened the door for another possible rate cut in March. (640K WAV) (640K AIFF)

"I think it's very high probability we will have another cut," she said. "This is a Fed hedging against a recession."

In the statement, the Fed suggested that inflation fears – which sparked a series of interest rate hikes from June 1999 to May 2000 – are contained. Analysts say that a lack of inflation fear gives the central bank wide latitude in weighing whether to cut rates further.

Fed policy makers "are very concerned about the slowdown in the economy," said Robert Stovall, market strategist at Prudential Securities. "The reading is that the bias is pointing toward another cut in March, most likely, if not sooner."

Warning signs

The Fed has been inundated with a raft of data suggesting that U.S. economic growth has slowed dramatically. The Commerce Department reported earlier Wednesday that gross domestic product posted its weakest growth since the second quarter of 1995, advancing at a 1.4 percent annual rate in last year's fourth quarter, down from 2.2 percent growth in the third quarter.

|

|

VIDEO

|

|

CNNfn's Peter Viles reports from Washington on the Fed's interest rate cuts. CNNfn's Peter Viles reports from Washington on the Fed's interest rate cuts. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

On Tuesday, a private research group reported that consumer confidence in January crumbled to its lowest level in four years amid worries about the slowing economy and rising layoffs at U.S. corporations.

Analysts said the consumer confidence figures were particularly shocking, raising the likelihood of a deep rate cut by the Fed, since Greenspan has pegged consumer confidence as an important gauge of the country's economic health. Declining consumer confidence often cuts into consumer spending, which accounts for roughly two-thirds of U.S. economic activity.

Last week, Greenspan signaled in testimony to Congress that the Fed likely would cut rates further, saying that U.S. economic growth is "very close to zero."

Keeping the economy on track

The Federal Reserve has a variety of tools at its disposal to influence the economy, but the two biggest weapons in the Fed's arsenal are the federal funds target rate and the discount rate.

When the Fed wants to stimulate the economy, it instructs the Federal Reserve Bank of New York to buy government securities from a bank in what is called open market transactions. The Fed pays for the securities by increasing that bank's reserves. With more reserves on hand, banks can lend more money to consumers and businesses, driving interest rates lower and fueling an economic expansion.

When the Fed wants to slow the economy, the New York trading desk sells government securities -- which, in turn, reduces the banks' reserve accounts. With less reserves on hand, banks are less willing to lend to consumers and businesses, driving interest rates higher and slowing down the economy.

When the FOMC announces a change in the fed funds target rate, it is essentially telling the market how the New York trading desk will act.

The discount rate, the interest rate charged to commercial banks by the central bank, is the second option used by the Fed to nudge the economy. This option is rarely exercised, however, since most U.S. banks lend money to each other. This rate is used mainly as a barometer for where interest rates should be.

Before January's surprise cut, the last time the Fed cut rates was in November 1998, the third in a string of reductions aimed at combating the credit crunch after the Russian debt crisis and the collapse of Long-Term Capital Management, a risky hedge fund for wealthy investors. The series of rate cuts was followed by six interest rate increases between June 1999 and May 2000 as the Fed tapped on the brakes in a bid to slow what was then red-hot economic growth and to ward off inflation.

|

|

|

|

|

|

|