|

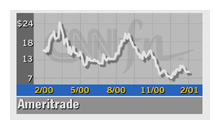

Ameritrade buys TradeCast

|

|

February 14, 2001: 12:03 p.m. ET

Nation's sixth-largest online broker in $70 million deal to buy TradeCast

|

NEW YORK (CNNfn) - Ameritrade Holding Corp., the nation's sixth-largest online broker based on trades, agreed Wednesday to acquire TradeCast Ltd. in a nearly $70 million stock deal.

Omaha, Neb.-based Ameritrade will swap 7.5 million shares for all the outstanding shares of TradeCast, with the potential to receive up to an additional 750,000 shares based upon future performance. The price tag of the stock purchase could range from $68 million to $75 million, an Ameritrade spokeswoman said.

The purchase is expected to close in 30-to-60 days once it is receives regulatory approval, and will add to earnings per share for the fiscal year ended Sept. 28, Ameritrade said in a release. Once consummated,  Houston-based TradeCast will operate as a unit of Ameritrade, which will retain TradeCast's 90 employees. Houston-based TradeCast will operate as a unit of Ameritrade, which will retain TradeCast's 90 employees.

In January, Ameritrade reported average daily trade volume of 131,000 trades per day. The online broker competes against Charles Schwab Corp. and E*Trade Group. Last month, Ameritrade warned that declining revenue would cause it to post a much wider first-quarter loss than Wall Street had predicted.

TradeCast provides direct-access online stock trading that lets individual equity traders trade stock online.

"TradeCast's relationships and market reach with broker/dealer customers perfectly complement the B2B elements of Ameritrade's strategy," Jim Ditmore, Ameritrade's chief information's officer. "By bringing together TradeCast's capabilities with our trading engine, we will offer one of the industry's best suites of technology and execution for broker/dealers who serve highly active traders."

Ameritrade (AMTD: Research, Estimates) shares fell by 13 cents to $8.84 in mid-day trading, E*Trade �(EGRP: Research, Estimates) dropped 13 cents to $12.38 and Schwab (SCH: Research, Estimates) declined $1.23 to $24.42.

|

|

|

|

|

|

|