|

U.S. productivity slows

|

|

February 7, 2001: 11:19 a.m. ET

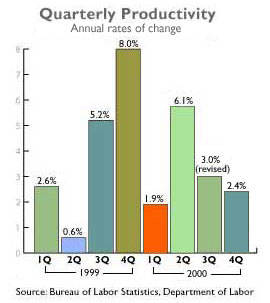

Key measure of output grew at 2.4% rate in 4Q, about in line with forecasts

|

NEW YORK (CNNfn) - Worker productivity growth in the United States slowed in the fourth quarter while a key measure of labor costs increased, the government reported Wednesday, a further reflection that the U.S. economy has cooled.

U.S. productivity, a closely watched gauge that measures how much workers produce per hour, grew at an annual rate of 2.4 percent in the final three months of 2000, the Labor Department said. That was about in line with Wall Street forecasts of a 2.5 percent increase but below the third quarter's revised 3.0 percent rate of growth.

However, the Labor Department said unit labor costs, a key gauge of inflationary pressures in the economy, rose at a 4.1 percent annual rate in the quarter, up from a revised 3.2 percent gain in the prior quarter. Analysts polled by Briefing.com had expected labor costs to grow only about 2.8 percent.

Productivity, while still growing, is down from the rapid advances recorded in early 2000, when productivity grew at a 6.1 percent rate in the second quarter. But analysts say productivity gains are healthy given the deceleration of the nation's economy overall. Last week, the government released preliminary estimates showing that gross domestic product growth slowed to a 1.4 percent annual rate in the fourth quarter, the slowest advance in more than five years. Productivity, while still growing, is down from the rapid advances recorded in early 2000, when productivity grew at a 6.1 percent rate in the second quarter. But analysts say productivity gains are healthy given the deceleration of the nation's economy overall. Last week, the government released preliminary estimates showing that gross domestic product growth slowed to a 1.4 percent annual rate in the fourth quarter, the slowest advance in more than five years.

"We knew that in the fourth quarter output had slowed substantially," said Wayne Ayers, chief economist at Fleet Boston Financial Corp. "Productivity growth was bound to slow."

The rising unit labor costs are a matter of concern, suggesting that inflation could be on the rise, but it's probably not enough of an increase to dissuade the Federal Reserve from cutting interest rates again to ward off recession, said Lara Rhame, an economist at Brown Brothers Harriman. Hoping to boost economic growth, Fed policy-makers lowered interest rates by a half-percentage point last week, its second such rate reduction in less than a month.

"In the Fed's eyes, this was probably not enough to change their minds that inflation is under control," she said. "There is still a lot of room to lower rates to stimulate economic growth."

Growing productivity has helped fuel the record U.S. economic expansion. As productivity increases, companies produce and sell more, boosting corporate profits, while keeping workers' wages in check and limiting inflation pressures. Economists credit the productivity gains in large part to businesses' investments in computers and other technology.

The government data were the first estimate of fourth-quarter productivity, and could be revised in the coming weeks.

For all of 2000, productivity increased by 4.3 percent, the strongest showing since a 4.5 percent gain in 1983, the government said. In 1999, productivity rose by only 2.6 percent. Labor costs edged up 0.7 percent in 2000, down from a 1.8 percent increase in 1999.

Click here for the latest market news

Financial markets showed little reaction to the report. In late-morning trading, the Dow industrials were up modestly, while the Nasdaq composite traded lower. Bonds edged slightly higher.

|

|

|

|

|

|

|