|

Sunbeam files Chapter 11

|

|

February 6, 2001: 2:49 p.m. ET

Appliance maker says it needs relief from burden of debt, shareholder suits

|

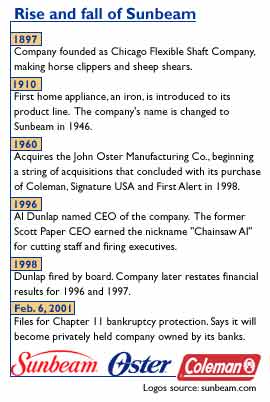

NEW YORK (CNNfn) - Sunbeam Corp. filed for Chapter 11 bankruptcy protection Tuesday as the company announced it reached an agreement with its secured creditors to reorganize its debts.

The Boca Raton, Fla.-based maker of such well-known appliance brands as Sunbeam, Oster, Mr. Coffee, Coleman and First Alert, cited its high debts and the costs of lawsuits related to its deflated stock price.

In Chapter 11, a company is protected from its creditors as it reorganizes and continues to operate. In Chapter 11, a company is protected from its creditors as it reorganizes and continues to operate.

The company said it has reached an agreement with its banks to convert most of its bank debt into other forms of debt as well as equity interest in the reorganized Sunbeam.

It said the bankruptcy filing has the support of banks holding $1.7 billion of the company's debt. It also said Bank of America, First Union and Morgan Stanley have agreed to support Sunbeam through the reorganization by issuing a new $285 million line of credit, while GE Capital Corp. is providing $200 million in financing backed by the company's domestic accounts receivable.

CEO Jerry Levin said Sunbeam will be privately held by its banks when it emerges from bankruptcy, with current management having some stock options in the new company. He said he expects the company eventually will be public again, and said new product development will allow it to overcome its current difficulties.

"Right now we've got a great new product flow going forward," he told CNNfn's Talking Stocks. "We think we have a great future." (248KB WAV) (248KB AIFF)

The company said the agreement with creditors should allow it to emerge from bankruptcy protection in a matter of months, without any interruption in production or distribution. It also said there should be no layoffs or plant closings due to the filing.

For the first nine months of 2000, Sunbeam's loss widened to $223.7 million, or $2.08 a share, from $155 million, or $1.54 a share, a year earlier. Sales fell to $1.6 billion from $1.8 billion. Fourth-quarter results have yet to be released, but analysts surveyed by First Call expect an additional 54-cent-a-share loss in the period.

Sunbeam has been struggling to right itself since former CEO Al Dunlap was ousted in 1998. Dunlap, known as "Chainsaw Al" for his tendency to cut thousands of jobs, was accused of using phony accounting to boost Sunbeam's profits. He denied those charges. But the company was forced to restate results for both 1996 and 1997 after his termination. Sunbeam has been struggling to right itself since former CEO Al Dunlap was ousted in 1998. Dunlap, known as "Chainsaw Al" for his tendency to cut thousands of jobs, was accused of using phony accounting to boost Sunbeam's profits. He denied those charges. But the company was forced to restate results for both 1996 and 1997 after his termination.

During his 23-month tenure at Sunbeam he cut about half of the 12,000 work force. He also made job cuts at companies he acquired. The company currently has about 10,900 employees, about 6,200 in the United States.

Dunlap acquired three other companies for Sunbeam -- Coleman, Signature Brands and First Alert -- in deals announced in 1997. But those acquisitions left the company with $1.7 billion in debt, which it cited in Tuesday's court filing as leading to the bankruptcy.

Shareholders sued the company following Dunlap's dismissal in 1998 amid questions about the company's actual performance sent share price plunging. The share price never recovered.

The company's most recent proxy statement lists Dunlap as its third-largest shareholder, with 1.2 million shares he received in a grant and options to buy another 6.3 million shares. Together, that gave him 6.8 percent of the company.

Its largest shareholder is financier Ron Perelman, whose investment arm MacAndrews and Forbes Holdings, received 37.1 million shares and warrants, or 28 percent of the company, in return for its purchase of Coleman from him. Its shares held directly constituted about 14 percent of shares outstanding.

Levin, who used to work for Perelman when he ran Coleman, told CNNfn that Perelman had been "extremely gracious about this whole process." A spokesman for Perelman also was relatively gentle to current management.

"Like every other shareholder, MacAndrew & Forbes was victimized by what happened with the collapse of the share price at Sunbeam," said James Conroy, senior vice president and special counsel of the firm. "We hope that today's filing signals a new beginning for the company."

Sunbeam did not disclose current liabilities and assets, but at the end of the third quarter it said its total liabilities stood at $3.2 billion, while assets totaled just under $3.0 billion. After deducting intangible assets, the company said it had an adjusted net deficit of $1.9 billion.

The company said it will use the bankruptcy to discharge all the securities-related litigation it now faces, along with its bondholder debt.

"We were not able to reach an agreement with all groups to satisfactorily restructure the financial obligations of the company," Levin said. "We intend for this restructuring of our financial obligations to free Sunbeam from its debt burden and litigation expenses and put the reorganized Sunbeam on the track for economic viability and successful operations."

Shares of Sunbeam (SOC: Research, Estimates) did not open for trading Tuesday. They closed Monday unchanged at 51 cents. The New York Stock Exchange said Tuesday it has suspended trading in the stock and filed with the Securities and Exchange Commission to delist it.

The exchange said the delisting is due to the stock's low value and was in process even before the announcement of the bankruptcy filing.

|

|

|

|

|

|

|