|

Disney tops forecasts

|

|

February 6, 2001: 3:00 p.m. ET

Theme park, movie operations offset problems of ABC, Internet operations

|

NEW YORK (CNNfn) - Walt Disney Co. reported a 77 percent decline in first quarter profit Tuesday, reflecting huge losses at its Internet unit and a hefty accounting charge. However, on an operating basis, the company topped Wall Street forecasts, as strength in its theme park and movie operations offset weakness at its ABC television network.

The company, which is meeting with analysts in Anaheim, Calif. Tuesday, also said it did not expect double-digit earnings per share growth in 2001 because of the softer economy and said it would take a $790 million charge in the second-quarter related to the closing of its Go.com Web site.

For the quarter ended Dec. 31, the Burbank, Calif.-based media conglomerate reported net income of $63 million, or 3 cents a share, compared with pro forma net income of $278 million, or 13 cents a share a year earlier.

Analysts on average expected earnings of 15 cents a share, according to First Call.

The results include $127 million in noncash charges related to its Internet operations for amortization of intangible assets, and impairment losses of $81 million. The company also incurred a $278 million loss related to an accounting change.

Excluding its Internet operations, Disney earned 28 cents a share, up from 25 cents a share and above forecasts for the quarter.

First-quarter revenue increased 7 percent to $7.3 billion. First-quarter revenue increased 7 percent to $7.3 billion.

"I am pleased with the strength of our results in the first quarter," Chief Executive Michael Eisner said in a statement. "Once again, Parks & Resorts proved itself to be an extraordinary driver of higher earnings. Significantly, these earnings came not only from our established theme park businesses, but from our new cruise line business as well."

Eisner also said the company was encouraged by the pending opening of its California Adventure theme park adjacent to the original Disneyland and the strong results of its home video and DVD business.

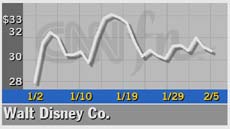

Disney (DIS: Research, Estimates) stock, which has been declining since October, jumped $1.38, or 4.5 percent, to $31.81 in afternoon trading Tuesday.

Tom Staggs, Disney's chief financial officer, told analysts in a recorded telephone announcement Tuesday that he remained confident Disney is "recession-proof," but said he he expects single-digit earnings growth in 2001 because of the softening economy. He added that he expects earnings before interest, taxes, depreciation and amortization beyond 2001 to grow 13 to 15 percent.

"While we are not projecting a significant turnaround in advertising, we do sense that the ad market is firming," he said at the meeting with analysts.

Staggs also said a possible strike in May by members of the Screen Actors Guild and the Screen Writers Guild could impact 2001 earnings, but that the company is making preparations to minimize that impact, including filming extra episodes of television programs.

Staggs also said the economic downturn could present Disney with opportunities for acquisitions during 2001.

Check out other media and entertainment stocks

As for the business units, Media Networks operating income decreased 8 percent to $590 million. Revenue increased 6 percent to $2.9 billion.

The decline reflects softer ad sales, lower ratings, and higher programming costs at the ABC television network. However, the popular "Who Wants to be a Millionaire" show again saved the day, significantly offsetting those declines, the company said.

Disney's cable network profit increased 3 percent to $324 million for the quarter as it posted strong advertising and subscriber sales at the A&E, Lifetime and The History Channel units.

However, Disney said a softer overall advertising market combined with increased programming costs at its ESPN sports network combined with the cost of starting up the new SoapNet network, offset cable gains.

Studio profits rebound

Studio entertainment revenue jumped 15 percent to $1.9 billion in the quarter, as operating income increased to $152 million compared with a $45 million loss a year ago.

Strong sales of the home video releases of the "Toy Story 2," "Shanghai Noon," "Gone in 60 Seconds," "The Little Mermaid II," and "Remember the Titans," helped drive studio gains, the company said.

Those gains also helped overcome difficult comparisons to overseas distribution of "Tarzan" and "The Sixth Sense" last year.

Sales at Disney Studio Stores fell 6 percent to $828 million as operating income decreased 13 percent to $177 million in the quarter, reflecting heavy discounting and softer retail sales during the holiday season.

Wider loss at Internet Group

Like most large media companies, Disney saw sharply lower earnings at its Internet Group where a $182 million charge contributed to a much wider loss than a year ago. The division posted a loss of $253 million, 32 percent greater than a year earlier. Revenue decreased 5 percent to $127 million.

Parks and Resorts operating income increased 6 percent to $385 million and revenue grew 9 percent to $1.7 billion, primarily on the strength of increased attendance connected to the company's 45th anniversary celebration.

Last month, Disney announced it was closing its money-losing Go.com Web portal, resulting in 400 layoffs and the end of the unit's tracking stock.

While Staggs said he did not expect more layoffs at the Internet Group, the company will continue to look for ways to further streamline its Internet operations.

|

|

|

|

|

|

|