|

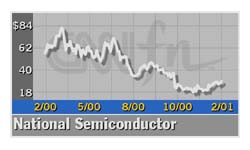

National Semi warns

|

|

February 1, 2001: 5:45 p.m. ET

Chip maker expects sharp sales and revenue declines for current quarter

|

NEW YORK (CNNfn) - National Semiconductor Corp. on Thursday said sales and earnings for its fiscal third quarter, which ends in February, will be much lower than previously anticipated.

Blaming softer demand for its semiconductor products used in wireless handsets and PCs and a buildup of inventory in the distribution channel, the company said it expects to log third-quarter sales in the range of $475 million-to-$480 million.

That would amount to as much as a 19 percent decrease from second-quarter revenue of $595 million, and is far short of the $558.4 million analysts had generally expected for the current quarter, according to a survey conducted by earnings tracker First Call.

When the company reported its second-quarter results in early December, executives had signaled slowing growth, saying at that time that they expected a third-quarter sales decline of as much as 10 percent.

"Seven weeks ago at our Dec. 7 earnings announcement, we projected a falloff in the current quarter of 10 percent based on slowness in the wireless market, PCs and peripherals, and a broad-based distribution inventory correction," Brian Halla, National Semiconductor's chief executive, said in a teleconference Thursday evening.

"Now that we have the months of December and January finished, we felt it necessary to factor those results into our earlier projections and issue this update," Halla added.

Halla said the company's "turns orders," referring to orders that are taken and shipped in the same quarter, were running significantly below those taken in the second-quarter. "These slow turns clearly tell us that our customers in the distribution channel are still working through their inventory reductions," he said.

National Semiconductor (NSM: Research, Estimates) said it expects its third-quarter gross margin to be between 47 percent and 48 percent. The company said earnings per share should be in the range of 20 cents-to-22 cents.

Wall Street had been looking for the company to turn a third-quarter profit of 31 cents per share, according to the First Call survey.

Click here to check on other chip stocks

Shares of National Semiconductor fell $1.39 to $27.31 in New York Stock Exchange trade ahead of the warning, which was issued after the closing bell. They fell to $25.51 in after-hours trade.

The company was the latest chip-related firm to warn of weaker-than-expected results because of softer demand and inventory buildups.

On Tuesday, Applied Materials (AMAT: Research, Estimates), the leading supplier of equipment used to manufacture semiconductors, warned that its fiscal-first quarter results would come in below previous expectations. Intel, the world's largest chip supplier, also ratcheted down its sales and profit forecast when it reported fourth-quarter results last month.

|

|

|

|

|

|

|